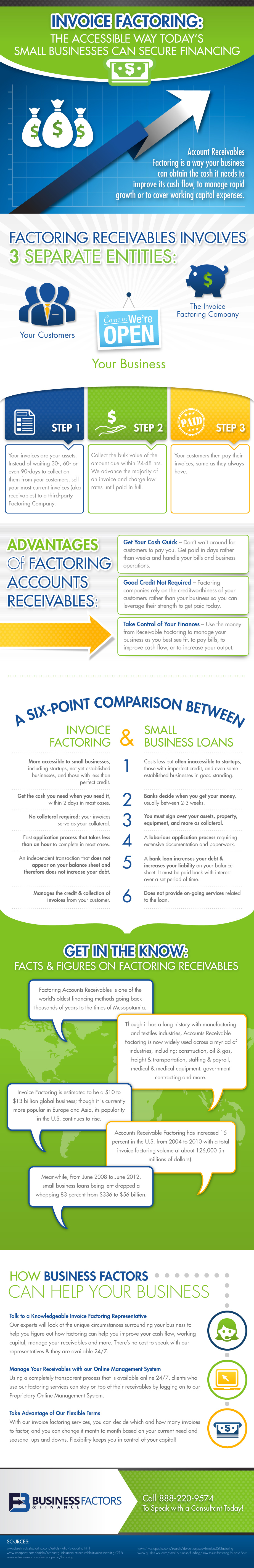

Invoice factoring financing is a type of business financing available at flexible rates that best fits your needs. It involves selling some or all of your company’s outstanding invoices to a third party to improve cash flow and revenue stability.

A factoring company pays you most of the invoiced amount immediately and collects payment directly from your customers. This solution is particularly beneficial for businesses operating in distressed situations, as factoring companies can offer bespoke solutions to enable continued transactions with trade partners during restructurings and reorganizations.

Factoring services typically go beyond what traditional suppliers offer, thanks to strong relationships with funding partners in distressed markets.

What Is Invoice Factoring Financing?

Invoice factoring financing, also known as accounts receivable financing, is a business funding option that allows companies to convert their outstanding invoices into immediate cash. This type of financing is especially beneficial for businesses that experience cash flow issues due to slow-paying customers or clients. With invoice factoring financing, businesses can get the funds they need to cover operational costs, pay employees, or invest in growth opportunities.

Definition

Invoice factoring financing, also known as accounts receivable financing, is a financing solution where a business sells its outstanding invoices or accounts receivable to a third-party company, known as a factor, at a discounted rate in exchange for immediate cash. The factor then takes over the responsibility of collecting payments from the customers or clients.

Benefits

- Improved cash flow: Invoice factoring financing provides businesses with the cash they need to cover immediate financial obligations, such as payroll, rent, and inventory.

- Accelerated growth: By receiving immediate cash from their invoices, businesses can invest in new equipment, hire additional staff, or expand their operations.

- Flexibility: Invoice factoring financing is a flexible funding solution that grows with your business. The more invoices you have, the more funding you can access.

- No debt incurred: Unlike traditional loans, invoice factoring financing does not create additional debt for your business. It is a form of financing that utilizes your accounts receivable as collateral.

- Outsourced credit control: Factors take over the responsibility of collecting payments from your customers, allowing you to focus on other aspects of your business.

How It Works

The process of invoice factoring financing can be summarized in a few simple steps:

- Businesses choose a reliable and reputable factoring company.

- The factoring company evaluates the creditworthiness of your customers or clients.

- You submit your outstanding invoices to the factoring company.

- The factoring company advances you a percentage of the invoice value, typically around 80-95%.

- The factoring company takes over the responsibility of collecting payments from your customers.

- Once the invoice is paid in full by the customer, the factoring company releases the remaining balance, minus their fees.

Overall, invoice factoring financing provides businesses with a quick and reliable source of funding, allowing them to overcome cash flow challenges and focus on growth.

Difference Between Invoice Factoring And Financing

Invoice factoring and financing are both options for businesses to improve their cash flow, but there is a key difference between the two. Invoice factoring involves selling your unpaid invoices to a third-party company at a discount, while invoice financing is a loan secured against your unpaid invoices.

Explanation

Invoice factoring and financing are two common options available for businesses looking to improve their cash flow. While both methods involve leveraging unpaid invoices as a means of obtaining funds, there are key differences between them that businesses should be aware of.

Which Option Makes The Most Sense?

When deciding between invoice factoring and financing, it is essential to understand the specific advantages and drawbacks of each option.

Invoice factoring involves selling unpaid invoices to a third-party company, known as a factor, in exchange for immediate cash. This allows businesses to receive funds quickly, without having to wait for customers to pay their invoices. The factor then assumes responsibility for collecting payment from the customers. This can be beneficial for businesses experiencing cash flow gaps or dealing with slow-paying customers.

On the other hand, invoice financing, also known as accounts receivable financing, offers businesses a line of credit or loan based on the value of their outstanding invoices. Instead of selling the invoices, businesses use them as collateral to secure financing. Unlike factoring, businesses retain control over the collection process, as they are still responsible for collecting payments from customers.

Exploring Your Options

When deciding which option makes the most sense for your business, it’s important to consider various factors. Here are a few key points to consider:

- Cash Flow Needs: If your business requires immediate funds and you are willing to relinquish control over the collection process, invoice factoring may be the better choice.

- Customer Relationships: If maintaining strong relationships with your customers is a priority, invoice financing may be the better option since you retain control over the collection process.

- Costs: Compare the costs associated with both options, including fees, interest rates, and potential discounts, to determine which option offers a better financial fit.

- Flexibility: Evaluate the flexibility offered by each option regarding the amount of funding, eligibility criteria, and repayment terms. This will ensure that you select the option that aligns with your business’s unique needs.

Steps In Invoice Factoring

Invoice factoring is a popular financing option for businesses to improve their cash flow. It allows them to convert their outstanding invoices into immediate cash by selling them to a third-party finance company, known as a factor. This process involves a few essential steps to ensure a smooth and efficient transaction. Let’s explore these steps in detail:

Underwriting

The first step in the invoice factoring process is underwriting. Once you submit your invoices to the factor, they assess the creditworthiness of your customers. This involves verifying their payment history, financial stability, and overall credibility. The factor will look at factors such as the customer’s credit rating, past payment patterns, and industry reputation to determine the risk involved. Their analysis will help them gauge the likelihood of your customers paying their invoices on time.

Ucc Check

After the underwriting process, the factor conducts a UCC (Uniform Commercial Code) check. This check involves searching public records to ensure there are no outstanding liens or claims against your invoices. It helps the factor determine the priority of their interest in the invoices and ensures that there are no legal obstacles that may affect their ability to collect payments on your behalf. The UCC check is a crucial step to protect both you and the factor from any potential legal issues.

Example

Let’s consider an example to better understand the steps involved in invoice factoring. Suppose you own a small trucking business and have outstanding invoices totaling $50,000 from various clients. You approach an invoice factoring company and submit these invoices for verification and funding. The factor reviews your invoices and the creditworthiness of your clients. They determine that the risk is acceptable and proceed with the underwriting process. Once the underwriting is complete, they conduct a UCC check to ensure there are no liens against your invoices. After confirming the legality and authenticity of the invoices, the factor offers you an advance of 90% of the invoice value, which amounts to $45,000. They hold the remaining 10% as a reserve until your clients pay their invoices in full. Once the clients settle their payments, the factor releases the reserve to you, minus their fees.

By following these steps, invoice factoring helps businesses access immediate cash flow by converting their outstanding invoices into cash. This form of financing is particularly beneficial for companies dealing with slow-paying customers or seasonal fluctuations in revenue. It provides businesses with the necessary capital to cover their operational expenses, invest in growth opportunities, and maintain a healthy cash flow.

Credit: m.facebook.com

Is Invoice Factoring A Good Idea?

Is Invoice Factoring a Good Idea?

Improving Cash Flow

Invoice factoring is a strategic financial solution that can significantly improve a company’s cash flow. It allows businesses to access immediate funds by selling their outstanding invoices to a third-party financial institution, which in turn provides them with upfront cash. This can help businesses manage their operational expenses, pay suppliers, invest in growth opportunities, and ultimately enhance their financial stability.

Releasing Money From Invoices

One of the key benefits of invoice factoring is the ability to release money that is tied up in unpaid invoices. By leveraging this method, businesses can expedite their cash flow and avoid the waiting period associated with invoice payment terms. This puts the power back in the hands of the business, allowing for more control over their working capital and the ability to seize emerging opportunities without being hindered by delayed payments.

Qualifying For Invoice Factoring

Qualifying for invoice factoring is relatively straightforward, especially compared to traditional bank loans. Approval is based on the creditworthiness of the business’s customers rather than the company’s credit history. This makes it a viable option for businesses that may have less-than-perfect credit scores. As long as a business has reputable customers and unpaid invoices, they are likely to qualify for invoice factoring, making it a practical and accessible financing solution.

Top Invoice Factoring Financing Companies

When it comes to invoice factoring financing, finding the right company can make a significant difference in your business’s financial stability. Here are three top companies that offer reliable and efficient invoice factoring financing services.

Universal Funding

Universal Funding is a renowned financial institution offering top-notch invoice factoring services. With a focus on providing liquidity for businesses, Universal Funding caters to various industries, including trucking, staffing, telecom, and oilfield services. Their expertise in factoring services makes them a go-to choice for businesses looking for reliable financing solutions.

United Capital Source

United Capital Source stands out with its quick approvals and flexible financing options. Whether you need SBA loans, business lines of credit, merchant advances, equipment financing, or working capital loans, United Capital Source provides fast and easy quotes to cater to your business’s specific financial needs.

Clarity Factoring

Clarity Factoring, based in Austin, Texas, offers bespoke solutions for businesses operating in distressed situations. With a proven track record of providing liquidity and tailored solutions for clients in challenging circumstances, Clarity Factoring stands out as a reliable partner for businesses facing complex financial challenges.

Credit: businessfactors.com

Credit: www.amazon.com

Frequently Asked Questions On Invoice Factoring Financing

What Is Invoice Factoring And Financing?

Invoice factoring and financing is a form of business financing where you sell your company’s outstanding invoices to a third party to improve cash flow. The factoring company pays you most of the invoiced amount upfront and collects payment directly from your customers.

Is Invoice Factoring A Good Idea?

Invoice factoring is a good idea for improving cash flow and revenue stability. It involves selling your company’s outstanding invoices to a third party, who pays you immediately and collects payment from your customers. This helps you maintain financial stability and avoid the wait for payment from clients.

How Do You Qualify For Invoice Factoring?

To qualify for invoice factoring, you need to “sell” some or all of your outstanding invoices to a third-party factoring company. This improves your cash flow and revenue stability. The factoring company will pay you most of the invoiced amount upfront and collect payment from your customers directly.

Do Banks Do Invoice Factoring?

Banks do offer invoice factoring services. It provides liquidity by purchasing outstanding invoices. This helps improve cash flow and revenue stability.

Conclusion

Invoice factoring financing offers businesses a flexible and effective solution to improve their cash flow and revenue stability. By selling outstanding invoices to a third party, businesses can receive immediate payment and ensure steady cash flow while the factoring company handles the collection process.

With the help of invoice factoring, businesses can overcome financial challenges and continue transacting with trade partners even during restructuring or reorganizations. Contact a reputable factoring company to explore the benefits of this financing option for your business.