Hitachi Capital Invoice Finance is a finance service company located in Austin, Texas, United States, offering a range of invoice finance solutions for businesses. They specialize in providing cash flow solutions to help businesses release funds tied up in unpaid invoices.

With their expertise and experience in the industry, Hitachi Capital Invoice Finance is dedicated to assisting businesses in gaining control over their working capital and improving cash flow. Whether it’s invoice discounting or factoring, they offer various financing options tailored to suit the unique needs of businesses in different industries.

By utilizing their services, businesses can better plan their expenses, invest in growth opportunities, and ensure smooth operations.

Credit: uk.linkedin.com

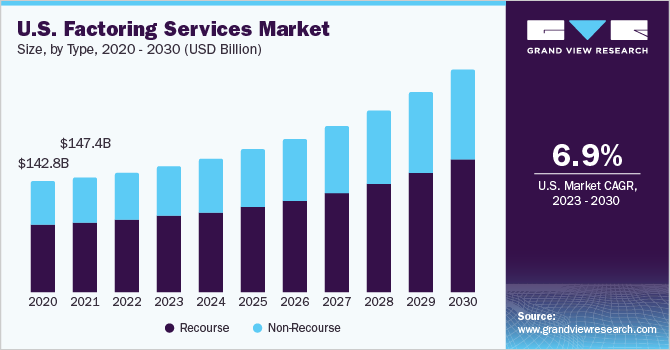

Credit: www.grandviewresearch.com

Frequently Asked Questions Of Hitachi Capital Invoice Finance

How Does Invoice Financing Work?

Invoice financing is a process where businesses can get immediate cash by selling their unpaid invoices to a lender. The lender advances a percentage of the total invoice amount and collects payment directly from the customer. This helps businesses improve cash flow and avoid waiting for customers to pay.

How Do You Use An Invoice For Financing?

To use an invoice for financing, businesses can opt for invoice factoring or invoice financing. In invoice factoring, the business sells their unpaid invoices to a factor who advances them a percentage (usually 70-90%) of the invoice value. The factor then collects the payment from the client and pays the remaining balance, minus fees.

Invoice financing, on the other hand, involves using the unpaid invoices as collateral to secure a loan or line of credit from a lender. The business retains control over collecting the payment from the client and repays the loan or line of credit with interest.

Who Can Use Invoice Finance?

Professional and business services providers, such as architects, engineers, legal firms, and companies in the financial sector, can benefit from invoice finance. It allows them to collect invoice payments upfront and avoid waiting for payment from clients. Invoice financing creates a relationship between the business and the lender.

What Is The Difference Between Invoice Financing And Factoring?

Invoice financing allows businesses to borrow money against their unpaid invoices, while factoring involves selling the invoices to a third party.

Conclusion

Hitachi Capital Invoice Finance offers a range of finance solutions for businesses in need of working capital. With their invoice financing options, businesses can gain greater control over their cash flow and plan their expenses more effectively. Unlike traditional factoring, Hitachi Invoice Finance creates a direct relationship between the business and the lender, providing a confidential facility that allows businesses to maintain control over managing their invoices.

If you’re looking for a reliable finance partner to propel your business forward, Hitachi Capital Invoice Finance is worth considering.