Eagle Capital Factoring provides working capital to businesses by purchasing their unpaid invoices at a discounted rate. By selling their invoices to Eagle Capital, businesses can access immediate funds to cover expenses and grow their operations.

Eagle Capital Factoring is a premier funding provider based in Austin, Texas. They specialize in helping businesses secure working capital by purchasing their unpaid invoices at a discounted rate. This allows companies to access cash flow quickly and efficiently. With a focus on customer satisfaction, Eagle Capital Factoring aims to be a reliable financial partner to their clients.

Whether businesses need funds for supplies, equipment, or manpower, Eagle Capital Factoring is there to support their growth. By utilizing their services, companies can avoid the challenges and limitations of traditional bank loans. Eagle Capital Factoring provides a convenient and flexible solution for businesses in need of fast and reliable working capital.

Credit: eaglebusinesscredit.com

Introduction To Eagle Capital Factoring

Eagle Capital Factoring is a reputable financial institution based in Austin, Texas, that specializes in providing working capital solutions for businesses. With years of experience in the industry, Eagle Capital Factoring has helped numerous companies overcome cash flow challenges and grow their operations.

What Is Eagle Capital Factoring?

Eagle Capital Factoring is a leading provider of factoring services, offering a unique financial solution for businesses to access working capital quickly and easily. Factoring is a process where a business sells its unpaid commercial invoices to a third-party factor, such as Eagle Capital Factoring, at a discounted rate. The factor then collects the payment from the customer and gives the remaining invoice amount to the business, minus any fees.

Unlike traditional bank loans, factoring does not require businesses to go through a lengthy application process or provide collateral. It is a flexible and efficient financing option that helps businesses improve their cash flow by converting their accounts receivable into immediate cash.

How Does Factoring Impact Working Capital?

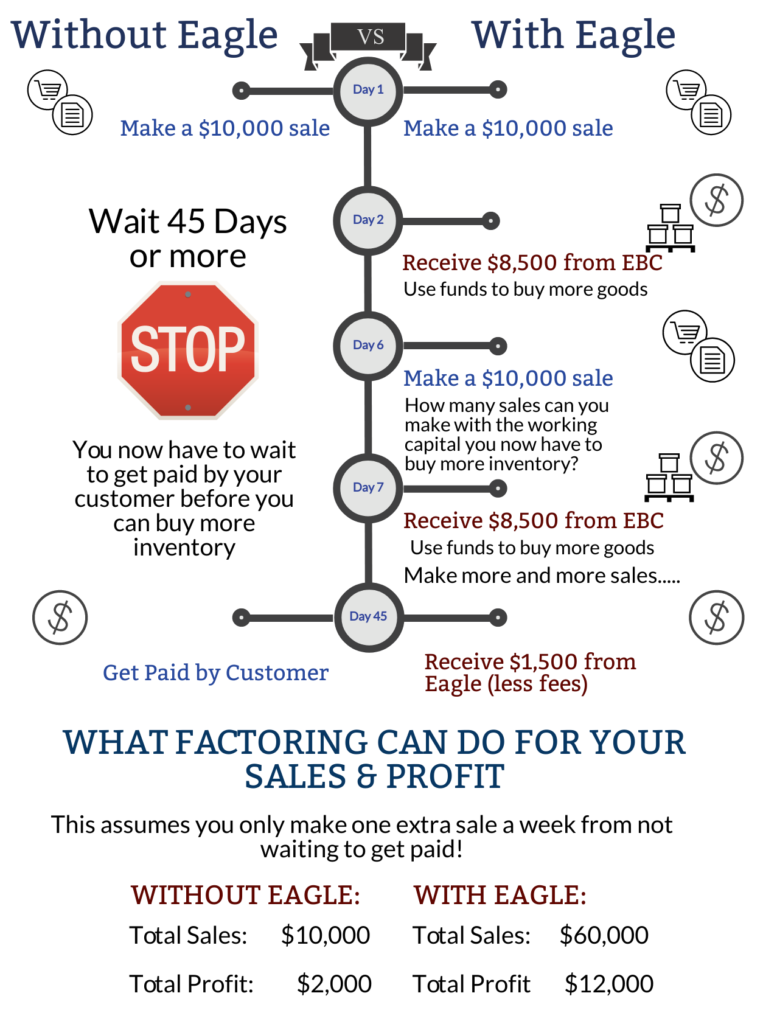

Factoring has a significant impact on a business’s working capital. By converting unpaid invoices into cash, businesses can fund their day-to-day operations, pay suppliers, cover payroll, invest in new equipment, and seize growth opportunities. With factoring, businesses can maintain a positive cash flow and avoid the delays associated with waiting for customers to pay their invoices.

Here are some key benefits of factoring that directly impact working capital:

- Immediate Cash Flow: Factoring allows businesses to access immediate cash, providing a consistent flow of working capital to meet ongoing expenses.

- Faster Collections: Eagle Capital Factoring takes care of the collection process, reducing the time and effort businesses need to spend on chasing outstanding payments.

- No Debt or Interest: Factoring does not create debt obligations like traditional loans. Businesses sell their invoices for a discounted rate, avoiding interest charges and repayment schedules.

- Flexible Funding: The amount of funding a business can receive through factoring is based on its sales volume. As the business grows and generates more sales, it can access higher amounts of working capital.

Overall, factoring provides businesses with a reliable and efficient means of improving their working capital position. By partnering with Eagle Capital Factoring, businesses can focus on their core operations and growth, knowing that their cash flow needs are well taken care of.

Credit: www.linkedin.com

Benefits Of Eagle Capital Factoring

Eagle Capital Factoring provides a solution for businesses to obtain working capital by selling their unpaid invoices at a discounted rate. This allows businesses to receive the funds they need while waiting for payment from their customers.

Boosting Working Capital

Eagle Capital Factoring offers numerous benefits that can significantly impact a business’s working capital. By leveraging the power of factoring, businesses can obtain the necessary funds to sustain and grow their operations. Unlike traditional loans, factoring allows businesses to sell their unpaid commercial invoices at a discounted rate, providing immediate cash flow.

With factoring, businesses no longer have to wait for customers to pay their invoices, which can often lead to long payment cycles and cash flow gaps. Instead, Eagle Capital Factoring collects the unpaid invoices on behalf of the business, subtracts a small fee, and transfers the remaining amount to the business. This enables businesses to access the majority of the invoice value upfront, providing a healthy boost to their working capital.

Obtaining Funding For Supplies, Equipment, And Manpower

One of the notable benefits of Eagle Capital Factoring is the ability to obtain funding for essential business needs such as supplies, equipment, and manpower. As a business owner, you understand that timely access to funds is crucial for sustaining operations and meeting customer demands.

Eagle Capital Factoring provides the financial confidence you need. By offering immediate cash flow through factoring, businesses can secure the necessary funding to purchase vital supplies and equipment, ensuring seamless operations. Whether you need to restock inventory, upgrade machinery, or recruit additional manpower, factoring bridges the funding gap and enables you to make timely decisions.

In addition, Eagle Capital Factoring offers a streamlined process, ensuring quick approval and funds disbursement. This eliminates the lengthy approval processes and extensive paperwork associated with traditional bank loans, allowing businesses to focus on their core operations.

Moreover, factoring with Eagle Capital Factoring does not require businesses to take on additional debt. Unlike loans that require repayment with interest, factoring simply involves selling invoices and receiving the majority of the payment upfront. This helps businesses avoid the burden of debt and interest payments, allowing them to allocate their resources to business growth and development.

Overall, the benefits of Eagle Capital Factoring are undeniable, providing businesses with a flexible funding solution that significantly boosts working capital. Whether it’s obtaining immediate cash flow, funding crucial business needs, or avoiding debt, factoring with Eagle Capital Factoring equips businesses with the financial support they need for sustainable growth and success.

Eagle Capital Factoring Services

Looking for reliable factoring services? Look no further than Eagle Capital Factoring. With a strong track record and a dedication to helping businesses succeed, we offer a range of factoring solutions tailored to your needs. Our team is committed to providing excellent service and ensuring your working capital needs are met.

Transportation Factoring

At Eagle Capital Factoring, we understand the unique challenges faced by transportation companies. That’s why we offer specialized factoring services designed to address your specific needs. Whether you need cash to cover fuel costs, pay your drivers, or invest in new equipment, our transportation factoring solutions can help.

With our transportation factoring services, you can:

- Receive immediate cash for your unpaid invoices

- Improve your cash flow

- Focus on growing your business instead of worrying about unpaid invoices

- Access working capital to cover expenses and invest in your operations

With Eagle Capital Factoring, your transportation company can keep moving forward with confidence.

Selective Factoring

We understand that not all businesses have the same factoring needs. That’s why we offer selective factoring services that allow you to choose which invoices to factor. This flexibility gives you greater control over your cash flow and allows you to focus on the invoices that will have the most immediate impact on your working capital.

Our selective factoring services offer:

- The ability to choose which invoices you want to factor

- Increased control over your cash flow

- Faster access to working capital for your most critical needs

Whether you need to factor all of your invoices or just a select few, Eagle Capital Factoring has the solution for you.

Why Choose Eagle Capital Factoring

When it comes to choosing a factoring company for your business, Eagle Capital Factoring stands out as a reliable and trustworthy option. With a commitment to providing flexible funding solutions and adhering to fiscally conservative principles, Eagle Capital Factoring is a preferred choice for businesses looking to optimize their cash flow and access working capital without the constraints of traditional business loans.

Flexible Alternative To Traditional Business Loans

Eagle Capital Factoring offers a flexible alternative to traditional business loans, allowing businesses to access working capital by selling their unpaid commercial invoices at a small discounted rate. This approach provides businesses with immediate funds, ensuring they can meet their financial obligations and sustain operations without the burden of long-term debt.

Fiscally Conservative Principles

Eagle Capital Factoring operates on fiscally conservative principles, prioritizing responsible financial practices to ensure the stability and sustainability of their clients’ businesses. By upholding these principles, Eagle Capital Factoring delivers reliable and ethical financial solutions, fostering long-term partnerships based on trust and transparency.

Reviews And Reputation Of Eagle Capital Factoring

Eagle Capital Factoring, based in Austin, Texas, has built a positive reputation for providing reliable funding solutions to businesses. With a focus on helping contractors pay for supplies, equipment, and manpower, Eagle Capital offers invoice factoring services that can improve working capital.

Customer Reviews

Eagle Capital Factoring has garnered exceptional customer reviews, reflecting the company’s commitment to providing top-notch financial services. Clients consistently praise the company’s professionalism, transparency, and efficiency. The positive feedback from satisfied customers underscores the reliability and trustworthiness of Eagle Capital Factoring.

Better Business Bureau Accreditation

Eagle Capital Factoring is accredited by the Better Business Bureau (BBB), signifying its dedication to maintaining high business standards and resolving customer concerns ethically. Holding BBB accreditation demonstrates Eagle Capital Factoring’s adherence to stringent business practices and customer-oriented service.

Credit: www.facebook.com

Frequently Asked Questions Of Eagle Capital Factoring

How Does Factoring Impact Working Capital?

Factoring impacts working capital by allowing businesses to access funds by selling unpaid invoices at a discounted rate. The business receives the remaining amount minus any fees once the factor collects from the customer.

What Is Eagle Capital Factoring?

Eagle Capital Factoring involves a company selling its unpaid commercial invoices at a discounted rate to obtain working capital.

How Does Factoring Impact Working Capital?

Factoring allows a business to obtain working capital by selling their unpaid commercial invoices at a small discounted rate. The business receives the remainder of the invoice minus any fees once the factor collects from the customer.

What Are The Benefits Of Eagle Capital Factoring?

Eagle Capital Factoring provides the funding contractors need to pay for supplies, equipment, and manpower, ensuring they get paid once the work is done.

Conclusion

Eagle Capital Factoring is the premier provider of working capital solutions for businesses in Austin, Texas. By offering invoice factoring services, Eagle Capital allows businesses to unlock the cash tied up in their unpaid commercial invoices. This allows for seamless funding to pay for supplies, equipment, and manpower and ensures that businesses can continue to grow and thrive.

With their straightforward financial partnership approach, Eagle Capital is a reliable and trusted choice for businesses in need of working capital solutions. Trust Eagle Capital Factoring to provide the funding you need to succeed.