A debtor factoring facility is a financing solution where a business sells its invoices to a third party, known as a factoring company, at a discount in order to receive immediate cash flow. This allows the business to reinvest the cash back into the company for various purposes such as purchasing inventory or investing in marketing.

It is a way to bridge the gap in cash flow and access funds that are tied up in unpaid invoices. Debtor factoring can be a beneficial option, especially for businesses facing cash flow issues or those with limited access to traditional financing methods.

By leveraging the value of unpaid invoices, businesses can quickly access funds and meet their financial obligations. However, it is important to consider the fees associated with a debtor factoring facility and weigh the advantages and disadvantages before making a decision.

Credit: www.linkedin.com

Introduction To Debtor Factoring Facility

Debtor Factoring Facility allows businesses to borrow against the value of their unpaid invoices, providing cash flow for reinvestment and growth. It is a financing option that assists in covering gaps in cash flow and can be especially beneficial for businesses with limited access to traditional small-business lenders.

What Is Debtor Factoring?

Debtor Factoring, also known as Invoice Factoring or Invoice Financing, is a financial facility that allows businesses to access immediate cash by selling their outstanding invoices to a third-party factoring company. Instead of waiting for customers to pay their invoices on their own terms, businesses can get instant liquidity by receiving a percentage of the invoice amount upfront from the factoring company.

This type of financing is particularly useful for small and medium-sized enterprises (SMEs) and businesses with tight cash flow, as it provides a flexible and quick solution to address their working capital needs. By turning their accounts receivable into cash, businesses can use the funds to cover operational expenses, invest in growth opportunities, or simply improve their financial stability.

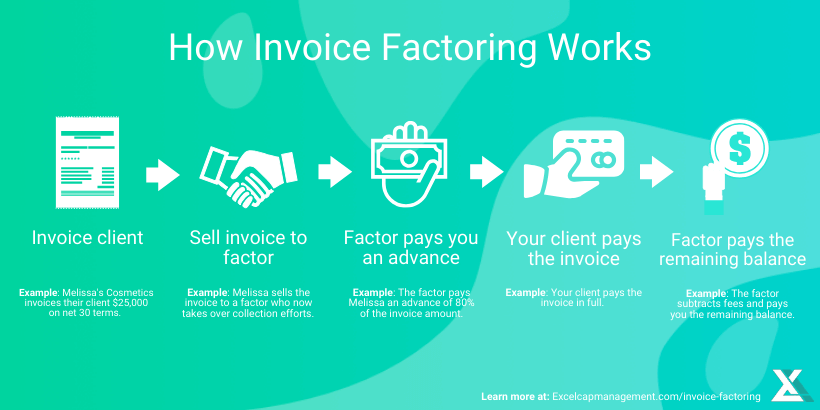

How Does A Factoring Facility Work?

The process of a factoring facility typically involves these steps:

- The business sells their invoices to the factoring company, which becomes the new owner of the accounts receivable.

- The factoring company advances a percentage of the invoice value (usually around 80% to 90%) to the business as an immediate cash injection.

- The factoring company takes over the responsibility of collecting the invoices from the customers on behalf of the business.

- Once the customers pay the invoices, the factoring company deducts their fee, which usually ranges from 1% to 5%, and remits the remaining balance to the business.

- The factoring facility can be ongoing, allowing the business to continually sell their invoices and access immediate cash, or it can be a one-time arrangement to address a specific cash flow issue.

One of the key advantages of a factoring facility is that it enables businesses to focus on their core operations without worrying about collections or bad debts. The factoring company assumes the credit risk of the customers and handles all the invoice management, allowing the business to streamline its financial operations.

In addition, a factoring facility is relatively easy to access compared to traditional bank loans. The factoring company primarily evaluates the creditworthiness of the customers instead of the business itself, making it a viable financing option for businesses with limited credit history or lower credit scores.

Overall, a debtor factoring facility can provide businesses with the necessary working capital to fuel their growth, improve cash flow, and enhance financial stability, especially in industries where late payment is common or customer creditworthiness is uncertain.

Advantages And Benefits Of Debtor Factoring

Debtor factoring is a flexible financing solution that can provide numerous advantages and benefits for businesses. Whether you are a small startup or an established company, debtor factoring can help you overcome cash flow challenges and access immediate working capital. In this section, we will explore three key advantages of debtor factoring:

Maximizing Cash Flow

One of the primary advantages of debtor factoring is its ability to maximize your cash flow. When you have unpaid invoices, it can create a gap in your cash flow, making it difficult to meet your financial obligations or invest in growth opportunities. Debtor factoring allows you to convert these outstanding invoices into immediate cash, eliminating the waiting period for payment. This infusion of available funds can help you cover your expenses, pay suppliers, invest in new equipment, or fuel your business expansion.

Covering Gaps In Cash Flow

Another significant benefit of debtor factoring is its strength in covering gaps in your cash flow. Cash flow gaps are common in businesses, especially during periods of rapid growth or when dealing with late-paying clients. Instead of waiting for these invoices to be paid, you can leverage debtor factoring to bridge the gap and access the working capital you need. This ensures that you can continue with your day-to-day operations uninterrupted, without having to worry about delayed payments affecting your cash flow.

Access To Immediate Working Capital

Perhaps the most valuable advantage of debtor factoring is the immediate access to working capital it provides. Traditional financing methods often involve lengthy application processes and strict credit requirements, making it challenging for businesses with limited credit history or poor credit scores to secure loans. With debtor factoring, your eligibility is based primarily on the creditworthiness of your customers rather than your own credit history. This means that even if you have struggled with financing in the past, you can still access the funds you need to run your business smoothly.

In conclusion, debtor factoring offers advantages and benefits that can significantly impact your business’s financial stability and growth. By maximizing your cash flow, covering gaps in cash flow, and providing immediate working capital, debtor factoring proves to be a valuable solution for businesses of all sizes.

How To Account For Debtor Factoring

When it comes to debtor factoring, it is important for businesses to understand how to properly account for these transactions. This ensures accurate financial reporting and proper management of cash flow. In this section, we will explore the steps involved in accounting for debtor factoring.

Recording Factoring Transactions

When recording factoring transactions, there are essential steps that need to be followed:

- Record the amount sold as a credit in accounts receivable.

- Record the cash received as a debit in the cash account.

- Record the paid factoring fee as a debit loss.

- Record the amount the factoring company retained in the debit-due account.

By following these steps, businesses can maintain accurate records of the factoring transaction. Let’s break down each step further:

Record the amount sold as a credit in accounts receivable

When a business sells their invoices to a factoring company, the outstanding amount of these invoices should be recorded as a credit in the accounts receivable account. This indicates that the business no longer holds these invoices as an asset.

Record the cash received as a debit in the cash account

As the factoring company pays the business for the invoices purchased, the cash received should be recorded as a debit in the cash account. This increases the available cash balance for the business.

Record the paid factoring fee as a debit loss

The factoring company charges a fee for their services, which is deducted from the cash received. This fee should be recorded as a debit in the loss account, indicating the expense incurred by the business.

Record the amount the factoring company retained in the debit-due account

If the factoring company retains a portion of the invoice amount as a reserve, this amount should be recorded as a debit in the due account. This represents the liability owed to the factoring company.

In conclusion, accurately accounting for debtor factoring is crucial for businesses. By following these steps, businesses can ensure proper financial reporting and effectively manage their cash flow.

Credit: fastercapital.com

Understanding Debt Factoring

Debt factoring, also known as invoice factoring, is a financing solution that allows a business to sell its accounts receivable to a third party, known as a factor, at a discount. This provides immediate cash flow and transfers the responsibility of collecting the debt from the business to the factor. Understanding how debt factoring works and its advantages and disadvantages is essential for businesses considering this financing option.

What Is Debt Factoring?

Debt factoring is a financial transaction in which a business sells its accounts receivable to a third party at a discount. The third party, known as a factor, assumes the responsibility of collecting the debt from the business’ customers.

Advantages And Disadvantages

- Advantages:

- Immediate Cash Flow: Debt factoring provides immediate access to cash, improving the business’ liquidity.

- Improved Cash Flow Management: It allows businesses to better manage their cash flow by converting accounts receivable into cash.

- No Added Debt: Since debt factoring involves selling existing receivables, it does not create additional debt for the business.

- Disadvantages:

- Cost: Debt factoring comes with fees and discounts, which can reduce the amount the business receives for the receivables.

- Loss of Control: Businesses relinquish control over the collection process to the factor, which may impact customer relationships.

- Perception: Some customers may view debt factoring as a sign of financial distress, potentially affecting business relationships.

Comparing Debt Factoring To Other Financing Options

When considering financing options for your business, it’s essential to weigh the pros and cons of each to make an informed decision. Debt factoring, also known as invoice factoring, offers a unique way for businesses to access immediate cash flow by selling their outstanding invoices to a third-party company. It’s important to compare debt factoring to other financing options to determine which best suits your business needs.

Alternatives To Debt Factoring

When comparing debt factoring to other financing options, it’s crucial to consider the following alternatives:

- Traditional Bank Loans: These loans are obtained from banks and typically require collateral and a good credit score.

- Business Line of Credit: A line of credit allows businesses to access a predetermined amount of funds as needed.

- Equity Financing: Involves selling a portion of the business to investors in exchange for capital.

Each of these alternatives has its advantages and disadvantages, and it’s essential to examine them closely in comparison to debt factoring.

Credit: www.excelcapmanagement.com

Frequently Asked Questions Of Debtor Factoring Facility

How Does A Factoring Facility Work?

A factoring facility works by allowing businesses to borrow against the value of their unpaid invoices. This provides cash flow to reinvest in the business, such as acquiring more inventory or investing in marketing. Factoring can cover gaps in cash flow when traditional lenders are not an option due to personal credit history.

The transaction is recorded by crediting the amount sold in accounts receivable and debiting the cash received and factoring fee. Factoring is like a credit card, where the factor (bank) buys the debt without recourse to the seller if the buyer doesn’t pay.

Debt factoring is a financing method where a company sells its invoices at a discount to a factoring company.

What Is A Debtor Finance Facility?

A debtor finance facility, also known as invoice finance, allows businesses to borrow money against the value of their unpaid invoices. This cash can be used to reinvest in the business for activities like purchasing more inventory or investing in marketing.

It is a helpful solution to cover gaps in cash flow for businesses that can’t secure traditional small-business loans due to personal credit history.

Is Factoring Receivables A Good Idea?

Factoring receivables can help cover cash flow gaps in your business, especially if you’re unable to secure financing from traditional lenders. It allows you to borrow against the value of unpaid invoices, providing the cash needed for activities like inventory acquisition and marketing.

Factoring is similar to a credit card, where a factoring company buys your customer’s debt without recourse to you if the customer doesn’t pay. It can be a good option for improving cash flow, particularly if you have credit limitations.

How Do You Account For Debtor Factoring?

Debtor factoring involves borrowing against unpaid invoices to access cash for business reinvestment. To account for debtor factoring, record the sold amount as a credit in accounts receivable, received cash as a debit in the cash account, paid factoring fee as a debit loss, and the factoring company’s retained amount in the debit-due account.

Conclusion

Debtor factoring is a valuable financial solution for businesses looking to improve their cash flow. By selling unpaid invoices to a factoring company, businesses can access immediate funds to reinvest in their operations. This alternative financing option offers advantages such as quick approval, flexibility, and the ability to cover gaps in cash flow.

With debtor factoring, businesses can focus on growth and expansion, knowing that their cash flow needs are being met. Consider debtor factoring as a viable option to improve your business’s financial health.