Factoring business model provides companies with the option to sell their receivables for immediate access to cash flow without restrictions. It involves a third party, known as a factor, purchasing the company’s accounts receivable at a discount.

This allows the company to receive payment immediately, even if the receivable’s payment deadline has not yet passed. Factoring is a beneficial financial transaction for businesses that need quick access to funds without relying on traditional bank loans. By understanding the factoring business model, companies can effectively manage their cash flow and meet their immediate financial needs.

Introduction To Factoring Business Model

The factoring business model allows companies to sell their invoices or debts to a third party at a discount, providing them with immediate cash flow. This strategy enables businesses to access funds quickly without the limitations of traditional financing methods.

Definition Of Factoring

Factoring is a financial transaction that offers businesses a way to quickly access working capital by selling their accounts receivable (invoices) to a third party, known as a factor, at a discounted price. This enables businesses to receive immediate payment for their outstanding invoices, allowing them to meet their cash flow needs effectively.

Benefits Of Factoring

Factoring offers numerous benefits for businesses, especially those that experience long payment cycles or have a high number of outstanding invoices. Some key advantages of factoring include:

- Improved Cash Flow: By selling their invoices, businesses can receive immediate cash, which can be used to cover expenses, invest in growth, or fulfill other financial obligations.

- Reduced Risk of Bad Debt: When businesses sell their invoices to a factor, they transfer the responsibility of collecting payment to the factor. This reduces the risk of bad debt and allows businesses to focus on their core operations instead of chasing late payments.

- Flexible Financing: Factoring provides businesses with a flexible financing solution as the amount of funding they receive is directly proportional to their sales volume. This means that as sales increase, so does the funding available.

- No Additional Debt: Factoring is not a loan but a sale of assets, which means that businesses can access working capital without taking on additional debt or diluting ownership.

- Improved Credit Management: Factors often perform credit checks on the customers of the business. This can help businesses make informed decisions about new customers and maintain healthier customer relationships.

- Expert Support: Working with a reputable factor provides businesses with access to expert financial advice and support, helping them manage their cash flow more effectively.

How Factoring Works

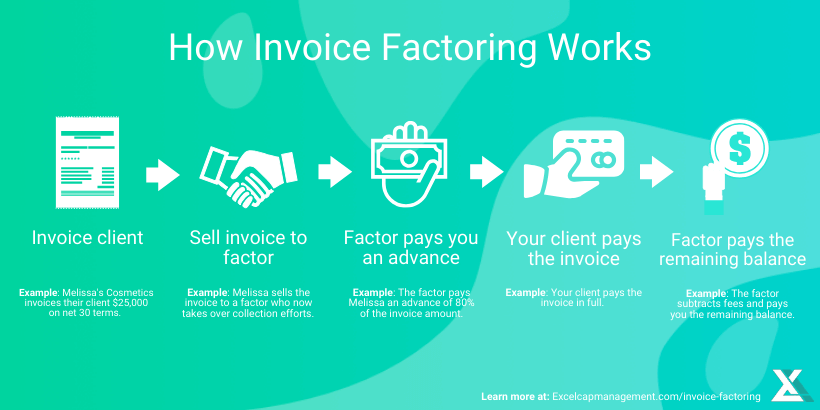

The process of factoring involves several steps:

- Submission of Invoices: The business submits their outstanding invoices to the factoring company, indicating the total amount and due dates.

- Verification and Approval: The factoring company verifies the authenticity of the invoices and assesses the creditworthiness of the business’s customers. Based on this evaluation, the factoring company approves or declines the factoring request.

- Advance Payment: If the factoring request is approved, the factoring company provides an advance payment to the business, typically ranging from 70% to 90% of the invoice value.

- Customer Payment: The business’s customers make payment directly to the factoring company on or before the invoice due date.

- Final Settlement: Once the factoring company receives the payment from the customers, they deduct their fees and any previously provided advances. The remaining amount is then remitted to the business.

Overall, factoring is a valuable business model that helps companies overcome cash flow challenges, improve their working capital, and focus on their core business operations. By partnering with a reputable factor, businesses can unlock the many benefits that factoring offers.

Credit: www.zoho.com

Understanding Factoring Receivables

Factoring receivables is a popular financing option for businesses that need immediate cash flow. It involves selling your company’s outstanding invoices to a third-party, known as a factor, at a discounted rate. This allows you to receive quick payment for your unpaid invoices, instead of waiting for your customers to pay. Understanding the process and pros of factoring receivables can help you determine if it is the right solution for your business.

Process Of Factoring Receivables

The process of factoring receivables is straightforward:

- The business sells its invoices to a factor, who typically pays a percentage of the invoice amount upfront, known as the advance rate.

- The factor takes over the responsibility of collecting payments from your customers.

- Once the customers pay their invoices, the factor deducts their fees and pays the remaining balance to your business.

This process ensures that your business gets the much-needed cash flow, while the factor takes care of the hassle of collecting payments. It allows you to focus on your core operations and growth.

Pros Of Factoring Receivables

Factoring receivables offers several advantages for businesses:

- Immediate Cash Flow: By selling your invoices, you can access quick funds to cover operational expenses, invest in growth opportunities, or manage unforeseen emergencies.

- No Debt Incurred: Factoring is not a loan, so you don’t accumulate debt on your balance sheet.

- No Credit Check: Unlike traditional bank financing, factoring relies on the creditworthiness of your customers, not your business. This makes it a viable option for businesses with limited credit history or poor credit scores.

- Outsourced Collections: The factor takes over the responsibility of collecting payments, saving you time and resources.

- Flexible Financing: Factoring allows you to choose which invoices to sell, giving you control over your cash flow needs.

These benefits make factoring receivables a popular financing option for businesses of all sizes and industries.

How To Get Paid From A Factoring Company

When it comes to getting paid from a factoring company, understanding the payment process and the factors impacting payment is crucial. This information will help you navigate the payment system successfully and ensure you receive the funds you are owed.

Payment Process

The payment process with a factoring company usually involves the following steps:

- The client (the company selling its receivables) invoices its customers as usual.

- The client sends a copy of the invoice to the factoring company.

- The factoring company verifies the invoice and the associated customer’s creditworthiness.

- Upon approval, the factoring company advances a percentage of the invoice amount, typically ranging from 70% to 90%.

- The factoring company collects the payment from the customer.

- Once the payment is received, the factoring company deducts its fee and any other charges.

- The factoring company remits the remaining balance, known as the reserve, to the client.

Factors Impacting Payment

Several factors can impact the payment process with a factoring company. These include:

- The creditworthiness of the client’s customers: The factoring company may decline to fund invoices from customers that have poor credit.

- The age of the invoices: Older invoices may carry a higher risk and result in a lower percentage of advance.

- The quality of the client’s receivables: Invoices with disputed or unresolved issues may not be eligible for funding.

- The agreement terms between the client and the factoring company: Different factoring agreements may have varying fee structures and payment timelines.

Understanding these factors will help you prepare for potential delays or adjustments in payment. It is essential to maintain clear communication with the factoring company to ensure a smooth payment process.

Credit: m.facebook.com

Factoring Companies: Making Money

Factoring companies play a crucial role in the business world, providing a valuable service that allows businesses to optimize their cash flow. The factoring business model revolves around the purchase of accounts receivable from businesses, offering immediate funds in exchange for a discounted price. This transactional aspect of factoring is a key element to how factoring companies make money.

Invoice Factoring Rates

Invoice factoring rates are an essential component of the financial mechanisms utilized by factoring companies. The rates typically represent the percentage of the invoice amount that the factoring company advances. It’s important for businesses to understand these rates thoroughly as they directly impact their cash flow management.

Profits Of Factoring Companies

The profitability of factoring companies is driven by the difference between the discounted purchase price of the accounts receivable and the actual value of the invoices. By leveraging their expertise in risk assessment and debtor management, factoring companies manage to generate profits through these transactions while providing much-needed liquidity for businesses.

Finding The Right Factoring Company

Finding the right factoring company for your business is crucial in the factoring business model. With numerous options available, it’s important to carefully evaluate factors such as rates, flexibility, and customer service to ensure you partner with the right company for your financial needs.

Finding the Right Factoring Company When it comes to finding the right factoring company for your business, it’s essential to consider various factors before making a decision. The right factoring company can provide your business with the necessary cash flow and support to maintain operations smoothly. Factors to Consider when choosing a factoring company.Factors To Consider

When choosing a factoring company, there are certain factors that you need to consider to ensure a successful partnership. These factors include the company’s fees, advance rates, customer service, contract terms, and industry expertise. It’s crucial to weigh these factors carefully to find a factoring company that aligns with your business needs.Top Factoring Companies In The Us

In the United States, several top factoring companies are known for their reliable services and expertise in various industries. Some of the top factoring companies in the US include RTS Financial, Riviera Finance, Triumph Financial Services LLC, eCapital LLC, Fundbox, and Porter Freight Funding.Top Factoring Companies In The Uk

When it comes to factoring companies in the UK, businesses have access to reputable firms such as Bibby Financial Services, Kriya, Lloyds Bank, Close Brothers Invoice Financing, Metro Bank, and Mitsubishi HC Capital UK PLC. These companies offer excellent factoring services tailored to the needs of UK-based businesses. When selecting a factoring company, it’s important to explore these top companies and evaluate their offerings based on your specific business requirements. By considering these factors and exploring the top companies in the US and UK, you can make an informed decision that will benefit your business’s cash flow and growth.

Credit: www.excelcapmanagement.com

Frequently Asked Questions For Factoring Business Model

Do Factoring Companies Make Money?

Factoring companies do make money by purchasing invoices or debts from other companies at a discounted rate and collecting the full payment from the debtor. This allows the selling company to receive immediate payment instead of waiting for the payment deadline.

What Is Factoring In Business Examples?

Factoring in business examples refers to a financial transaction where a company sells its invoices or debts to a third party, known as a factoring company, at a discount. This allows the company to receive immediate payment for its receivables, even if the payment deadline has not yet arrived.

An example would be a small business selling its unpaid invoices to a factoring company in order to access cash flow.

How Much Money Do Factoring Companies Make?

Factoring companies make money by purchasing invoices at a discount and collecting the full invoice amount from the client’s customers.

How Do You Get Paid From A Factoring Company?

The factoring company pays you for the invoices they purchase at a discounted rate.

Conclusion

The factoring business model provides companies with the opportunity to generate immediate cash flow by selling their receivables to a third-party factor. This enables companies to access the funds they need without the constraints of waiting for payment from customers.

Factoring can be a valuable financial tool for businesses seeking to improve cash flow and maintain operations. By leveraging factoring services, companies can effectively manage their receivables and secure the working capital they need to thrive in today’s competitive market.