Factoring payment terms refer to the conditions and agreements between a supplier and a factor in a factoring transaction. It is a legal transaction where the supplier assigns their factored receivables to the factor based on the contract regulating the provision of various services such as finance, collection of receivables, credit risk insurance, and administration.

The terms and conditions of factoring are outlined in the contract, and they dictate how the factor will handle the supplier’s invoices and how payments will be collected from customers. Invoice factoring is a type of invoice finance where a factoring company purchases outstanding invoices from a business, providing immediate payment and taking responsibility for collecting payments from customers.

It helps improve cash flow and revenue stability for the business.

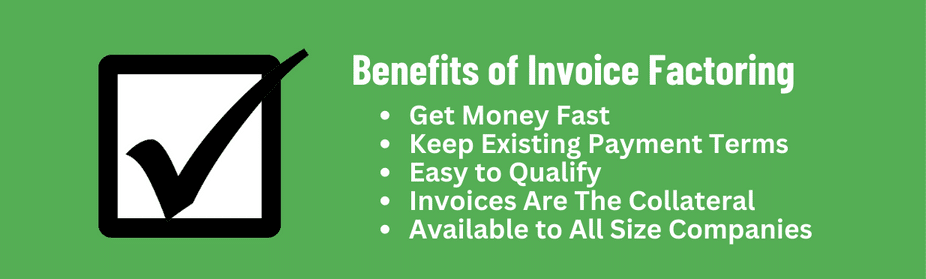

Benefits Of Factoring Payment Terms

Factoring payment terms offer several benefits, such as improved cash flow, increased working capital, and reduced financial risk. By selling outstanding invoices to a third party, businesses can receive immediate payment and avoid the hassle of collecting payments from customers.

Improved Cash Flow

Factoring payment terms offer several benefits, with improved cash flow being one of the most significant advantages. By factoring their receivables, businesses can access immediate cash for their outstanding invoices. This is particularly helpful for small and medium-sized enterprises (SMEs) that often face cash flow challenges due to delayed payments from customers. Instead of waiting for weeks or months for invoices to be paid, factoring allows businesses to receive a substantial portion of the invoiced amount upfront. This timely influx of cash can help cover operational expenses, invest in growth initiatives, or simply provide peace of mind knowing that there is a consistent flow of funds.Ability To Offer Payment Terms

Offering payment terms has become a common practice in the business world. It allows companies to attract more customers and increase sales by providing flexibility in payment options. However, offering payment terms can put a strain on the cash flow of a business, especially when customers take longer than anticipated to make the payment. Factoring payment terms address this challenge by bridging the gap between invoicing and payment. Businesses can continue to offer favorable payment terms to their customers while ensuring a steady cash flow by leveraging factoring services. This enables companies to strike a balance between attracting customers and maintaining a healthy cash flow.Easy Access To Funding

One of the greatest advantages of factoring payment terms is the easy access to funding it provides. Unlike traditional financing options, factoring does not require extensive paperwork or collateral. Factoring companies focus more on the creditworthiness of the customers who owe the outstanding invoices, rather than the financial position of the business itself. This makes factoring an ideal solution for small businesses that may not have a strong credit history or valuable assets to offer as collateral. The simplified application process and quick approval time allow businesses to obtain the funds they need to operate and grow their business without the hassle of traditional financing.Risk Mitigation

Factoring payment terms also provide businesses with the benefit of risk mitigation. When a business extends payment terms to their customers, there is always a risk of non-payment or delayed payment, which can impact the bottom line. By factoring their receivables, businesses transfer the credit risk to the factoring company. This means that the factoring company assumes the responsibility of collecting payment from customers, reducing the business’s exposure to credit risk. This can be particularly advantageous for businesses operating in industries with high default rates or those serving customers with inconsistent payment behaviors. By mitigating credit risk, businesses can focus on their core operations with more peace of mind.Streamlined Collection Process

Another benefit of factoring payment terms is the streamlined collection process it offers. Factoring companies specialize in collecting outstanding invoices, which means they have the expertise, resources, and systems in place to efficiently manage the collection process. This can save businesses valuable time and resources that would otherwise be spent on chasing payments and managing collections. The factoring company takes care of follow-ups, reminders, and reconciliations, ensuring a smooth and systematic collection process. This allows businesses to focus on their core activities, such as sales and operations, while leaving the collection process in the hands of professionals. In conclusion, factoring payment terms come with several benefits that can greatly enhance a business’s financial stability and growth prospects. From improved cash flow and easy access to funding to risk mitigation and a streamlined collection process, factoring offers a comprehensive solution for managing payment terms effectively. Businesses that leverage factoring payment terms can enjoy the advantages of offering flexible payment options while ensuring a steady cash flow and reducing credit risk.:max_bytes(150000):strip_icc()/progress-billings-Final-b1660a46c0b946b6af2704c4b00cedbd.png)

Credit: www.investopedia.com

Understanding Invoice Factoring

Invoice factoring is a financial solution that helps businesses improve their cash flow by selling their outstanding invoices to a third-party company, known as a factor. This allows businesses to access immediate funds rather than waiting for customers to pay their invoices. But what exactly is invoice factoring and how does it work? Let’s explore further.

Definition Of Invoice Factoring

Invoice factoring, also known as accounts receivable factoring, is a financial arrangement where a business sells its invoices to a third-party factor at a discounted rate. In exchange for the invoices, the factor pays the business a certain percentage of the total invoice value upfront. The factor then collects payment directly from the customers.

Difference Between Invoice Factoring And Financing

Invoice factoring is often confused with traditional financing, but there are key differences between the two. While financing involves borrowing money from a lender and repaying it over time, invoice factoring involves selling invoices to a factor. Here are some distinctions:

| Invoice Factoring | Financing |

|---|---|

| Business sells invoices to a third-party factor | Business borrows money from a lender |

| Immediate access to funds | Repayment over time with interest |

| Factor collects payment directly from customers | Business is responsible for repayment |

Exploring Your Options

If you’re considering invoice factoring for your business, it’s important to explore your options and choose the right factor. Here are some popular invoice factoring companies:

- FundThrough

- Riviera Finance

- Fundbox

- Bibby Financial Services

- OTR Solutions

Apart from these, there are several other reputable factoring companies available in the market. It’s crucial to research and compare their services, terms, and rates to find the best fit for your business requirements.

Now that you have a better understanding of invoice factoring and its benefits, you can make an informed decision about whether it’s the right financial solution for your business. Remember to choose a reputable factor and thoroughly review the terms and conditions before entering into an agreement.

How Does Invoice Factoring Work?

Factoring payment terms involve a legal transaction where the supplier assigns their receivables to a factor based on the contract. This allows for finance, collection, credit risk insurance, and administration services to be provided. Invoice factoring helps improve cash flow by selling outstanding invoices to a third party, who pays most of the invoiced amount upfront and collects payment directly from customers.

Factoring contracts involve small businesses selling invoices to factors in exchange for upfront cash. Factoring fees typically range from 1% to 5%.

Example Of Invoice Factoring

Let’s consider an example to understand how invoice factoring works. Suppose you run a small business that provides consulting services to various clients. You have outstanding invoices worth $10,000 that are yet to be paid by your clients. However, you need immediate cash to cover your business expenses. This is where invoice factoring can help. You decide to contact a factoring company and sell your outstanding invoices to them. The factoring company evaluates the creditworthiness of your clients and agrees to advance you 80% of the invoice value upfront. In this case, you will receive $8,000 from the factoring company immediately, allowing you to meet your financial needs promptly.Contacting A Factoring Company

When you decide to utilize invoice factoring, the first step is to reach out to a reputable factoring company. These companies specialize in providing quick cash flow solutions by purchasing your outstanding invoices. Conduct thorough research to find a factoring company that aligns with your business needs. Contact the factoring company either through their website or by making a call. Provide them with essential information, such as your business name, the total value of outstanding invoices, and the industry you operate in. The factoring company will assess your eligibility for factoring based on their evaluation criteria.Invoice Factoring Vs. Cash Advance Loan

Invoice factoring differs from a cash advance loan in several ways. While both options provide funds to businesses, the fundamental difference lies in how they operate.- Invoice Factoring: With invoice factoring, you sell your unpaid invoices to a factoring company in exchange for immediate cash. The responsibility of collecting payment from your clients is transferred to the factoring company. This option allows you to overcome cash flow challenges without accumulating debt.

- Cash Advance Loan: On the other hand, a cash advance loan involves borrowing a specific amount of money from a lender and repaying it with interest over time. This option requires you to have a good credit score and may involve additional fees and interest charges.

Credit: treasuryimprovement.ch

Terms And Conditions Of Factoring

Factoring payment terms are governed by a set of terms and conditions that outline the legal nature of factoring, the services provided by the factor, and the general terms and conditions of factoring. Understanding these terms and conditions is crucial for businesses considering factoring as a financial solution.

Legal Nature Of Factoring

Factoring is a legal transaction where the Supplier assigns the factored receivable to the Factor based on and according to the Contract regulating the provision of one or several services indicated herein by the Factor to the Supplier: finance, collection of receivables, credit risk insurance, administration and more.

Services Provided By The Factor

The factor provides several services to the Supplier, including finance, collection of receivables, credit risk insurance, and administration, which are regulated by the Contract between the parties.

General Terms & Conditions Of Factoring

The general terms and conditions of factoring typically include provisions related to the assignment of receivables, advance rates, fees, credit insurance, and recourse options in case of non-payment by the debtor. These terms and conditions form the basis of the factoring agreement and govern the relationship between the Supplier and the Factor.

Invoice factoring is a type of invoice finance where a business can improve its cash flow and revenue stability by selling some or all of its outstanding invoices to a third party, known as a factor. The factor pays the business most of the invoiced amount immediately and then collects payment directly from the customers. It is an effective way for businesses to manage their cash flow and ensure financial stability.

Understanding Factoring Contracts

Understanding factoring contracts is crucial for businesses looking to optimize their cash flow. A factoring contract, also known as a receivables purchase agreement, outlines the terms and conditions under which a business sells its outstanding invoices to a third-party financial institution, known as the factor. By diving into the intricacies of factoring contracts, businesses can grasp the complexities of the payment process and the role of factors in enhancing their financial stability.

Sale Of Outstanding Invoices

The sale of outstanding invoices, outlined in the factoring contract, involves the transfer of accounts receivable from the business to the factor at a discounted rate. This facilitates immediate access to cash, enabling businesses to address pressing financial needs without waiting for customer payments.

Role Of Factors

The factor plays a pivotal role in factoring contracts, providing essential financial services such as advanced funding, credit protection, and accounts receivable management. They help businesses navigate through cash flow challenges and mitigate credit risks, contributing to improved financial stability.

Payment Process

Upon the sale of invoices, the factor expedites the payment process by providing a percentage of the invoice value upfront. Subsequently, the factor assumes the responsibility of collecting payments from the customers, relieving the business from the burden of managing accounts receivable and enhancing their liquidity.

Credit: capitalplus.com

Frequently Asked Questions For Factoring Payment Terms

What Are The Terms And Conditions Of Factoring?

Factoring terms and conditions are determined by a legal contract between the supplier and the factor. It includes provisions for financing, collection of receivables, credit risk insurance, and administration. The supplier assigns the factored receivables to the factor based on this contract.

Factoring improves cash flow and revenue stability by allowing the supplier to sell their outstanding invoices to a third party in exchange for upfront cash.

What Is Factoring Pay?

Factoring pay refers to the process of selling some or all of your company’s outstanding invoices to a third party for upfront cash. The factoring company will pay you most of the invoiced amount immediately and then collect payment directly from your customers.

This helps improve cash flow and revenue stability.

How Do Factoring Contracts Work?

Factoring contracts involve a small business selling its outstanding invoices to third-party factors, receiving upfront cash. When the client pays, the money goes to the factor, not the business. This provides immediate cash flow and revenue stability. Factors usually pay 80-90% of the invoice amount.

What Is The Average Factoring Fee?

The average factoring fee usually ranges from 1% to 5%. It is a cost-effective way to improve cash flow.

Conclusion

Factoring payment terms offer a valuable solution for businesses looking to improve cash flow and maintain revenue stability. By selling outstanding invoices to a third party, factoring allows businesses to access upfront cash and have the factor handle the collection process.

The terms and conditions of factoring agreements are crucial in ensuring a smooth transaction. Understanding the average factoring fee and how factoring contracts work is essential for businesses considering this financial option. With its ability to provide immediate funds, factoring payment terms can be a strategic choice for businesses in need of cash flow optimization.