Purchase of Accounts Receivable involves a company buying another company’s outstanding invoices to increase their working capital. This process, known as factoring or accounts receivable financing, provides a quick and easy alternative to traditional bank financing.

It allows the purchasing company to collect the receivables while the selling company receives immediate cash flow. Receivables purchase agreements typically involve multiple parties, with one company selling their receivables to another party, while additional companies act as administrators and servicers.

Overall, purchasing accounts receivable offers companies a convenient way to manage cash flow and access capital.

Benefits Of Purchasing Accounts Receivable

Purchasing accounts receivable has numerous benefits, including the ability to quickly and easily increase working capital. This process, also known as factoring or accounts receivable financing, provides an excellent alternative to traditional bank financing for companies.

Increase Working Capital

When it comes to managing cash flow, one of the biggest challenges for businesses is having enough working capital on hand. This is where purchasing accounts receivable can be incredibly beneficial. By buying these outstanding invoices from your customers, you get immediate access to the funds that are tied up in these receivables. This influx of cash can help you increase your working capital and ensure that you have enough liquidity to cover your day-to-day expenses and invest in growth opportunities.With increased working capital, you can:

- Meet your regular financial obligations, such as paying salaries and suppliers on time

- Invest in new equipment or technology to improve your business operations

- Expand your product or service offerings to attract more customers

- Take advantage of new business opportunities or ventures

Quick And Easy Financing

Traditional bank financing can be a lengthy and cumbersome process. It often involves extensive paperwork, collateral requirements, and credit checks. This can be especially challenging for small businesses or startups that may not have a long track record or substantial assets to pledge as collateral. However, purchasing accounts receivable provides a quick and easy financing solution that bypasses these hurdles.When you sell your accounts receivable, you can:

- Receive immediate payment for your outstanding invoices, usually within a matter of days

- Eliminate the need to wait for your customers to pay, reducing your overall cash conversion cycle

- Streamline your cash flow and improve your financial stability

- Focus on growing your business instead of chasing down late payments

Alternative To Traditional Bank Financing

In addition to being quick and easy, purchasing accounts receivable is an excellent alternative to traditional bank financing. Many businesses may not qualify for bank loans due to various reasons, such as limited credit history or insufficient collateral. However, when you sell your accounts receivable, the focus is on the creditworthiness of your customers rather than your own financial position.By choosing this alternative financing option, you can:

- Access funds without relying on traditional lending institutions

- Overcome cash flow gaps and stay ahead of your financial obligations

- Enjoy more flexibility and control over your finances

- Expand your borrowing capacity as your business grows

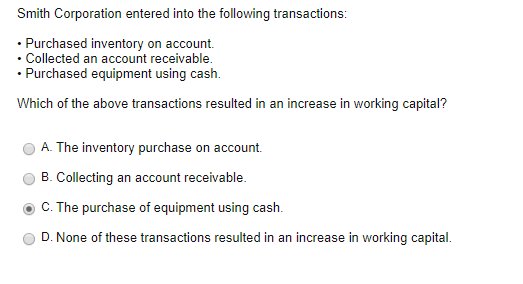

Credit: www.chegg.com

Process Of Purchasing Accounts Receivable

Purchasing accounts receivable is a strategic financial solution that allows businesses to access immediate capital by selling their outstanding invoices to a third-party entity. This process, also known as accounts receivable financing or factoring, provides businesses with the much-needed liquidity to fund operations, growth, and other financial obligations.

What Is Accounts Receivable Financing?

Accounts receivable financing, also referred to as factoring, is a financing option where businesses sell their outstanding invoices to a factoring company. In return, the business receives an immediate cash advance, typically around 70% to 90% of the invoice value. The factoring company then assumes the responsibility of collecting payments from the customers.

Accounts Receivable Purchase Agreement

An accounts receivable purchase agreement is a legally binding contract between a business and a factoring company. This agreement outlines the terms and conditions of the sale of accounts receivable, including the purchase price, fees, recourse, and other important details. It provides both parties with a clear understanding of their rights and obligations.

Factoring Companies And Their Role

Factoring companies specialize in purchasing accounts receivable from businesses. These companies evaluate the creditworthiness of a business’s customers and offer cash advances based on the invoices’ value. They also handle the collection process, ensuring timely payment from customers. Factoring companies play a crucial role in providing businesses with immediate access to funds and improving their cash flow.

How To Record Purchased Accounts Receivable

To record purchased accounts receivable, you need to make a journal entry by debiting the accounts receivable account and crediting the sales account. This process is known as factoring or accounts receivable financing and is a way for companies to increase their working capital quickly and easily.

It serves as an alternative to traditional bank financing.

When a company purchases accounts receivable, it is important to properly record this transaction in the books. This ensures accurate financial reporting and tracking of cash flow. The recording of purchased accounts receivable involves debiting the accounts receivable account and crediting the sales account. Let’s take a closer look at how these journal entries are made.Debiting Accounts Receivable Account

To record the purchase of accounts receivable, the accounts receivable account is debited. This indicates an increase in the amount owed to the company for goods or services provided. The debiting of the accounts receivable account is done to reflect the acquisition of these receivables. This entry is typically made on the asset side of the balance sheet.Crediting Sales Account

At the same time, the sales account is credited when recording the purchase of accounts receivable. This entry reflects the decrease in sales revenue as a result of selling these receivables to another party. By crediting the sales account, the company accurately reflects the reduction in its sales figures. This entry is typically made on the income statement. To summarize, when recording the purchase of accounts receivable, the accounts receivable account is debited, indicating an increase in the company’s outstanding receivables. At the same time, the sales account is credited, reflecting the decrease in sales revenue. These journal entries ensure the accurate tracking and reporting of accounts receivable transactions.

Credit: www.wallstreetprep.com

Understanding Receivables Purchase Agreements

Accounts Receivable Purchase Agreements involve the sale and purchase of accounts receivable between parties, providing a way to quickly increase working capital. This alternative financing option is often used by companies as a means of improving cash flow.

Understanding Receivables Purchase Agreements The purchase of accounts receivable can be a strategic financial move for businesses looking to improve their cash flow and leverage their outstanding invoices. Understanding the nuances of Receivables Purchase Agreements is vital for companies seeking to engage in this financial arrangement. These agreements involve multiple parties and establish the rights and obligations of each party, ensuring a clear understanding of the transaction. Parties Involved in the Agreement A Receivables Purchase Agreement typically involves three primary parties: the seller, the buyer (often a bank or financial institution), and the debtor. The seller, usually a business entity, sells its accounts receivable to the buyer in exchange for immediate funding. The debtor is the party responsible for paying the outstanding invoices. Creation of Accounts Receivables The creation of accounts receivables is an integral part of a company’s day-to-day operations. When a business provides goods or services on credit, it generates accounts receivable. These receivables represent the amount owed to the company and serve as a valuable asset. Rights and Recourse of the Bank The rights and recourse of the bank in a Receivables Purchase Agreement are critical aspects of the arrangement. The bank may retain recourse to the seller in case the debtor fails to pay the outstanding invoices. This recourse provides a layer of security for the bank and influences the terms and pricing of the agreement. Additionally, the bank may have rights related to the administration and servicing of the purchased receivables, further defining its role in the transaction. The careful delineation of rights and recourse ensures clarity and mitigates risk for all parties involved in the Receivables Purchase Agreement. As businesses seek to optimize their cash flow and working capital, understanding the intricacies of Receivables Purchase Agreements is fundamental. These agreements play a pivotal role in enabling businesses to unlock the value of their accounts receivable while providing financial flexibility and liquidity. By comprehending the roles and responsibilities of the involved parties and the implications of the agreement, businesses can make informed decisions and leverage this financial tool effectively.Accounts Receivable Purchase Programs

Accounts Receivable Purchase Programs are a solution for businesses looking to quickly increase their working capital. By selling their accounts receivable to a buyer, companies can easily access the funds tied up in unpaid invoices, providing them with the cash flow they need to grow and succeed.

Accounts Receivable Purchase Programs Accounts Receivable (AR) purchase programs are financial strategies that help companies enhance their liquidity by selling their AR to a bank or financial entity at a discounted rate. This allows organizations to convert their outstanding invoices into cash, improving their cash flow and working capital. AR purchase programs offer various benefits to corporations and play a crucial role in boosting their financial stability.Process Of Purchasing Receivables

The process of purchasing receivables involves a few key steps: 1. Evaluation: The financial institution assesses the creditworthiness of the seller and the quality of the receivables. 2. Agreement: Upon approval, a purchase agreement is drafted, detailing the terms and conditions of the transaction. 3. Purchase: The bank buys the AR from the seller at a discounted rate, providing immediate funds to the corporation.Benefits For Corporations

Corporations can reap several advantages from AR purchase programs, including: – Improved Cash Flow: Immediate access to cash helps in meeting operational expenses and investments. – Reduced Bad Debt Risk: Transferring AR mitigates the risk of non-payment and bad debt, enhancing financial stability. – Working Capital Optimization: Selling AR provides working capital flexibility, enabling companies to pursue growth opportunities.Roles Of Banks In Purchase Programs

Banks play pivotal roles in AR purchase programs by: – Providing Liquidity: Banks offer immediate cash to corporations by purchasing their AR, aiding in financial stability. – Risk Mitigation: Evaluating the creditworthiness of sellers and assessing the quality of receivables to minimize risks. – Customizing Solutions: Tailoring AR purchase programs to meet the specific financial needs of corporations, fostering a collaborative partnership. By actively engaging in AR purchase programs, corporations can efficiently manage their cash flow, minimize bad debt risks, and optimize their working capital, ultimately resulting in a more robust financial foundation.:max_bytes(150000):strip_icc()/workingcapitalmanagement_definition_0914-38bc0aea642a4a589c26fbc69ea16564.jpg)

Credit: www.investopedia.com

Frequently Asked Questions Of Purchase Of Accounts Receivable

How Do You Record Purchased Accounts Receivable?

To record purchased accounts receivable, debit the accounts receivable account and credit the sales account. This helps increase working capital for the company. It’s a process of factoring or accounts receivable financing, acting as an alternative to traditional bank financing.

Why Would A Company Buy Accounts Receivable?

Companies buy accounts receivable to quickly increase their working capital through factoring or accounts receivable financing. This is an alternative to traditional bank financing.

What Is The Agreement For The Purchase Of Receivables?

The agreement for the purchase of receivables is a contract between a buyer and seller. The seller sells their accounts receivables, and the buyer collects the receivables. This allows the seller to quickly increase their working capital without relying on traditional bank financing.

What Is The Sale And Purchase Of Receivables?

The sale and purchase of receivables refer to when one company sells its accounts receivables to another party. This helps the selling company increase working capital quickly and easily. These agreements involve multiple parties, with one company selling its receivables, another party buying them, and additional companies serving as administrators and servicers.

It is a way for businesses to manage their cash flow efficiently.

Conclusion

Purchasing accounts receivable can be a beneficial strategy for companies looking to increase their working capital quickly and easily. Factoring or accounts receivable financing offers an alternative to traditional bank financing, providing a means to unlock the value of unpaid invoices.

By entering into agreements for the purchase of receivables, businesses can effectively manage their cash flow and improve financial stability. This approach allows for the swift conversion of unpaid invoices into immediate cash, providing flexibility and growth opportunities for companies.