The invoice factoring market size is estimated to be around $4,600 to $4,871 billion globally, with significant growth potential in the future. Invoice factoring offers businesses immediate access to working capital, helping them bridge funding gaps caused by slow-paying customers and improving cash flow.

Factoring also allows businesses to maintain longer payment terms with loyal customers while still fueling business growth. The market for invoice factoring is expected to experience exponential growth due to its benefits and increasing demand from businesses of all sizes.

This market presents lucrative opportunities for both factoring companies and businesses seeking alternative financing options.

Introduction To Invoice Factoring

Invoice factoring is a financial tool used by businesses to improve cash flow and manage their working capital effectively. It is a popular alternative financing option where companies sell their outstanding invoices to a third-party known as a factor in exchange for immediate funds.

What Is Invoice Factoring?

Invoice factoring, also known as accounts receivable factoring, is a financial solution that allows businesses to convert their unpaid invoices into immediate cash. Instead of waiting for customers to pay their invoices over a long period, companies can sell these invoices to a factoring company at a discounted rate.

The factoring company, also referred to as the factor, advances a certain percentage of the invoice value upfront, typically ranging from 70% to 90%. The remaining amount is held as a reserve and released once the customer pays the invoice in full, minus the factoring fees.

How Does Invoice Factoring Work?

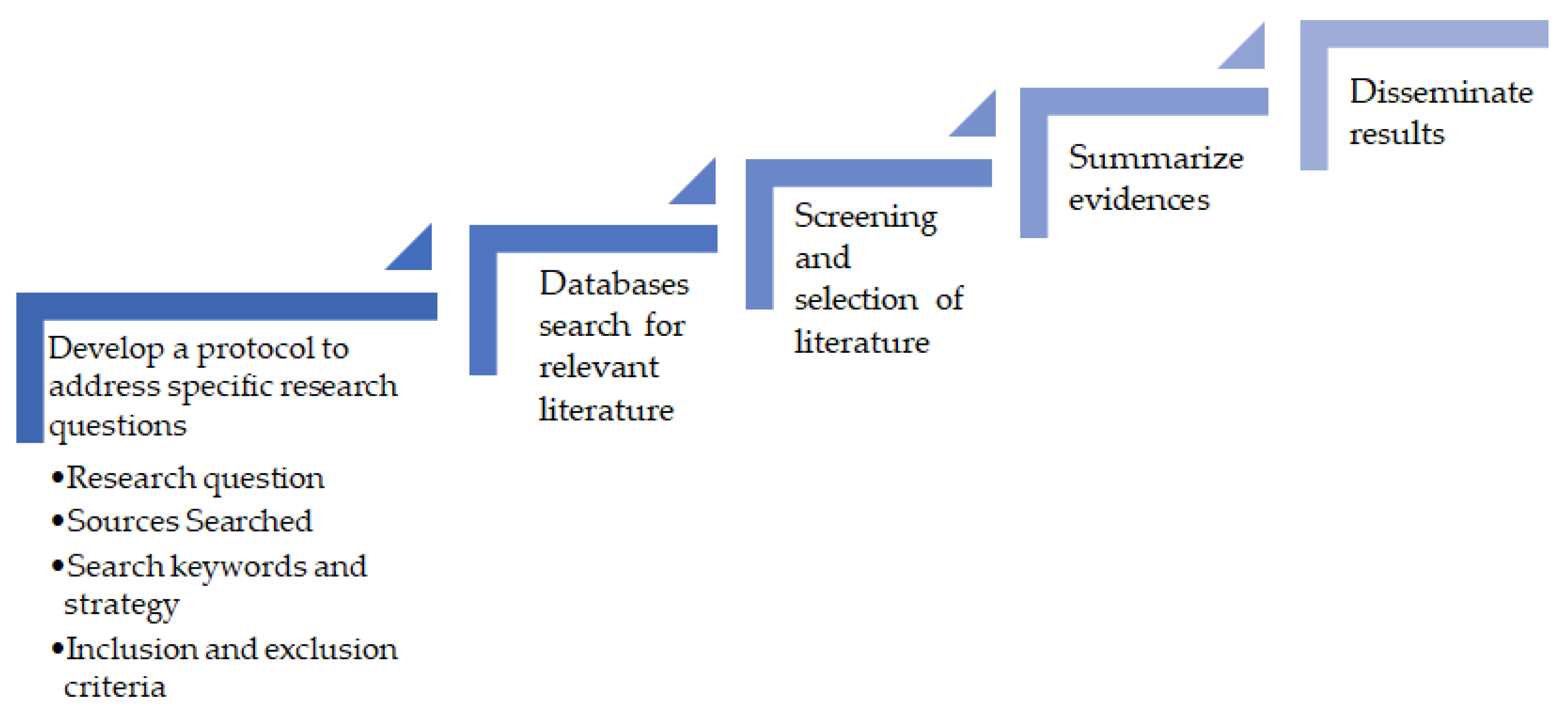

The process of invoice factoring involves the following steps:

- The business provides goods or services to its customers and generates invoices.

- The business selects invoices that are eligible for factoring based on the terms and conditions set by the factoring company.

- The business submits the selected invoices to the factoring company, along with the necessary documentation.

- The factoring company verifies the authenticity of the invoices and conducts due diligence on the business’s customers to assess their creditworthiness.

- Once approved, the factoring company advances a percentage of the invoice value to the business, typically within 24 to 48 hours.

- The business receives immediate cash and can use it to cover operational expenses, pay suppliers, or invest in growth opportunities.

- The factoring company takes over the responsibility of collecting payments from the customers.

- When the customer pays the invoice in full, the factoring company releases the remaining amount, minus their factoring fees.

Overall, invoice factoring provides businesses with a quick and reliable way to access working capital, improve cash flow, and eliminate the burden of waiting for customer payments. It is a flexible financing solution that can be tailored to suit the specific needs of different industries and businesses of all sizes.

Credit: www.mdpi.com

Benefits Of Invoice Factoring

Invoice factoring is a financial strategy that businesses can use to improve their cash flow and access immediate working capital. This method allows companies to keep loyal customers on longer payment terms while still ensuring a steady cash flow to fuel business growth. In this section, we will explore the benefits of invoice factoring and how it can positively impact businesses of all sizes.

Improved Cash Flow

One of the key benefits of invoice factoring is the ability to improve cash flow. With invoice factoring, businesses can receive immediate payment for their invoices rather than waiting for customers to settle their accounts. This eliminates the need for a long wait, ensuring that businesses have the necessary funds to cover their expenses and invest in growth opportunities.

Access To Immediate Working Capital

Invoice factoring provides businesses with access to immediate working capital. By turning unpaid invoices into cash, companies can bridge the funding gap caused by slow-paying customers. This quick injection of working capital allows businesses to pay their suppliers, meet payroll obligations, and seize new opportunities without delay.

Ability To Keep Loyal Customers On Longer Payment Terms

Another advantage of invoice factoring is the ability to keep loyal customers on longer payment terms. While businesses may need immediate cash flow, they also want to maintain a strong relationship with their customers. Invoice factoring allows businesses to offer extended payment terms while still receiving the necessary funds upfront. This flexibility helps to ensure customer satisfaction and loyalty, fostering long-term partnerships for sustainable growth.

Global Invoice Factoring Market Size

The global market size for invoice factoring is experiencing significant growth, providing businesses with immediate access to working capital and improved cash flow. This trend is shaping the future of invoice factoring and enabling businesses to expand and maintain loyal customer relationships.

Overview Of The Global Factoring Market

The global factoring market has been witnessing significant growth in recent years, with businesses increasingly turning to invoice factoring as a solution to their cash flow needs. Invoice factoring, also known as accounts receivable financing, allows companies to sell their outstanding invoices to a third-party, known as a factor, in exchange for immediate cash.

This practice helps businesses overcome the challenges of slow-paying customers and allows them to access working capital to cover funding gaps. By factoring their invoices, companies can improve their cash flow, reduce the risk of bad debt, and focus on growing their business.

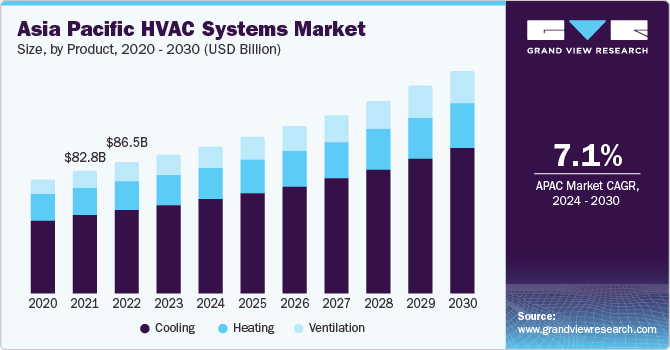

Current Market Trends

Several trends are shaping the future of the global invoice factoring market:

- Increased adoption: More businesses are recognizing the benefits of invoice factoring and opting for this financing solution to meet their short-term cash flow needs.

- Technological advancements: The development of digital platforms and fintech solutions has revolutionized the invoice factoring industry, making it more convenient and accessible for businesses of all sizes.

- Globalization: With businesses expanding their operations globally, the demand for cross-border invoice factoring has been on the rise. Companies now have the opportunity to factor invoices from international clients, providing them with a valuable source of working capital.

- Industry-specific solutions: Invoice factoring providers are increasingly tailoring their services to meet the unique needs of specific industries, such as manufacturing, healthcare, and construction. This helps businesses in these sectors overcome industry-specific challenges and access the funding they require.

As these trends continue to shape the global factoring market, it is expected that the market size will continue to grow. According to Allied Market Research, the global invoice factoring market was valued at $4,871.00 million in 2021, and it is projected to reach $4,700.00 million by the end of the forecast period.

Credit: www.grandviewresearch.com

Profitability Of Invoice Factoring

When it comes to understanding the profitability of invoice factoring, it’s essential to delve into the nuances of this financing option. Invoice factoring can be a lucrative avenue for businesses seeking immediate access to working capital, improved cash flow, and flexibility in managing customer payments. Examining the factors influencing profitability sheds light on the potential benefits and considerations associated with this financial strategy.

How Profitable Is Invoice Factoring?

Invoice factoring offers businesses the ability to convert their outstanding invoices into instant cash, providing relief from cash flow gaps caused by slow-paying customers. It enables companies to maintain a steady flow of working capital, empowering them to pursue growth opportunities without being hindered by delayed payments. The profitability of invoice factoring lies in its capacity to support business expansion, enhance liquidity, and mitigate the impact of late-paying clients on a company’s financial health.

Factors Influencing Profitability

Several factors play a crucial role in determining the profitability of invoice factoring. The creditworthiness of a company’s customers, the industry’s average payment cycles, and the terms of the factoring agreement are pivotal considerations. Additionally, the efficiency of the factoring process, including swift approval and funding, influences the overall profitability. By carefully evaluating these factors, businesses can maximize the benefits of invoice factoring and optimize their financial performance.

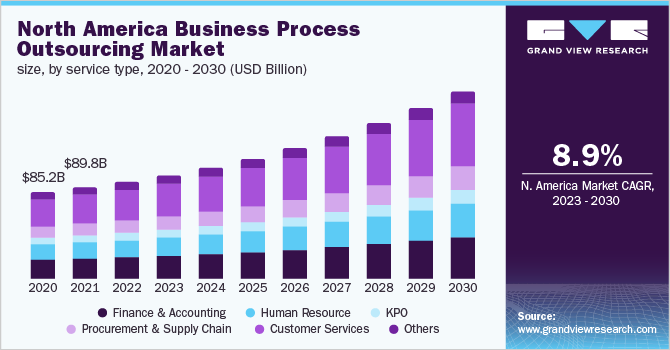

Future Trends In The Invoice Factoring Market

Key Trends Shaping The Future Of Invoice Factoring

As the invoice factoring market continues to evolve, several key trends are expected to shape its future trajectory. These trends include technological advancements and automation, as well as the impact of economic factors.

Technological Advancements And Automation

Technological advancements and automation are set to revolutionize the invoice factoring industry. With the emergence of advanced fintech solutions, businesses can expect streamlined and efficient invoice processing, reducing manual errors and expediting the funding process.

Impact Of Economic Factors

The invoice factoring market is also influenced by economic factors such as market fluctuations and global economic conditions. These factors can impact the overall demand for invoice factoring services, prompting providers to adapt and innovate to meet the evolving needs of businesses.

Credit: www.grandviewresearch.com

Frequently Asked Questions For Invoice Factoring Market Size

What Is The Future Of Invoice Factoring?

The future of invoice factoring looks promising. It provides immediate access to working capital, improving cash flow to help businesses grow. Invoice factoring also allows for longer payment terms with loyal customers. The global factoring market is significant, indicating the potential for continued growth.

Is Invoice Factoring Profitable?

Invoice factoring can be profitable as it provides immediate access to working capital, improves cash flow, and allows businesses to extend payment terms for loyal customers while still growing.

How Big Is The Global Factoring Market?

The global factoring market is valued at approximately $4,700. 00 to $4,871. 00.

What Is The Percentage Of Factoring An Invoice?

The percentage of factoring an invoice can vary between 1-5% of the invoice value.

Conclusion

The invoice factoring market continues to grow rapidly, driven by the need for businesses to improve cash flow and access working capital. With its ability to provide immediate funding and support to cover gaps created by slow-paying customers, invoice factoring has become a valuable tool for businesses looking to grow and maintain relationships with loyal customers.

As the global economy evolves, the future of invoice factoring looks promising, positioning it as a crucial financial solution for businesses of all sizes. With various market research reports supporting its growth, the invoice factoring market is set to make a significant impact in the coming years.