Invoice discounting is a financing option for small businesses where they can obtain cash by selling their unpaid invoices to a third-party lender at a discount. It provides immediate working capital to businesses without waiting for customers to pay their invoices.

Invoice discounting is a popular choice for small businesses as it helps improve cash flow, allows businesses to meet their financial obligations, and provides flexibility in managing their finances. By leveraging their accounts receivable, small businesses can receive a percentage of the invoice value upfront, enabling them to cover expenses, invest in growth opportunities, and maintain a healthy cash flow.

This financing solution helps small businesses bridge the gap between invoicing and receiving payment, ensuring a steady inflow of funds to support operations.

Credit: www.zoho.com

Introduction To Invoice Discounting

Invoice Discounting for Small Businesses is an effective way for businesses to manage their cash flow by financing their sales ledger and releasing funds against unpaid invoices. This allows them to plan ahead, invest in their business, and avoid the waiting period for customers to pay.

What Is Invoice Discounting And How Does It Work?

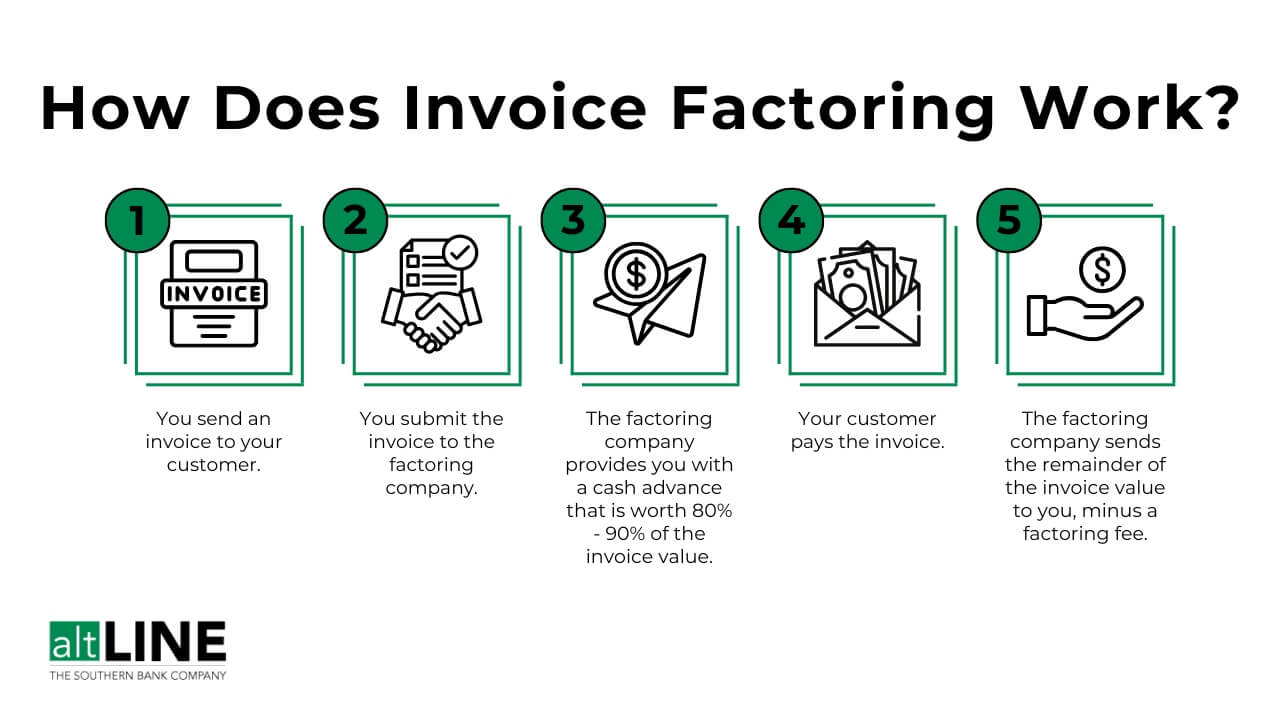

Invoice discounting is a financing solution that allows small businesses to access immediate cash flow by selling their outstanding invoices to a third-party financier, also known as a factor. Rather than waiting for customers to pay invoices on their due dates, businesses can receive a portion of the invoice value upfront, usually around 80-85%. Once the customer pays the invoice, the factor deducts a small fee and returns the remaining balance to the business.

What Are The Benefits Of Invoice Discounting?

Invoice discounting offers several benefits for small businesses:

- Improved Cash Flow: By receiving funds upfront for outstanding invoices, businesses can cover their immediate expenses without waiting for customers to pay.

- Flexibility: Invoice discounting allows businesses to choose which invoices to finance, depending on their cash flow needs.

- Confidentiality: Unlike invoice factoring, invoice discounting is a confidential arrangement, meaning customers are unaware of the financing arrangement.

- Control Over Collections: Businesses control the collection process and maintain the customer relationship.

What Are The Risks Of Invoice Discounting?

While invoice discounting can be beneficial for small businesses, it is essential to consider the potential risks:

- Risk of Non-Payment: If a customer fails to pay the invoice, the business may be responsible for repaying the advanced funds.

- Undermined Customer Relationships: Some customers may view invoice discounting as a sign of financial instability, potentially damaging the business relationship.

- Cost of Financing: Factors charge a fee for their services, which can vary depending on factors such as the creditworthiness of the customers and the volume of invoices being financed.

Despite the risks, invoice discounting can be a valuable financing option for small businesses looking to improve their cash flow and maintain control over their accounts receivable. Assessing the creditworthiness of customers and carefully managing the financing arrangement can help mitigate potential risks.

How Invoice Discounting Works

Invoice discounting is a financing solution that enables small businesses to access funds by using their unpaid invoices as collateral. With invoice discounting, businesses can manage their cash flow effectively and invest in growth while waiting for customers to pay.

It is a convenient option for small businesses in need of immediate funds without taking on additional debt.

Step 1: Submission Of Invoices

Firstly, small businesses submit their invoices to an invoice discounting provider. These invoices represent the outstanding payments owed to the business by their customers. It is important for businesses to ensure that the invoices submitted are accurately prepared and contain all the necessary details, such as the customer’s name, invoice number, payment due date, and the total amount due.

Step 2: Verification And Approval

Once the invoices are submitted, the invoice discounting provider verifies the accuracy of the information provided. They review the invoices to ensure that they are valid, legitimate, and compliant with the terms and conditions of the agreement. This verification process is crucial to protect both the business and the discounting provider against any potential fraud or discrepancies. Once the invoices are verified, they are approved for further processing.

Step 3: Advances And Collections

After the invoices are approved, the invoice discounting provider offers an advance payment to the business. This advance payment is a percentage of the total invoice value, typically ranging from 70% to 90%. The exact percentage depends on various factors, such as the creditworthiness of the business’s customers and the industry in which the business operates. The business can then use this advance payment to meet its immediate cash flow needs.

The invoice discounting provider takes over the responsibility of collecting the payments from the business’s customers. They send reminders, follow-up on overdue payments, and handle the entire collection process on behalf of the business. This frees up valuable time and resources for the business to focus on its core operations and growth.

Step 4: Repayment Process

Once the invoice discounting provider successfully collects the payments from the business’s customers, the remaining balance (minus any fees or charges) is paid back to the business. This repayment process ensures that the business receives the remaining portion of the invoice amount that was not initially advanced by the discounting provider.

The repayment is usually done electronically, and the funds are transferred to the business’s designated bank account. It is important for the business to carefully manage its cash flow and ensure that it can cover the repayment amount when it is due.

Overall, the process of invoice discounting offers a flexible and efficient way for small businesses to access immediate funds and improve their working capital. By leveraging their outstanding invoices, businesses can address their cash flow challenges and focus on their growth and success.

Top Invoice Discounting Companies

Invoice discounting can be a valuable financing solution for small businesses seeking to improve their cash flow. By selling their invoices to a third-party company at a discounted rate, businesses can access immediate funds to cover their expenses and invest in growth opportunities. In this blog post, we will explore some of the top invoice discounting companies that small businesses can consider partnering with. These companies are known for their reliable services and competitive rates.

Fundbox is a leading invoice discounting company that specializes in providing financing solutions for small businesses. With its user-friendly platform, Fundbox offers fast and flexible funding options, allowing businesses to access the capital they need within a few hours. By linking with accounting software, Fundbox automates the invoice discounting process, making it convenient for businesses to manage their cash flow effectively.

FundThrough is another reputable invoice discounting company that caters to the needs of small businesses. Through its innovative platform, FundThrough simplifies the funding process by offering immediate advances on outstanding invoices. Businesses can access funds quickly and use them to meet their financial obligations without waiting for their customers to make payment. With FundThrough, small businesses can keep their operations running smoothly and seize growth opportunities when they arise.

Riviera Finance is a well-established invoice discounting company that has been serving small businesses for several decades. With its extensive experience in the industry, Riviera Finance understands the unique challenges faced by small businesses and provides tailored financial solutions to meet their needs. By outsourcing their accounts receivable management to Riviera Finance, businesses can focus on their core operations while ensuring steady cash flow.

Bibby Financial Services is a global provider of invoice discounting services, offering customized solutions designed specifically for small businesses. Through its advanced technology and expertise, Bibby Financial Services helps businesses optimize their cash flow and mitigate the risk of late or non-payment by their customers. With Bibby Financial Services, small businesses can improve their working capital and drive growth.

OTR Solutions is a trusted invoice discounting company that specializes in helping small businesses manage their cash flow effectively. With its streamlined processes and personalized approach, OTR Solutions offers businesses a seamless financing solution that allows them to leverage their outstanding invoices to access immediate funds. By partnering with OTR Solutions, small businesses can overcome cash flow challenges and focus on achieving their growth objectives.

Risks And Considerations

Investors considering invoice discounting for small businesses should carefully assess the risks involved. Factors to consider include the creditworthiness of the customer and the potential for payment default. While invoice discounting offers high returns, it’s important to understand the associated risks.

Invoice discounting is a financing option that allows small businesses to unlock the value of their unpaid invoices to access immediate cash flow. While it offers numerous benefits, such as improving working capital and reducing the impact of late payments, it’s crucial for small business owners to be aware of the risks and considerations associated with invoice discounting. By understanding these factors before investing in invoice discounting, small businesses can make informed financial decisions that align with their overall business strategies.Factors To Consider Before Investing In Invoice Discounting

When contemplating invoice discounting, small businesses should carefully evaluate the creditworthiness of their customers. Customer creditworthiness directly impacts the risk of non-payment and defaults, which can significantly affect the overall success of invoice discounting arrangements. Additionally, it’s essential to comprehend the risks involved and determine whether the potential high returns of invoice discounting are worth the associated uncertainties.The Creditworthiness Of The Customer

Before engaging in invoice discounting, small businesses should conduct thorough evaluations of their customers’ creditworthiness. Assessing the payment history, financial stability, and credit records of customers can help mitigate the risk of non-payment and defaults. Customer creditworthiness is a critical factor that directly influences the success of invoice discounting arrangements.Understanding The Risks Involved

Small business owners must have a comprehensive understanding of the potential risks associated with invoice discounting. By evaluating the potential for payment delays, defaults, and the impact on cash flow, businesses can make informed decisions regarding the risks involved in invoice discounting. Understanding these risks is crucial for mitigating any potential negative impacts that may arise from invoice discounting arrangements.Are High Returns In Invoice Discounting Worth The Risks?

Assessing whether the potential high returns in invoice discounting outweigh the associated risks is essential for small businesses. While invoice discounting offers the opportunity for increased liquidity and improved cash flow, businesses must carefully weigh these benefits against the potential risks of non-payment and default. Considering this balance is vital to determining the suitability of invoice discounting for a small business’s financial strategy.Benefits And Use Cases Of Invoice Discounting

Invoice discounting is a valuable financial tool for small businesses, offering a range of advantages that can facilitate growth and improve cash flow management. Below, we explore the key benefits and use cases of invoice discounting for small businesses.

Improving Cash Flow Management

Invoice discounting enables small businesses to access the funds tied up in their unpaid invoices, providing an immediate cash injection that can be used to cover operational expenses, invest in new projects, or seize growth opportunities. By unlocking funds that would otherwise be tied up in extended payment terms, small businesses can maintain a healthy cash flow and ensure ongoing operations run smoothly.

Investing In Growth

With the access to immediate funds through invoice discounting, small businesses can take advantage of growth opportunities without having to wait for customers to settle their invoices. This flexible financing solution allows businesses to invest in expanding their product lines, entering new markets, or ramping up marketing efforts – essentially providing the necessary resources to drive business expansion.

Flexible Funding For Small Businesses

Unlike traditional long-term loans, invoice discounting provides small businesses with flexible access to working capital, without the burden of taking on additional debt. This agile funding solution allows businesses to meet their short-term financial needs, while retaining control over their ongoing operations and growth trajectory.

Case Studies: How Small Businesses Have Benefited From Invoice Discounting

Below are real-world examples of how small businesses have leveraged invoice discounting to achieve their financial goals:

- Case Study 1: XYZ Manufacturing

- Case Study 2: ABC Consulting Services

These case studies will be detailed in the next section, highlighting the direct impact of invoice discounting on the growth and financial stability of small businesses. By examining these use cases, small business owners can gain a clearer understanding of the tangible benefits that invoice discounting can offer.

Credit: altline.sobanco.com

Credit: myndfin.com

Frequently Asked Questions On Invoice Discounting For Small Businesses

How Risky Is Invoice Discounting?

Investors should carefully consider the risks before entering invoice discounting. Factors such as the creditworthiness of the customer can pose a higher risk of payment default. It is important to understand the risks involved and evaluate if the high returns are worth it.

Is Invoice Discounting Profitable?

Invoice discounting can be profitable, but it comes with risks. It can help manage cash flow and release funds against unpaid invoices, but investors should carefully consider the creditworthiness of the customer and potential delays in payments.

What Is The Average Cost Of Invoice Discounting?

The average cost of invoice discounting varies depending on the size of the business and the specific terms of the agreement. Costs can range from 0. 5% to 5% of the invoice value. Factors such as creditworthiness and risk may also influence the final cost.

Why Would A Business Use Invoice Discounting?

Businesses use invoice discounting to finance their sales ledger and release funds against unpaid invoices. It helps them manage cash flow, plan ahead, and invest in staff, materials, and equipment while waiting for customers to pay. Invoice discounting is a great way to ensure a steady flow of cash for business operations.

Conclusion

Invoicing discounting is a powerful tool for small businesses to manage cash flow and fuel growth. By unlocking the value of unpaid invoices, businesses can access immediate funds, allowing them to invest in staff, materials, and equipment while waiting for customers to pay.

However, it’s crucial for investors to carefully consider the risks involved, such as the creditworthiness of customers. Overall, invoice discounting can be a lucrative option for small businesses looking to optimize their financial operations and drive success.