The business apportionment factor is the assignment of a portion of a corporation’s income to a specific state for the purpose of determining the corporation’s income tax in that state. This is done to determine how much of the corporation’s earnings are a result of business activities conducted in that state, allowing the state to charge the appropriate amount of income tax.

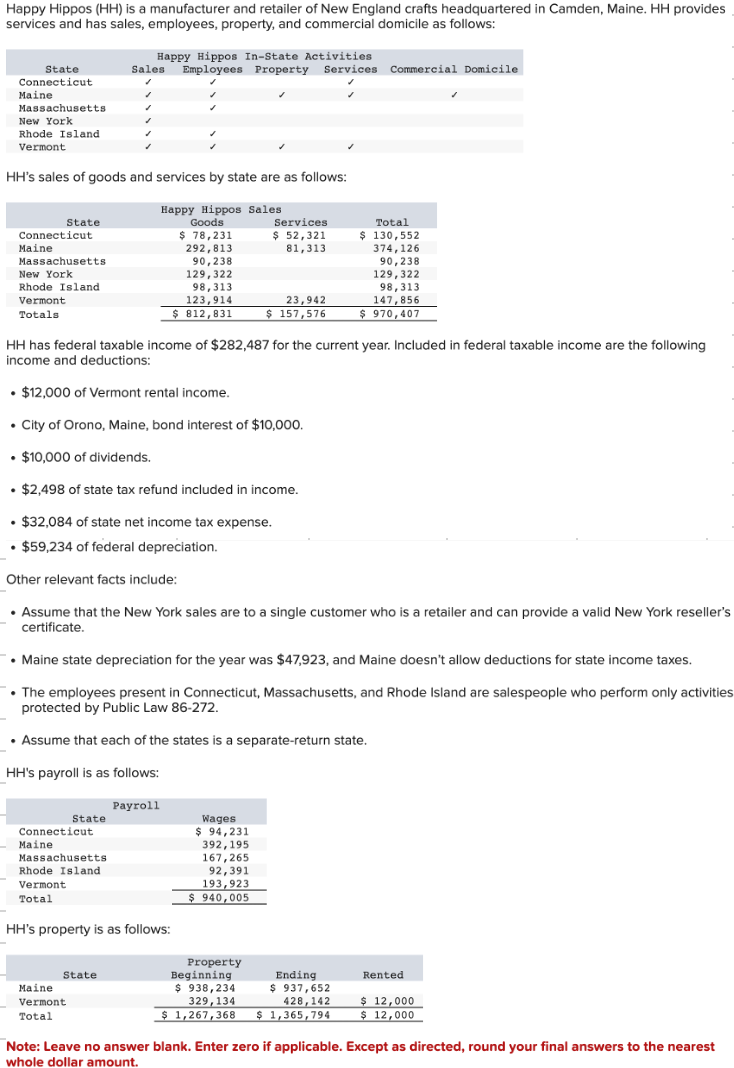

The apportionment factor can be calculated using a formula that takes into account factors such as payroll, property, and sales.

Credit: www.chegg.com

Credit: gusto.com

Frequently Asked Questions For Business Apportionment Factor

What Is Business Apportionment Factor?

The business apportionment factor is the percentage of a corporation’s income that is assigned to a specific state for the purpose of determining the corporation’s income tax in that state. It is determined by the state to calculate the appropriate amount of income tax based on the earnings generated in that state.

How Do You Calculate 3 Factor Apportionment?

The 3 factor apportionment method calculates a corporation’s income tax in a particular state by considering three factors: payroll, property and sales. Each factor is given equal weight in the calculation. The state determines how much of the corporation’s earnings are attributable to business done in that state in order to assess the correct amount of income tax.

Is Business Income Apportioned Or Allocated?

Business income is subject to apportionment, not allocation. Apportionment assigns a portion of a corporation’s income to a specific state for income tax purposes. This is done to determine the appropriate amount of income tax owed in that state based on the amount of business conducted there.

What Is The Rule Of Apportionment?

The rule of apportionment assigns a corporation’s income to specific states for tax purposes. This ensures fair taxation based on business activities in each state.

Conclusion

The business apportionment factor is crucial in determining the amount of income tax a corporation owes in a particular state. By assigning a portion of the corporation’s income to that state, the state can charge the appropriate amount of income tax based on the business done within its borders.

Understanding and calculating the apportionment factor is essential for businesses to ensure they comply with state tax regulations and avoid penalties. It is important for businesses to consult with tax professionals to navigate this complex process accurately.