Invoice factoring is a type of invoice finance where a business sells its outstanding invoices to improve cash flow and revenue stability, with a factoring company paying most of the invoiced amount upfront and collecting payment from customers directly. Disadvantages can include funding restrictions and the need to pay off money advanced on unpaid invoices when ending the arrangement.

However, invoice factoring can provide immediate access to working capital, improve cash flow, and help a business grow. Additionally, it is important to note that invoice factoring companies in the US are not formally regulated by a government body. Factoring is a financial transaction where a business sells its accounts receivable to a third party.

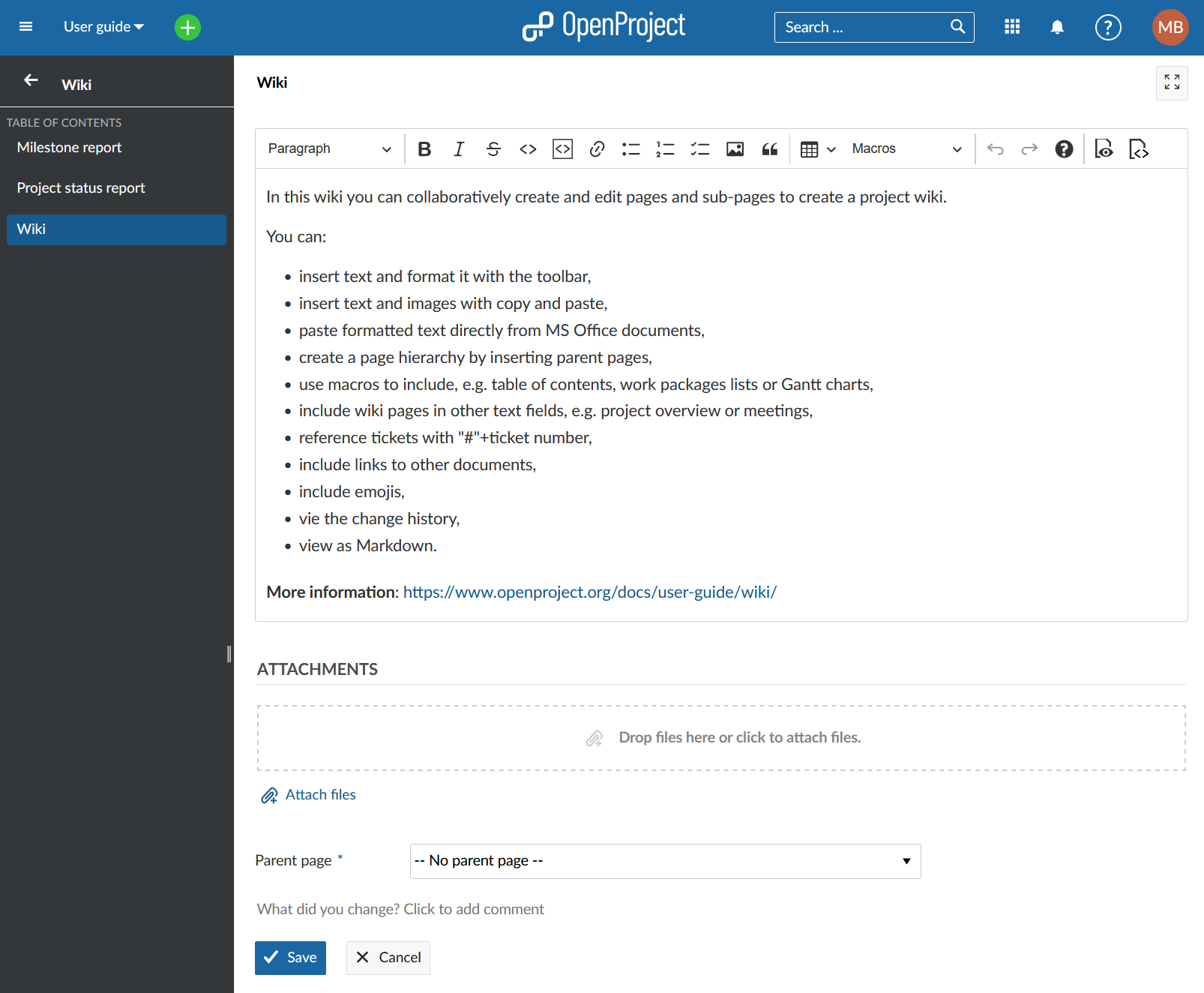

Credit: www.openproject.org

What Is Invoice Factoring?

Invoice factoring is a type of invoice finance where you sell your outstanding invoices to a third party, improving cash flow and revenue stability. The factoring company pays you most of the invoiced amount immediately and collects payment directly from your customers.

Definition And Explanation

Invoice factoring is a type of financial transaction known as debtor finance. In this process, a business sells its accounts receivable, also known as invoices, to a third party. The purpose of invoice factoring is to improve the cash flow and revenue stability of the business. By “selling” their invoices, businesses can receive immediate payment for most of the invoiced amount, while the factoring company takes on the responsibility of collecting payment directly from the customers.

How Does Invoice Factoring Work?

The process of invoice factoring involves several key steps:

- The business provides goods or services to its customers and generates invoices.

- The business then sells these invoices, either in part or in full, to an invoice factoring company.

- The factoring company advances a significant portion of the invoiced amount, typically around 80-90% of the total.

- The factoring company takes on the responsibility of collecting payment from the customers.

- Once the customers pay their invoices, the factoring company deducts its fees and any additional charges, and then pays the remaining balance to the business.

Invoice factoring provides businesses with immediate access to working capital, which helps cover funding gaps caused by slow-paying customers. It improves cash flow and allows businesses to keep loyal customers on longer payment terms while still growing their operations. However, it’s important to note that factors may restrict funding against poor quality debtors or poor debtor spread, which requires careful management of funding fluctuations.

Advantages And Disadvantages Of Invoice Factoring

There are both advantages and disadvantages to using invoice factoring:

Advantages:

- Immediate access to working capital

- Improved cash flow

- Increased revenue stability

- Ability to keep loyal customers on longer payment terms

Disadvantages:

- Potential funding restrictions for poor quality debtors

- Management of funding fluctuations

- Obligation to pay off any advanced money if invoices are unpaid by customers

It’s important to carefully consider the advantages and disadvantages of invoice factoring before deciding if it’s the right solution for your business. While it can provide immediate financial benefits, it’s crucial to fully understand the potential drawbacks as well.

Remember, invoice factoring companies in the United States are not regulated by a formal government body. However, many legitimate factoring companies are members of associations where they self-regulate their activities.

Overall, invoice factoring is a valuable financial tool for businesses looking to improve cash flow and revenue stability. It offers immediate access to working capital and allows businesses to focus on their core operations while a third party takes care of the collection process.

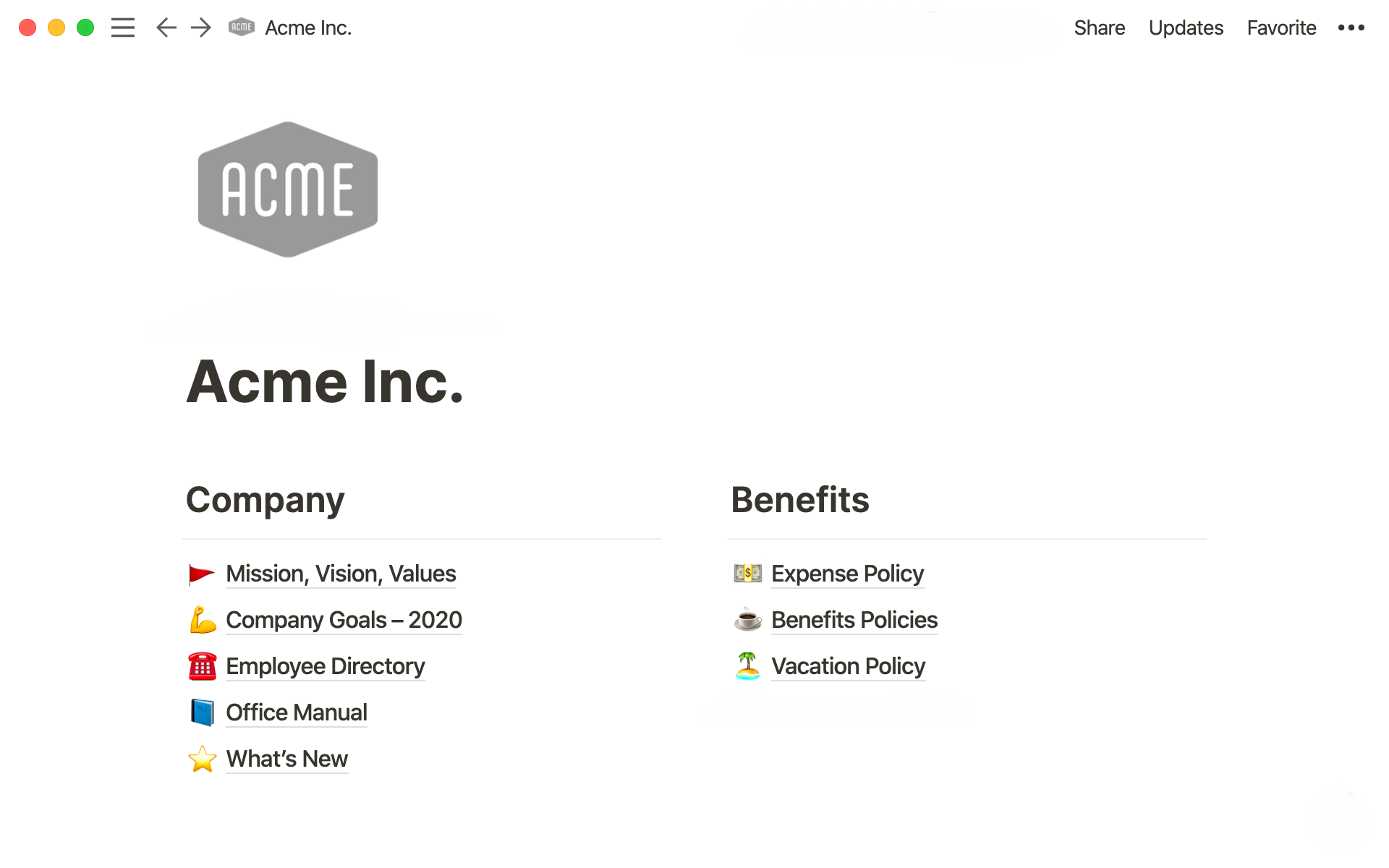

Credit: www.notion.so

Advantages Of Invoice Factoring

Invoice factoring offers numerous advantages for businesses, including improved cash flow, increased working capital, and the ability to keep loyal customers on longer payment terms. By selling outstanding invoices to a third party, businesses can ensure a stable revenue stream and avoid the hassle of chasing after late payments.

Improved Cash Flow

Invoice factoring offers a significant advantage in the form of improved cash flow. By selling your outstanding invoices to a third party, you can receive payment for the majority of the invoiced amount immediately. This provides your business with a much-needed injection of cash, allowing you to meet your financial obligations, pay your employees, and invest in growth opportunities without having to wait for your customers to make payment.Access To Working Capital

With invoice factoring, you gain access to working capital that might otherwise be tied up in unpaid invoices. This can be particularly helpful for small businesses that struggle to secure traditional loans or lines of credit from banks. By leveraging your accounts receivables, you can access the funds you need to cover operational expenses, invest in new equipment or technology, and fuel business growth.Maintaining Longer Payment Terms

Another advantage of invoice factoring is the ability to maintain longer payment terms with your customers while still improving your cash flow. This can be particularly beneficial for businesses that want to offer flexible payment options to their clients or extend credit terms to retain loyal customers. By working with a factoring company, you can ensure a consistent cash flow while maintaining longer payment terms, giving your business the financial flexibility it needs to thrive. In conclusion, invoice factoring provides several advantages for businesses, including improved cash flow, access to working capital, and the ability to maintain longer payment terms with customers. By leveraging your outstanding invoices, you can ensure a steady stream of cash flow, meet your financial obligations, and fuel business growth.Disadvantages Of Invoice Factoring

While invoice factoring offers numerous benefits, it is important to consider the potential drawbacks before deciding if it is the right financing option for your business. Here are two notable disadvantages of invoice factoring:

Restriction On Funding

One of the disadvantages of invoice factoring is that factoring companies often place restrictions on the funding they provide. These restrictions can be based on the quality of your debtors and the spread of your debtors. If your business has poor quality debtors or a limited debtor spread, you may face challenges in obtaining sufficient funding from a factoring company. It is crucial to carefully manage these funding fluctuations and choose a factoring company that aligns with your specific business needs and debtor profile.

Payoff Requirement For Ending Arrangement

Another disadvantage of invoice factoring is the requirement to pay off any money advanced by the factoring company on outstanding invoices if the customer has not yet made payment. This creates a potential financial burden if your customers delay payments or default on their obligations. It is important to understand the terms and conditions of the factoring arrangement and consider the potential impact on your cash flow if you need to end the arrangement prematurely. Prioritize open communication with the factoring company and your customers to mitigate any challenges in closing the arrangement.

While invoice factoring can be a valuable financing solution for businesses seeking improved cash flow and revenue stability, it is essential to weigh the disadvantages against the potential benefits. By carefully assessing your business needs, debtor profile, and the terms of the factoring arrangement, you can make an informed decision about whether invoice factoring is the right fit for your business.

Regulation Of Invoice Factoring In The Us

Invoice factoring, a popular financial option for businesses to improve their cash flow, operates under certain regulations in the United States. The regulation of invoice factoring in the US involves factors such as lack of formal government regulations and self-regulation by factoring associations.

Lack Of Formal Government Regulations

Interestingly, unlike traditional financial institutions, invoice factoring companies in the US are not heavily regulated by a formal government body. This lack of formal oversight has led to a self-regulation approach within the industry.

Self-regulation By Factoring Associations

Most legitimate factoring companies in the US are members of associations where they engage in self-regulatory practices. These associations’s self-regulation efforts ensure that factoring companies adhere to ethical and professional standards, creating a sense of accountability within the industry.

Different Types Of Factoring

Invoice factoring is a type of invoice finance that offers businesses a way to improve their cash flow and revenue stability by selling some or all of their outstanding invoices to a third party. There are different types of factoring that businesses can consider based on their specific needs and preferences.

Recourse Factoring

Recourse factoring is a type of factoring where the business retains the risk of non-payment from the customer. In this arrangement, if the customer fails to pay the invoice, the business is responsible for repurchasing the invoice from the factor. This type of factoring usually comes with lower fees and is suitable for businesses with established credit and collection policies.

Disclosed Factoring

Disclosed factoring is a type of factoring where the customer is notified that the business is using a factor to collect on the invoices. In this arrangement, the factor collects the payments directly from the customers, but the business maintains control over its sales ledger. This type of factoring is transparent to the customers and can be beneficial for businesses looking to maintain a positive relationship with their customers.

Credit: www.notion.so

Frequently Asked Questions On Invoice Factoring Wiki

How Does Invoice Factoring Work?

Invoice factoring is a type of invoice finance where you sell your company’s outstanding invoices to a third party. The factoring company pays you most of the invoiced amount upfront and collects payment directly from your customers. This helps improve your cash flow and revenue stability.

What Are The Disadvantages Of Invoice Factoring?

The disadvantages of invoice factoring include restricted funding against poor quality debtors, managing funding fluctuations, and having to pay off any money advanced on unpaid invoices when ending the arrangement.

Is Invoice Factoring Profitable?

Invoice factoring can be profitable as it provides immediate access to working capital and improved cash flow. By selling outstanding invoices to a third party, businesses can cover funding gaps caused by slow-paying customers and keep loyal customers on longer payment terms while still growing their business.

Is Invoice Factoring Regulated In The Us?

Yes, invoice factoring in the US is not regulated by a formal government body. Factoring companies usually self-regulate within industry associations.

Conclusion

Invoice factoring is a beneficial financing option for businesses looking to improve cash flow and maintain revenue stability. By selling their outstanding invoices to a third party, companies can access immediate funds and leave the collection process in the hands of the factoring company.

While there may be some disadvantages, such as restrictions on funding and potential fees for ending the arrangement, the advantages of invoice factoring, such as improved cash flow and the ability to keep long-term customers, make it a profitable option for many businesses.

It’s important to note that invoice factoring is not regulated by a formal government body in the US, but reputable factoring companies often self-regulate through industry associations.