To accurately account for factoring receivables, the business should record the amount sold as a credit in accounts receivable, the cash received as a debit in the cash account, the paid factoring fee as a debit loss, and the amount the factoring company retained as a debit in the due account. Factoring receivables is a well-established method used by businesses to obtain finance, sales ledger administration services, or protection from bad debts.

In this process, accounts receivable are sold outright, usually to a factoring company, who assumes the full risk of collection without recourse to the business. This allows the business to receive immediate cash in exchange for their accounts receivable, helping with cash flow management.

However, it is important for businesses to accurately record these transactions in their accounting books to ensure transparency and proper financial reporting.

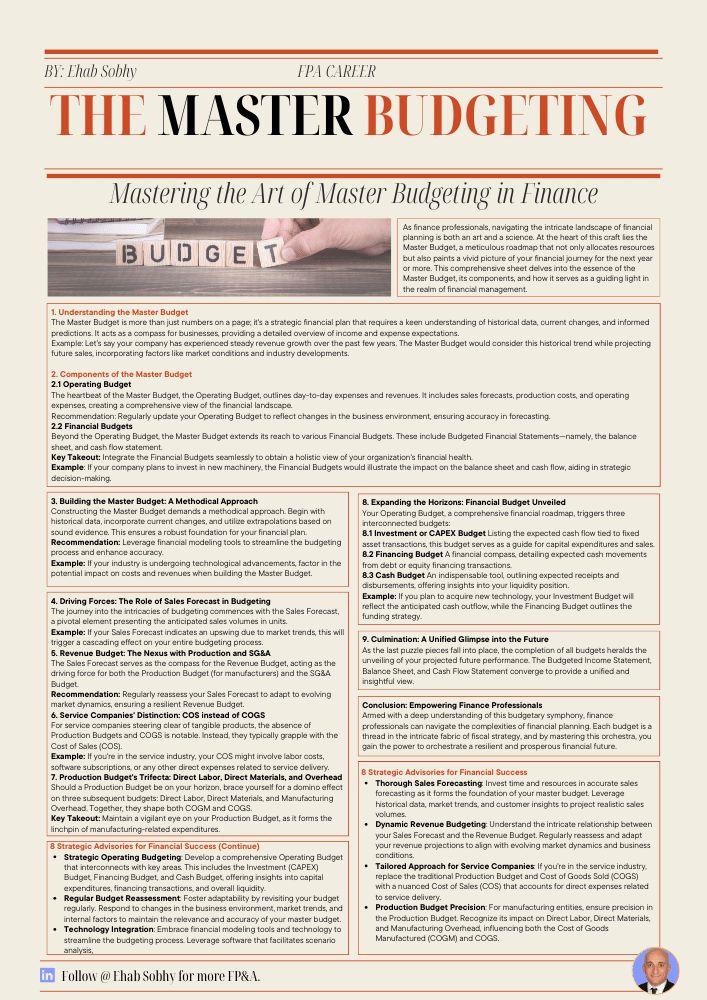

Credit: www.linkedin.com

Introduction To Factoring Receivables

Factoring receivables is a well-established method of obtaining finance, sales ledger administration services, or protection from bad debts. It is a financial arrangement where a business sells its accounts receivable to a third party, called a factor, at a discount. In return for this purchase, the factor provides immediate cash to the business. This allows the business to improve its cash flow and access working capital without having to wait for customers to pay their invoices.

Definition Of Factoring Receivables

Factoring receivables, also known as accounts receivable factoring, is a financial transaction where a business sells its accounts receivable to a third party, called a factor, at a discount. The factor then assumes responsibility for collecting the outstanding payments from the customers.

Benefits Of Factoring Receivables

Factoring receivables offers several benefits to businesses:

- Improved Cash Flow: By selling accounts receivable, businesses can receive immediate cash instead of waiting for customers to pay their invoices. This allows businesses to meet their immediate financial obligations and invest in growth opportunities.

- Working Capital: Factoring receivables provides businesses with working capital, which can be used for various purposes like purchasing inventory, paying employees, or expanding operations.

- Reduced Administrative Burden: When businesses factor their receivables, the factor takes over the responsibility of collecting payments from customers. This frees up the business’s resources and allows them to focus on core operations.

- Risk Mitigation: Factoring receivables can protect businesses from bad debts. The factor assesses the creditworthiness of the customers and takes on the risk of non-payment. This ensures that businesses are paid for their products or services, even if the customer fails to pay.

In summary, factoring receivables is a beneficial financial strategy for businesses to improve cash flow, access working capital, reduce administrative burden, and mitigate the risk of bad debts.

Accounting Treatment Of Factoring Receivables

Factoring receivables is a commonly used financial practice that provides businesses with immediate cash by selling their accounts receivable to a third-party company, known as a factor. While factoring offers numerous benefits to businesses, it is important to understand the accounting treatment of factoring receivables to ensure accurate financial record-keeping.

Recording The Amount Sold

When a business sells its accounts receivable to a factor, the amount sold must be recorded. This is done by crediting the accounts receivable account with the value of the receivables that have been sold. By doing so, businesses can accurately reflect the reduction in their accounts receivable balance.

Recording The Cash Received

Upon selling the receivables, the business receives immediate cash from the factor. This cash amount must be recorded by debiting the cash account. This ensures that the increase in cash is accurately reflected in the financial records.

Recording The Factoring Fee

Factoring companies charge a fee for their services, which is typically based on a percentage of the total receivables sold. To properly account for this factoring fee, businesses must debit a loss account. By doing so, the financial statements accurately reflect the expense incurred from the factoring arrangement.

Recording The Retained Amount By The Factoring Company

After deducting their fee, the factoring company retains a portion of the receivables as security against potential defaults or customer disputes. This retained amount should be recorded by debiting a due account. This ensures visibility and transparency in the financial statements regarding the factoring arrangement.

Factoring Receivables And Gaap

When it comes to factoring receivables, it is important to understand the Generally Accepted Accounting Principles (GAAP). PwC outlines the proper accounting treatment for factoring receivables, focusing on the correct recording of transactions, recognizing the net realizable value, and the off-balance-sheet financing nature of factoring.

This ensures accurate financial reporting and compliance with accounting standards.

Net Realizable Value

When it comes to accounting for factoring receivables, it is crucial to adhere to Generally Accepted Accounting Principles (GAAP). According to US GAAP, the company’s accounts receivable balance must be stated at “net realizable value”. This means that the accounts receivable balance presented in the company’s financial statements must be equal to the amount of cash they expect to collect from customers.

Net realizable value is calculated by subtracting any estimated allowances for doubtful accounts from the total accounts receivable balance. This helps provide a more accurate representation of the company’s receivables and ensures that only collectible amounts are reported on the balance sheet.

Presentation On The Balance Sheet

When factoring receivables, it is important to understand how it affects the presentation on the balance sheet. Factoring is not treated as a loan because the sales invoice is purchased rather than money being lent. As a result, there is no immediate liability to be recorded in the books of the issuing company.

This lack of liability is a key reason why factoring is known as off-balance-sheet financing. The factored receivables are typically removed from the accounts receivable account and replaced with the cash received from the factoring company. This adjustment ensures that the balance sheet accurately reflects the company’s current financial position.

Additionally, the factoring fee paid to the factoring company is recorded as a debit loss on the balance sheet. This expense represents the cost of obtaining financing through factoring and should be properly disclosed in the financial statements.

It is worth noting that factoring arrangements can vary, and the specific presentation on the balance sheet may depend on the terms of the agreement between the company and the factoring company. Therefore, it is essential to carefully review the terms and consult with accounting professionals to accurately record and present factored receivables in accordance with GAAP.

Credit: viewpoint.pwc.com

Factoring Receivables Vs. Debt Financing

Factoring receivables and debt financing are two essential methods used by businesses to improve their cash flow and access working capital. While both serve the purpose of providing immediate funds, there are distinct differences between the two approaches that businesses should consider when making financial decisions.

Definition Of Ar Factoring

Accounts Receivable (AR) factoring, also known as invoice discounting, is a financial transaction where a business sells its accounts receivable to a third-party (a factor) at a discount in exchange for immediate cash. The factor then collects the payments from the business’ customers.

Difference Between Ar Factoring And Debt Financing

AR factoring involves selling the rights to collect outstanding invoices to a third-party, providing immediate cash but at a discounted rate. On the other hand, debt financing refers to borrowing funds from a lender, such as a bank, with the obligation to repay the principal amount along with interest over a specified period.

Credit: ramp.com

Frequently Asked Questions On Accounting For Factoring Receivables Pwc

How Do You Account For Accounts Receivable Factoring?

To account for accounts receivable factoring, follow these steps: 1. Record the amount sold as a credit in accounts receivable. 2. Record the cash received as a debit in the cash account. 3. Record the paid factoring fee as a debit loss.

4. Record the amount the factoring company retained in the debit-due account.

Is Ar Factoring Considered Debt?

AR factoring is considered a form of short-term debt financing. It involves the sale of accounts receivable to a factoring company, which provides immediate cash to the business. The factoring company assumes the risk of collecting the receivables.

What Is The Gaap Accounting For Receivables?

Under GAAP accounting, accounts receivable must be stated at “net realizable value,” which means it should reflect the amount of cash expected to be collected from customers. Factoring of receivables involves recording the amount sold as a credit in accounts receivable, recording the cash received as a debit in the cash account, and recording the factoring fee and retained amount as debits in relevant accounts.

Factoring is not considered debt and is treated as off-balance-sheet financing.

How Is Factoring Recorded On Balance Sheet?

Factoring is not recorded as a loan on the balance sheet. Instead, the amount sold is recorded as a credit in accounts receivable and the cash received is recorded as a debit in the cash account. The factoring fee is recorded as a debit loss and the amount retained by the factoring company is recorded in the debit-due account.

Conclusion

In accounting for factoring receivables, it is crucial to accurately record the transaction. This involves crediting the accounts receivable for the amount sold and debiting the cash account for the funds received. Additionally, the factoring fee should be recorded as a debit loss, and the amount retained by the factoring company should be recorded in the debit-due account.

By following these steps, businesses can effectively manage their factoring receivables.