Invoice financing for startups provides a fast and flexible funding solution by allowing them to receive cash advances on their outstanding invoices. By leveraging the creditworthiness and payment history of their customers, startups can qualify for invoice financing without the need for traditional bank financing.

This alternative financing option helps startups improve their cash flow and fuel their growth without taking on additional debt or equity. Invoice financing allows startups to focus on their core business operations while ensuring a steady stream of working capital to support their day-to-day activities and expansion plans.

1. Introduction To Invoice Financing For Startups

Invoice financing is a financing option that has gained popularity among startups in recent years. For businesses that face cash flow challenges, invoice financing offers a quick and flexible solution to access the funds tied up in their outstanding invoices. By selling their unpaid invoices to a third-party company (known as a factor), startups can receive an immediate advance of the invoice value, typically around 70-90% of the total amount. The factor then collects the payment directly from the customer.

1.1 What Is Invoice Financing?

Invoice financing, also known as accounts receivable financing or invoice factoring, is a financial tool that enables startups to access immediate funds by selling their unpaid invoices to a third-party company. This allows businesses to bridge the gap between invoice issuance and customer payment, helping to maintain a healthy cash flow.

1.2 Benefits Of Invoice Financing For Startups

- Improved cash flow: Invoice financing provides immediate access to funds, allowing startups to cover their expenses and invest in growth initiatives without waiting for customer payments.

- Reduced credit risk: With invoice financing, startups transfer the credit risk to the factor. This means that even if a customer fails to pay, the startup is still able to receive payment for the invoice.

- Flexible funding: Invoice financing offers startups a flexible funding option that grows with their sales. As the business generates more invoices, the available funding increases.

- Easy qualification: Qualifying for invoice financing is typically easier than qualifying for traditional business loans. Factors primarily consider the creditworthiness of the startup’s customers rather than the startup’s financial history.

- Time-saving: By outsourcing the collection of invoices to the factor, startups can save time and focus on other areas of their business, such as product development or customer acquisition.

1.3 Alternatives To Invoice Financing

While invoice financing can be a valuable tool for startups, it’s important to consider alternative financing options as well. Some alternatives to invoice financing include:

- Business lines of credit: A business line of credit provides a revolving credit line that startups can draw upon as needed. This can be a good option for businesses with ongoing cash flow needs.

- Small business loans: Startups may consider applying for a small business loan from a traditional financial institution. This option can provide a lump sum of funding that can be used for various business purposes.

- Equity financing: Startups can also raise funds by selling equity in their company to investors. This option gives investors a share of ownership in the startup in exchange for capital.

Considering the unique needs and circumstances of your startup, it’s essential to explore different financing options and choose the one that aligns best with your business goals and financial requirements.

2. How Invoice Financing Works For Startups

Invoice financing can be a game-changer for startups looking to quickly access funds in order to grow their business. It offers a unique solution for businesses that struggle with long payment terms from their clients or customers, by providing them with immediate working capital.

2.1 The Process Of Invoice Financing

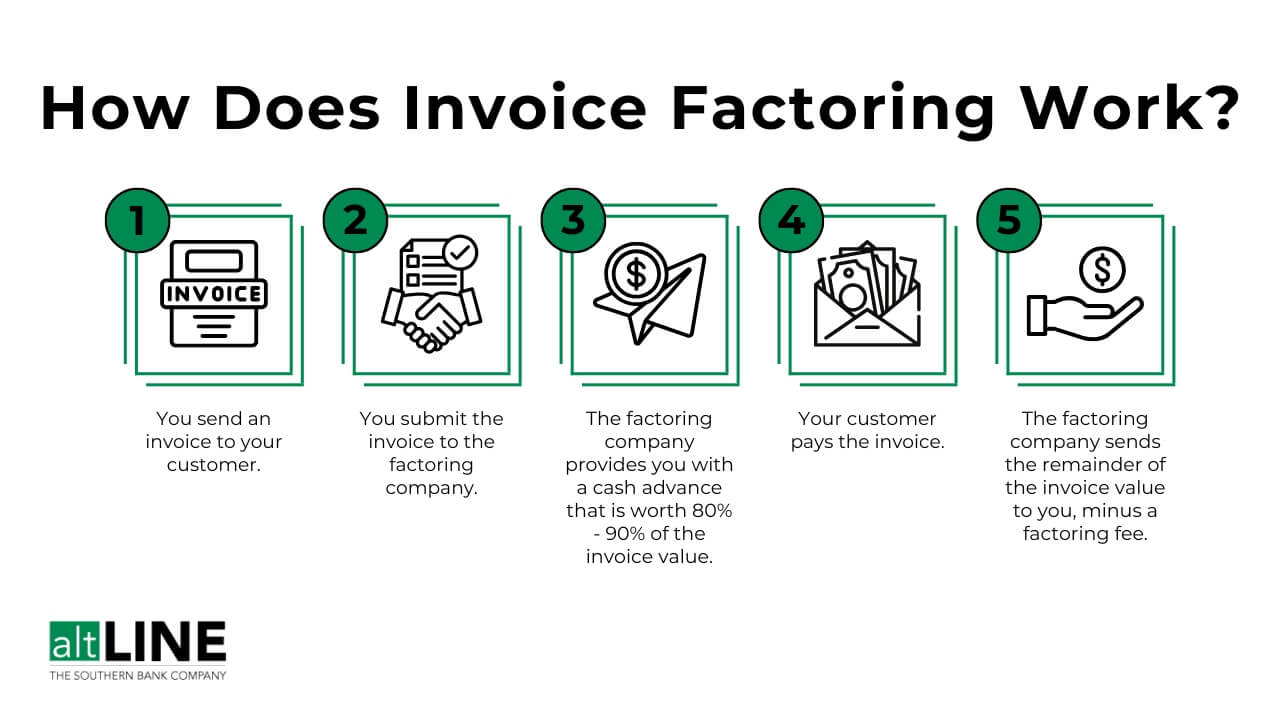

The process of invoice financing is simple and streamlined. Here’s how it works:

- First, a startup sells its outstanding invoices to an invoice financing company at a discount.

- The financing company usually advances a percentage of the invoice value upfront, typically around 70-80%.

- The remaining percentage, minus the financing company’s fee, is paid to the startup once the customer pays the invoice.

- Throughout this process, the financing company may also take over the responsibility of managing the collection of payments from customers.

2.2 Qualifying For Invoice Financing

Qualifying for invoice financing as a startup is relatively straightforward. Here are the key factors that determine eligibility:

- The startup must have creditworthy customers with a good track record of paying on time.

- The creditworthiness and reputation of the customers play a significant role in the underwriting process.

- Startups with reliable customers are more likely to qualify for invoice financing compared to other traditional business loan options.

2.3 Is Invoice Financing Risky For Startups?

While invoice financing can be a valuable tool for startups, it’s essential to consider any potential risks involved:

- Startups must carefully evaluate the costs and fees associated with invoice financing to ensure it aligns with their financial goals.

- It’s crucial to choose a reputable invoice financing company that understands the unique needs of startups and offers transparent terms and conditions.

- Additionally, startups should have a solid understanding of their customers’ payment history to minimize the risk of late or non-payment.

By understanding the process, qualifications, and risks associated with invoice financing, startups can make an informed decision about whether it’s the right financing option to fuel their growth.

3. Costs And Considerations Of Invoice Financing For Startups

Invoice financing can be a valuable tool for startups looking to manage their cash flow and accelerate their growth. However, it’s important for entrepreneurs to carefully consider the costs and factors involved in this type of financing. In this section, we will explore the average cost of invoice financing, the factors that affect its cost, and whether it is expensive for startups.

3.1 Average Cost Of Invoice Financing

The average cost of invoice financing can vary depending on several factors. Typically, lenders charge fees based on a percentage of the invoice value, ranging from 1% to 5%.

Here is a breakdown of the average costs associated with invoice financing:

| Cost Component | Average Cost |

|---|---|

| Funding Fee | 1% – 5% of the invoice value |

| Discount Rate | 1% – 3% per month |

| Origination Fee | 1% – 3% of the credit line |

It’s important to note that these are just average costs and can vary based on the specific terms and conditions offered by different lenders.

3.2 Factors That Affect The Cost Of Invoice Financing

Several factors can influence the cost of invoice financing for startups. These factors include:

- Creditworthiness of the startup: Lenders may offer more favorable rates to startups with a strong credit history and a low risk of default.

- Volume of invoices: Startups that generate a higher volume of invoices may be eligible for lower rates due to economies of scale.

- Length of financing period: The longer the financing period, the higher the total cost of invoice financing.

By understanding these factors, startups can better negotiate terms with lenders to optimize their financing costs.

3.3 Is Invoice Financing Expensive For Startups?

The cost of invoice financing may seem relatively higher compared to traditional forms of financing, such as bank loans. However, it’s essential to consider the benefits it offers.

- Improved cash flow management: Invoice financing allows startups to access immediate cash from unpaid invoices, enabling them to cover operating expenses and invest in growth opportunities.

- Flexibility and convenience: Unlike traditional loans, invoice financing does not require collateral and offers a faster approval process, making it an attractive option for startups.

- Lower risk of non-payment: Invoice financing transfers the risk of non-payment to the lender, reducing the financial impact on startups in case of late or non-payment by customers.

In conclusion, while invoice financing may have associated costs, its benefits can outweigh the expenses for startups looking to optimize their cash flow and fuel their growth.

Credit: altline.sobanco.com

4. Top Invoice Financing Providers For Startups

When it comes to maintaining a healthy cash flow for startups, invoice financing can be a game-changer. It allows businesses to access the funds tied up in unpaid invoices, providing the much-needed working capital to support growth and expansion. Finding the right invoice financing provider is crucial for startups, as it can significantly impact their financial stability and success.

4.1 Ecapital

eCapital offers fast and flexible invoice financing solutions specifically designed for startups. With minimal paperwork and quick approval processes, startups can access the funds they need to fuel their growth.

4.2 Fundthrough

FundThrough provides reliable invoice financing options for startups, empowering them to effortlessly manage their cash flow. With FundThrough, startups can seamlessly convert their outstanding invoices into cash, ensuring a steady flow of working capital.

4.3 Bibby Financial Services

Bibby Financial Services understands the unique challenges faced by startups and offers tailored invoice financing solutions. By partnering with Bibby Financial Services, startups can unlock the value of their invoices and drive sustainable growth.

4.4 Riviera Finance

Riviera Finance specializes in providing invoice factoring services for startups, delivering a dependable source of funding to support their financial needs. Their flexible and transparent approach makes them a preferred choice for startups seeking invoice financing.

4.5 Otr Solutions

OTR Solutions offers innovative invoice financing solutions specifically curated to meet the dynamic needs of startups. By leveraging OTR Solutions’ expertise, startups can optimize their cash flow and focus on achieving their business goals.

5. Considerations For Startups Using Invoice Financing

Invoice financing can be a game-changer for startups, providing them with a valuable source of working capital to support growth and expansion. However, like any financial tool, startups need to carefully consider the implications and potential risks before leveraging invoice financing. In this section, we’ll explore the key considerations for startups using invoice financing, including the benefits, risks, and tips for maximizing its advantages.

5.1 How Invoice Financing Can Help Startups Grow

Invoice financing offers startups a way to access immediate working capital by leveraging their accounts receivables. This can be particularly beneficial for startups that face cash flow challenges, as it allows them to bridge the gap between invoicing and receiving payments. By unlocking the cash tied up in unpaid invoices, startups can fund their operations, invest in expansion, and take advantage of growth opportunities without having to wait for customer payments.

5.2 Risks And Challenges Of Invoice Financing For Startups

While invoice financing can provide much-needed capital, startups must also be mindful of the potential risks and challenges associated with this funding method. These may include higher costs compared to traditional loans, potential strain on customer relationships due to third-party involvement, and the risk of relying too heavily on future receivables. It’s crucial for startups to fully understand these risks and develop strategies to mitigate them effectively.

5.3 Tips For Maximizing The Benefits Of Invoice Financing

To maximize the benefits of invoice financing, startups should focus on optimizing their invoicing and collection processes, maintaining healthy customer relationships, and carefully evaluating the terms and fees offered by invoice financing providers. By streamlining their invoicing procedures, startups can accelerate cash flow and minimize the time it takes to convert invoices into working capital. Additionally, seeking transparent and competitive financing terms is essential for ensuring that the cost of invoice financing remains manageable for startups.

Credit: www.fundingcircle.com

Credit: www.linkedin.com

Frequently Asked Questions Of Invoice Financing For Startups

How Do You Qualify For Invoice Financing?

To qualify for invoice financing, you need creditworthy customers who pay on time. The reputation and creditworthiness of your customers play a significant role in the underwriting process, making it easier to qualify for invoice financing compared to other business loan options.

What Is The Average Cost Of Invoice Financing?

The average cost of invoice financing varies depending on factors such as the size of the business and the creditworthiness of its customers. It is important to shop around and compare quotes from different providers to find the best rates for your business.

Is Invoice Financing Risky?

Invoice financing can be risky. It depends on the creditworthiness and payment history of your customers. Qualifying for invoice financing is easier if your customers have a good reputation. However, it’s important to consider the costs and fees associated with invoice financing before making a decision.

Is Invoice Financing Expensive?

Invoice financing can vary in cost. However, it can be an expensive option compared to traditional business loans. Factors such as the creditworthiness of your customers and the reputation of your business can influence the cost. It’s best to research the terms and fees involved with invoice financing before deciding if it’s the right choice for your business.

Conclusion

Invoice financing can be a game-changer for startups looking to overcome their financial challenges. With the ability to receive immediate cash flow by selling their unpaid invoices, startups can fuel their growth without relying on traditional bank financing. This funding option is particularly beneficial for startups with creditworthy customers who have a history of paying on time.

By leveraging invoice financing, startups can access the capital they need to scale and expand their business without creating additional debt or requiring equity. Embracing invoice financing can be a strategic move for startups, enabling them to overcome cash flow restrictions and seize growth opportunities.