To credit accounts receivable means to record a transaction where the customer has paid their debt, resulting in a decrease in the amount owed to the business. The accounts receivable balance on a trial balance is typically a debit until the customer makes a payment.

Account receivable credit is a term used in accounting to describe the process of recording a transaction where a customer pays their debt, resulting in a decrease in the amount owed to the business. It refers to the act of crediting the accounts receivable and debiting the cash account, as the money is now in the bank and is no longer owed.

On a trial balance, the accounts receivable balance is usually shown as a debit until the customer makes a payment. Understanding the concept of account receivable credit is crucial for businesses to accurately track and manage their outstanding payments. We will delve deeper into the meaning of account receivable credit and how it works in the overall financial management of a company.

Credit: www.versapay.com

Understanding Account Receivable Credit

Account receivable credit refers to the amount owed by customers to a company. When the customer makes the payment, the accounts receivable is credited, and cash account is debited. This process balances out the debits and credits, ensuring equal money movement.

Definition

Accounts receivable credit refers to the situation when the amount of money owed to a company by its customers is less than the amount of money the company owes its customers. Typically, accounts receivable are recorded as debits, indicating the amount owed to the business. However, there are times when credit balances can occur in the accounts receivable account.

How It Works

When a customer pays their outstanding balance, the accounts receivable will be credited, indicating that the payment has been received. At the same time, the cash account will be debited, as the money is now in the company’s bank and no longer owed. This ensures that the debits and credits are equal and balance each other out in the accounting records.

For example, let’s say a customer had an outstanding balance of $500. When they make a payment of $300, the accounts receivable will be credited by $300, and the cash account will be debited by the same amount.

Benefits Of Account Receivable Credit

- Improved cash flow: By promptly collecting payments from customers, businesses can enhance their cash flow and maintain a healthy financial position.

- Reduced bad debt: With effective credit management practices, companies can minimize the risk of non-payment and bad debts.

- Enhanced customer relationships: Timely and accurate credit transactions create a positive impression on customers, leading to stronger relationships and potential repeat business.

Overall, understanding account receivable credit is crucial for businesses to efficiently manage their cash flow, ensure accurate financial records, and strengthen their customer relationships. By optimizing accounts receivable credit, businesses can improve their financial stability and maximize their profitability.

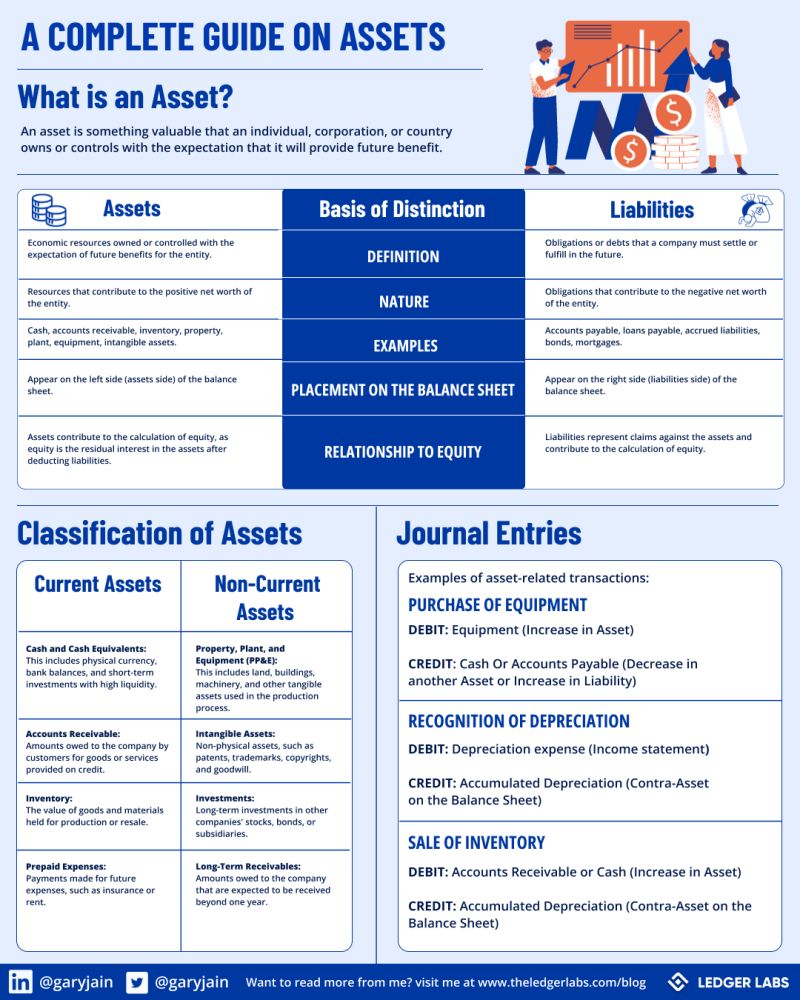

Credit: www.whizconsulting.net

Accounts Receivable As Debit Or Credit

Accounts receivable plays a crucial role in the financial operations of a business. It represents the outstanding payments owed to the company by its customers. When it comes to recording these transactions, the question arises: should accounts receivable be considered as a debit or credit?

Debit Or Credit?

The general rule is that accounts receivable is recorded as a debit. As an asset, accounts receivable represents the amount of money owed to the business by its customers. Since assets are typically recorded as debits, accounts receivable follows the same principle.

However, there are instances when accounts receivable can have a credit balance. This usually occurs when the amount owed to the company by its customers is less than the amount the company owes its customers. In such cases, the accounts receivable account will have a credit balance.

Journal Entry

So, how do you record accounts receivable transactions? When a customer makes a purchase on credit, the journal entry would look like this:

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable | XXXX | |

| Sales | XXXX |

Once the customer pays their outstanding balance, the journal entry to record the payment would be:

| Account | Debit | Credit |

|---|---|---|

| Cash | XXXX | |

| Accounts Receivable | XXXX |

This way, the journal entries ensure that the debits and credits are balanced, as they should be in double-entry bookkeeping.

Understanding whether accounts receivable should be recorded as a debit or credit is essential for accurate financial reporting. By properly recording these transactions, businesses can maintain a clear picture of their outstanding customer balances and ensure their books are balanced.

Examples Of Credit Balances In Accounts Receivable

Credit balances in accounts receivable occur when the amount of money owed to a company by its customers is less than the amount the company owes its customers. While accounts receivable is typically recorded as a debit, credit balances can occur in certain situations.

Definition

Accounts receivable is typically recorded as a debit, representing the amount of money owed to a business by its customers. However, there are instances when credit balances can occur in the accounts receivable account. This happens when the amount of money owed to the company by its customers is less than the amount of money the company owes its customers.

Impact On Accounts Receivable

A credit balance in accounts receivable can have several implications:

- Overpayments: Sometimes, customers inadvertently make payments in excess of what is owed. These overpayments result in credit balances in the accounts receivable.

- Returns and refunds: When customers return products and receive refunds, the amount refunded may exceed their outstanding balances. This leads to credit balances in the accounts receivable.

- Discounts and allowances: Businesses may offer discounts or allowances to their customers. If the applied discount or allowance exceeds the outstanding balance, it creates a credit balance in the accounts receivable.

A credit balance in accounts receivable has important financial implications:

- Reduction in liabilities: The credit balance in accounts receivable represents a reduction in the company’s liabilities, as it owes less money to its customers.

- Potential cash flow challenges: If the credit balance remains unresolved for an extended period, it can lead to potential cash flow challenges for the business.

- Reconciliation complexities: The presence of credit balances in accounts receivable can make the reconciliation process more complex, requiring additional analysis and adjustments to ensure accuracy.

Solving Credit Balances In Accounts Receivable

When credit balances occur in accounts receivable, businesses should take the following steps to resolve them:

- Contact the customer: Reach out to the customer to inform them about the credit balance and discuss potential options for resolution, such as applying it as a credit toward future purchases or issuing a refund.

- Apply credits correctly: Ensure that any credits are properly applied to the customer’s account, matching the amount of the credit to the outstanding balance to eliminate the credit balance.

- Monitor accounts regularly: Regularly review accounts receivable balances to identify any credit balances and take appropriate action promptly.

- Adjust accounting records: Make necessary adjustments to the accounting records to reconcile the accounts receivable and accurately reflect the current financial position of the business.

Resolving credit balances in accounts receivable not only helps maintain accurate financial records but also ensures smooth cash flow management and customer satisfaction.

Credit: www.linkedin.com

Managing Credit Balances In Accounts Receivable

Managing credit balances in accounts receivable involves carefully tracking the amounts owed to a company by customers and ensuring that any credit balances are resolved. This includes crediting accounts receivable once customers have paid and debiting the cash account. By effectively managing credit balances, businesses can maintain accurate financial records and improve their cash flow.

Sure, I can help you with that! Here’s an engaging section of a blog post about managing credit balances in accounts receivable in HTML format.What Is A Credit Balance?

A credit balance in accounts receivable occurs when the amount of money owed to a company by its customers is less than the amount of money the company owes its customers. This creates a negative balance in the accounts receivable account, indicating that the company owes the customer money instead of the other way around.

How To Manage A Credit Balance

Managing a credit balance in accounts receivable is crucial for maintaining financial accuracy and customer satisfaction. Here are some essential steps to manage a credit balance effectively:

- Review Accounts: Regularly review accounts receivable to identify any credit balances.

- Customer Communication: Contact customers with credit balances to resolve the issue promptly.

- Adjust Invoices: Adjust invoices or issue refunds to clear the credit balance.

- Record Transactions: Properly record all adjustments and transactions related to credit balances.

- Prevent Future Balances: Implement processes to prevent future credit balances and maintain accurate records.

Frequently Asked Questions Of Account Receivable Credit

What Does It Mean To Credit Accounts Receivable?

To credit accounts receivable means to reduce the amount owed to a business by a customer. It is done when the customer pays, and the money is transferred from accounts receivable to the cash account. Normally, accounts receivable is recorded as a debit on the trial balance.

Is Accounts Receivable A Debit Or Credit T Account?

Accounts receivable is recorded as a debit in a T account.

What Is The Journal Entry For Receivables Credit?

When receivables are credited, it means the amount owed to the company is reduced. This is recorded as a credit in the journal, balancing out the debit entry for the sale and reflecting the money collected from the customer.

What Is An Example Of A Credit Balance In Accounts Receivable?

A credit balance in accounts receivable occurs when a company owes less to customers than they owe.

Conclusion

Understanding the concept of accounts receivable credit is crucial for maintaining a balanced financial system. When a customer pays, accounts receivable is credited and the cash account is debited. This ensures that the money is now in your bank and not owed to you.

It is important to record entries accurately, with debits and credits balancing each other. While accounts receivable is typically recorded as a debit, credit balances can occur when the amount owed by customers is less than what the company owes them.

Managing credit balances in accounts receivable is essential for maintaining a healthy cash flow.