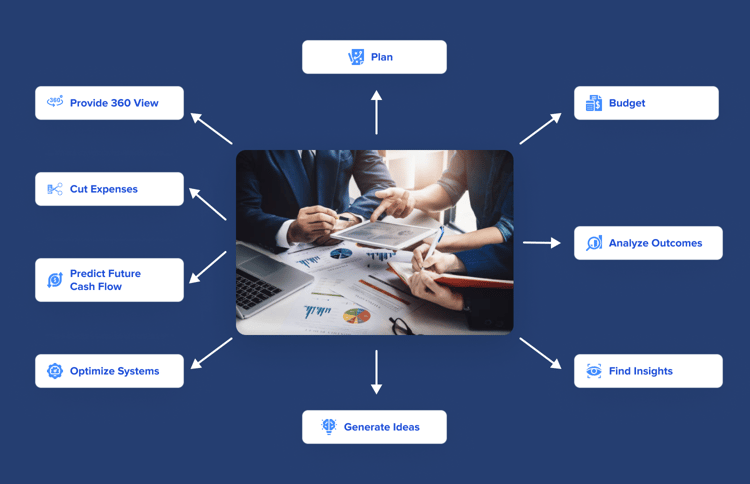

Capital Invoice is a factoring company based in Athens, Georgia, that provides working capital financing to small businesses. They offer a range of financial workflow solutions to improve cash flow and revenue stability.

With over fifteen years of experience, Lisa Slocum is a partner at Capital Invoice, specializing in helping businesses access the funds they need to continue growing.

What Is Invoice Factoring?

Invoice factoring is a form of invoice finance where a business sells its outstanding invoices to a third party for an immediate cash advance. This provides a quick infusion of working capital and stabilizes the company’s cash flow. The factoring company then collects the payment directly from the customer, making it an efficient funding solution for businesses.

Definition

Invoice factoring is a type of invoice finance that allows businesses to enhance their cash flow and revenue stability. In this solution, a company sells some or all of its outstanding invoices to a third party, known as a factoring company. The factoring company pays the business a significant portion of the invoiced amount immediately, taking over the responsibility of collecting payment directly from the customers.

How It Works

When a business engages in invoice factoring, they submit their outstanding invoices to a factoring company. The factoring company then reviews the invoices and advances a large portion of the total amount, typically around 80-90%, to the business. This provides the business with immediate access to funds that can be used for various operational expenses, such as paying suppliers or investing in growth initiatives.

Once the factoring company provides the advance payment, they take over the collection process. They communicate directly with the customers, ensuring timely payment. When the customers pay, the factoring company deducts their fee and any outstanding balance, and then remits the remaining amount to the business.

Benefits

Using invoice factoring can bring several benefits to businesses:

- Improved cash flow: Invoice factoring enables businesses to access a significant portion of their outstanding invoices’ value immediately, providing them with the necessary funds to meet their financial obligations and pursue growth opportunities.

- Enhanced revenue stability: By outsourcing the task of collecting payments to a factoring company, businesses can reduce the risk of late payments or non-payments, ensuring a steady cash flow.

- Flexible financing: Invoice factoring is not a loan, so it doesn’t require collateral or a lengthy approval process. It allows businesses to access funds based on their sales, making it suitable for both established companies and startups.

- Streamlined operations: With the factoring company taking care of the collection process, businesses can focus on their core operations and reduce administrative tasks related to accounts receivable management.

Overall, invoice factoring provides businesses with a reliable and efficient way to address cash flow challenges and maintain financial stability.

Credit: www.plooto.com

Working With An Invoice Factoring Company

When it comes to managing cash flow and ensuring a steady revenue stream, many businesses turn to invoice factoring. This financial solution allows companies to sell their outstanding invoices to a third-party, known as an invoice factoring company, in exchange for upfront payment. Working with an invoice factoring company can provide immediate working capital and help businesses maintain a healthy cash flow.

Choosing The Right Company

When selecting an invoice factoring company, it is crucial to choose one that aligns with your specific business needs. Consider the following factors:

- Industry expertise: Look for a factoring company that has experience working with businesses in your industry. They will understand the unique challenges and requirements of your sector.

- Funding flexibility: Evaluate the flexibility of the factoring company in terms of the volume of invoices they can handle and the funding they offer. Ensure they can support your business’s growth.

- Reputation and reliability: Research the reputation and track record of potential factoring companies. Read customer reviews and testimonials to gauge their reliability and customer satisfaction.

- Transparency and communication: A good factoring company will provide clear and transparent terms and conditions. Communication should be open and frequent to keep you informed about the status of your invoices.

Responsibilities And Liabilities

Before partnering with an invoice factoring company, it is essential to understand the responsibilities and liabilities involved. Here are some key considerations:

- Invoice verification: Ensure that the factoring company verifies all invoices before providing funding to avoid any issues or discrepancies.

- Customer relationships: While the factoring company takes on the responsibility of collecting payment from your customers, your business must maintain a good relationship with them to prevent any potential conflicts or communication gaps.

- Liability for unpaid invoices: In some scenarios, if a customer fails to pay an invoice, the factoring company may hold your business liable for the outstanding amount. Understand the terms and conditions regarding liability to mitigate any financial risks.

- Confidentiality: Clarify the confidentiality policies of the factoring company to ensure that your business and customer information remains secure and protected.

Working with an invoice factoring company can be a smart financial move for businesses looking to improve cash flow and maintain revenue stability. However, it is crucial to choose the right company and understand the responsibilities and liabilities involved in the partnership. By selecting a reputable and reliable factoring company and being aware of the terms and conditions, businesses can effectively leverage this funding solution to achieve their financial goals.

Is Invoice Factoring Right For Your Business?

Is Invoice Factoring Right for Your Business?

Factors To Consider

1. Cash flow needs: Consider your business’s cash flow needs and whether invoice factoring can help improve your cash flow situation. If your business regularly deals with late-paying customers and has a significant amount of outstanding invoices, invoice factoring can provide you with immediate access to cash.

2. Creditworthiness of your customers: Invoice factoring is based on the creditworthiness of your customers, as the factoring company will be collecting payment directly from them. If your customers have a good credit history and are known for timely payments, invoice factoring can be a suitable financing option for your business.

3. Cost of factoring: Consider the cost associated with invoice factoring. Factoring fees can vary greatly among different factoring companies, so it’s essential to compare rates and terms to ensure you’re getting the best deal for your business.

Ideal Businesses For Invoice Factoring

1. Small and medium-sized businesses: Invoice factoring is particularly beneficial for small and medium-sized businesses that may not have access to traditional financing options. It can provide them with the working capital they need to cover operational costs and expand their business.

2. Businesses with slow-paying customers: If your business deals with customers who often pay invoices late, invoice factoring can help bridge the cash flow gap. It ensures that you receive immediate payment for your outstanding invoices without having to wait for customer payments.

3. Rapidly growing businesses: For businesses experiencing rapid growth, invoice factoring can be a flexible financing solution. It allows them to convert their accounts receivable into cash and reinvest it back into the business to fuel further growth.

Credit: www.lsq.com

Case Study: Capital Invoice

Capital Invoice is a leading financial institution providing innovative solutions for businesses in need of working capital funding. In this case study, we will delve into their services, success stories, and how they have helped businesses thrive.

About Capital Invoice

Capital Invoice offers financial solutions such as invoice factoring, business loans, and business credit services. Their team of experts understands the challenges businesses face and provides tailored financial solutions to meet their needs.

Services Offered

- Invoice Factoring

- Business Loans

- Business Credit Services

Capital Invoice specializes in offering customized financial solutions to help businesses manage their cash flow, improve revenue stability, and achieve growth.

Success Stories

Capital Invoice has a proven track record of helping businesses thrive. By providing flexible funding options and personalized financial strategies, they have empowered numerous businesses to achieve their goals and overcome financial challenges.

Credit: www.leaseuk.com

Frequently Asked Questions Of Capital Invoice

What Is An Invoice Factoring Loan?

An invoice factoring loan is a type of invoice finance where you sell some or all of your company’s outstanding invoices to a third party. This helps improve your cash flow and revenue stability. The factoring company pays you most of the invoiced amount immediately and collects payment directly from your customers.

What Happens If A Factoring Company Doesn’t Get Paid?

If a factoring company doesn’t get paid, the business owner or operator is responsible for the unpaid invoices. They will need to buy back the invoices from the factoring company. The factoring company assumes liability for the unpaid invoices.

Is Invoice Factoring A Good Business?

Invoice factoring can be a good business for companies with bad credit. Factoring companies focus on the creditworthiness of your customers, not your business. However, it’s important to note that every factoring company is different.

How Do Factoring Companies Make Money?

Factoring companies make money by purchasing a portion or all of a company’s outstanding invoices at a discounted rate. They pay the company immediately for the invoices and then collect payment directly from the customers. The difference between the discounted rate and the actual invoice value is the profit for the factoring company.

Conclusion

Capital Invoice, we strive to provide top-notch working capital financing solutions for small businesses in Athens, GA and Atlanta. With over fifteen years of experience in the industry, our team is dedicated to helping businesses improve their cash flow and revenue stability.

Whether you need invoice factoring or invoice financing, we have the expertise to meet your financial needs. Contact Capital Invoice today to learn more about how we can support your business’s growth and success.