Factoring Company Singapore provides invoice factoring services in Singapore, allowing businesses to release cash tied up in unpaid customer invoices. By utilizing factoring, businesses can maintain control of their cash flow without relying on loans or overdrafts.

Factoring is a valuable financial tool that helps businesses overcome cash flow challenges and improve their working capital. With the assistance of a factoring company, businesses can access immediate funds by selling their invoices at a discounted rate. This provides businesses with the necessary resources to meet their financial obligations and continue growing.

Factoring Company Singapore offers reliable and efficient factoring solutions tailored to the unique needs of businesses in Singapore. Improve your cash flow and accelerate business growth with the assistance of a reliable factoring company in Singapore.

Understanding Factoring

Factoring, also known as invoice factoring, is a financial solution that allows businesses to unlock the cash tied up in outstanding customer invoices. It provides a way to boost cash flow without relying on traditional methods such as overdrafts or loans.

With factoring, businesses can sell their unpaid invoices to a factoring company, also known as the factor, for a percentage of the invoice value, typically between 70% to 95%. The factor then takes over the responsibility of collecting payment from the customers. Once the customers pay the invoices, the factor pays the remaining balance, minus a fee or discount, to the business owner.

The factoring process involves a few simple steps:

- The business owner provides the factor with the details of the outstanding invoices.

- The factor verifies the creditworthiness of the customers and determines the eligibility of the invoices for factoring.

- The factor advances a percentage of the invoice value, typically within 24 to 48 hours, providing immediate cash flow to the business.

- The factor takes over the responsibility of collecting payment from the customers.

- Once the customers pay the invoices, the factor disburses the remaining balance to the business owner, minus a fee or discount.

Factoring offers several benefits for businesses:

- Improved Cash Flow: Factoring allows businesses to access cash quickly, enabling them to cover expenses, invest in growth, and take advantage of new opportunities.

- Reduced Financial Stress: By outsourcing the responsibility of collecting payment, businesses can focus on their core operations instead of chasing overdue invoices.

- Flexible Funding: Factoring provides a scalable funding solution that grows with the business. As the business generates more invoices, it can access more cash through factoring.

- No Debt: Unlike loans or credit lines, factoring does not create debt for the business. It is a form of financing that relies on the strength of the invoices rather than the business’s creditworthiness.

- Professional Credit Management: Factoring companies often have expertise in credit evaluation and collection. They can help businesses mitigate the risks associated with late payments and bad debts.

Overall, factoring offers businesses a flexible and efficient way to manage their cash flow and accelerate growth. By partnering with a reputable factoring company in Singapore, businesses can unlock the cash tied up in their invoices and gain peace of mind.

Credit: www.solifi.com

Factoring Companies In Singapore

When it comes to managing cash flow and ensuring financial stability for your business in Singapore, partnering with a reliable factoring company can be a game-changer. Factoring companies such as Bibby Financial Services (Singapore) Pte Ltd, Planworth Global Factoring (S’pore) Pte. Ltd., and IFS Capital Limited offer a range of services tailored to your specific needs.

Bibby Financial Services (singapore) Pte Ltd

Bibby Financial Services (Singapore) Pte Ltd is a reputable financial institution known for its efficient factoring process. With a straightforward approach, they help businesses release the cash tied up in outstanding customer invoices before they are paid. This enables businesses to maintain control over their cash flow without relying on overdrafts or loans. Contact Bibby Financial Services at +65 6922 5030 to learn more.

Planworth Global Factoring (s’pore) Pte. Ltd.

Planworth Global Factoring (S’pore) Pte. Ltd. is a leading corporate office specializing in factoring services. Their team understands the challenges faced by businesses in managing cash flow and offers customized solutions to address those needs. With expertise in invoice factoring, they provide businesses with the necessary funding to maintain financial stability. Contact Planworth Global Factoring at +65 6291 9008 to explore their services further.

Ifs Capital Limited – For Sme Working Capital & Small Business Loans Financing

IFS Capital Limited is a trusted financial institution offering working capital and small business loans financing specifically designed for SMEs. Their comprehensive range of financial services includes factoring solutions that help SMEs optimize cash flow and maintain stability. With a dedicated team and responsive support, IFS Capital Limited is committed to assisting businesses in meeting their financial goals. Get in touch with them at +65 6270 7711 to discover how they can support your business.

List Of The Best Factoring Companies In Singapore

- Bibby Financial Services (Singapore) Pte Ltd

- Planworth Global Factoring (S’pore) Pte. Ltd.

- IFS Capital Limited

Partnering with a reliable factoring company can provide numerous benefits for your business, allowing you to maintain control over your cash flow and overcome financial challenges. Whether it’s ensuring prompt payment for outstanding invoices or accessing working capital for growth, these factoring companies in Singapore offer tailored solutions to meet your specific needs.

Cost Of Factoring

Factoring Company Singapore provides cost-effective factoring solutions for businesses in Singapore. By leveraging invoice factoring, businesses can access immediate cash flow without the need for a loan or overdraft, helping them stay in control of their finances.

Factors Affecting Costs

When it comes to factoring services, understanding the cost is crucial for businesses in Singapore. Several factors affect the cost of factoring, and being aware of them can help you make informed decisions about your financing options.- The creditworthiness of your customers: Factoring companies typically consider the creditworthiness of your customers when determining the cost of factoring. If your customers have a good credit history, the cost may be lower as the risk of non-payment is minimized.

- The volume of invoices: The number and value of invoices you wish to factor can also impact the cost. Generally, factoring companies offer a better rate for higher invoice volumes, allowing you to save on fees.

- The age of your invoices: The age of your invoices can affect the cost as well. Factoring companies may charge higher fees for older invoices due to the increased risk of non-payment.

- The industry you operate in: The industry your business operates in can also influence the cost of factoring. Some industries may have higher default rates or longer payment cycles, leading to higher fees charged by factoring companies.

Average Cost Of Factoring

The average cost of factoring in Singapore can vary depending on the factors mentioned above. However, it typically involves two main components: a discount rate and a factoring fee.- Discount rate: The discount rate is the percentage of the invoice amount that the factoring company charges as a fee. This rate can range from 1% to 5% or more, depending on the risk associated with your invoices.

- Factoring fee: In addition to the discount rate, factoring companies may charge a factoring fee, which is a fixed fee based on the total value of the invoices factored. This fee can range from a few hundred dollars to a few thousand dollars.

Choosing The Best Factoring Company

When it comes to financing your business, choosing the best factoring company in Singapore is crucial for maintaining healthy cash flow. Invoice factoring, also known as accounts receivable factoring, is a financial solution that allows businesses to unlock the cash tied up in unpaid invoices. To help you make an informed decision, here are the factors to consider when selecting the best factoring company in Singapore.

Factors To Consider

- Experience and Reputation: Look for a factoring company with a proven track record and positive reviews from previous clients.

- Industry Expertise: Consider a factoring company that specializes in serving businesses within your industry for a better understanding of your unique needs.

- Transparent Fees and Contracts: Ensure the factoring company provides clear information about their fees, terms, and conditions to avoid any hidden costs.

- Customer Support: Evaluate the level of customer service and support offered by the factoring company to address any concerns or inquiries promptly.

List Of The Best Factoring Companies In Singapore

| Factoring Company | Contact | Reviews |

|---|---|---|

| Bibby Financial Services (Singapore) Pte Ltd | +65 6922 5030 | “Their factoring process is very straightforward.” |

| Planworth Global Factoring (S’pore) Pte. Ltd. | +65 6291 9008 | |

| IFS Capital Limited | +65 6270 7711 | for SME Working Capital & Small Business Loans Financing |

Factoring companies play a vital role in helping businesses manage their cash flow by providing access to working capital based on their outstanding invoices. With the right factoring partner, you can improve your business’s financial stability and growth potential.

Invoice Financing And Unlocking Cash

Invoice financing is a valuable tool for businesses to unlock the cash tied up in outstanding invoices. This funding method provides immediate access to working capital, allowing companies to stay in control of their cash flow without needing to rely on overdrafts or traditional loans.

How Invoice Financing Works

Invoice financing, also known as factoring, functions by selling outstanding invoices to a third-party factoring company at a discount. This enables the business to receive an immediate cash advance, typically around 80-90% of the invoice amount. The factor then collects the payment from the customer and pays the remaining balance, deducting a small fee for their services.

Benefits Of Invoice Financing

- Provides quick access to cash to maintain steady operations.

- Helps to mitigate the impact of delayed payments and late customer settlements.

- Allows businesses to focus on growth and expansion strategies rather than worrying about cash flow constraints.

- Reduces the risk of bad debt and provides credit protection.

Invoice Financing In Singapore

Singapore, being a thriving business hub, offers a range of invoice financing solutions to help companies meet their short-term cash flow needs. With a highly competitive financial market, businesses can choose from various factoring providers to find the most suitable arrangement for their specific requirements.

Invoice financing is a flexible and accessible option for businesses in Singapore looking to optimize their cash flow management effectively.

Credit: www.netsuite.com

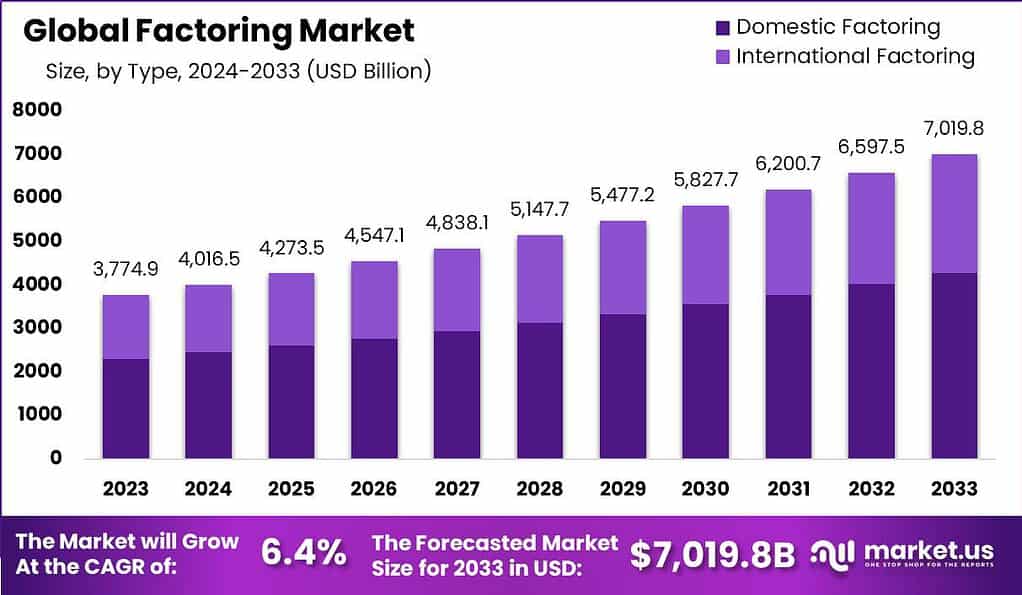

Credit: market.us

Frequently Asked Questions On Factoring Company Singapore

What Is Singapore Factoring?

Singapore factoring, also known as invoice factoring, is a way for businesses to access cash from outstanding customer invoices. It helps maintain control of cashflow without relying on overdrafts or loans. Factoring companies in Singapore provide this service to businesses by purchasing their invoices at a discounted rate.

Who Is The Number 1 Factoring Company?

Bibby Financial Services is the number 1 factoring company. They offer a straightforward factoring process.

How Much Does A Factoring Company Cost?

Factoring company costs vary and depend on factors like the size of your business, the industry you’re in, and the value of your invoices. Contact a factoring company for a personalized quote.

What Does Factoring Company Do?

A factoring company helps businesses by buying their unpaid invoices to provide immediate cash flow.

Conclusion

In today’s fast-paced business world, Factoring Company Singapore offers a unique solution to businesses looking to improve their cash flow. By allowing companies to release funds tied up in outstanding invoices, factoring enables businesses to stay in control of their finances without the need for traditional loans or overdrafts.

With a variety of reputable factoring companies to choose from, businesses in Singapore have the opportunity to optimize their cash flow and maintain financial stability. Whether you’re a small startup or an established corporation, factoring could be the key to maintaining a healthy bottom line.