Banks provide invoice factoring services to businesses in need of working capital, allowing them to generate income from lending without the risks of traditional lending. This financing option is beneficial for companies looking to release money from their invoices quickly, improve cash flow, and reduce time spent chasing late payments.

Additionally, bank factoring, also known as accounts receivable funding, allows businesses to collateralize loans and lines of credit using outstanding invoices as security. To qualify for factoring, companies need invoices to factor, creditworthy clients, a completed factoring application, an accounts receivable aging report, a business bank account, a tax ID number, and personal identification.

Invoice factoring involves selling outstanding invoices to a third party (factoring company) in exchange for cash. Invoice factoring is a popular alternative financing solution that enables businesses to access much-needed working capital by selling their outstanding invoices to a third party. This allows companies to receive immediate cash flow rather than waiting for customers to pay their invoices. In Austin, Texas, there are several banks that offer invoice factoring services to help businesses improve cash flow and meet their financial needs. These banks provide financing by purchasing unpaid invoices at a discounted rate, providing businesses with the necessary funds to cover day-to-day expenses, invest in growth opportunities, and manage their operations effectively. Whether it’s in the trucking, staffing, telecom, or oilfield services industry, invoice factoring banks in Austin offer tailored solutions to support businesses of all sizes. With their expertise in invoice factoring and commitment to providing excellent service, these banks help businesses thrive in a competitive market.

What Is Invoice Factoring?

Invoice factoring is a financial service commonly provided by banks to help businesses improve cash flow and access working capital. It offers a convenient solution for companies to release money from their invoices more quickly and avoid the hassle of chasing late payments. Let’s dive deeper into what invoice factoring entails.

Definition

Invoice factoring, also known as accounts receivable financing, is a process where a business sells its outstanding invoices to a financial institution, typically a bank. This allows the company to receive immediate funds, usually a percentage of the invoice amount, instead of waiting for the customers to pay their invoices. In return, the factor, or the bank, will collect the payments from the customers.

How It Works

The process of invoice factoring involves several steps:

- The business submits its invoices to the bank for factoring.

- The bank evaluates the creditworthiness of the business’s customers.

- The bank advances a certain percentage of the invoice amount, typically around 70-90%.

- The bank manages the collection of payments from the customers.

- Once the customers pay their invoices, the bank deducts the factoring fee and remits the remaining funds to the business.

Benefits

Invoice factoring offers several benefits for businesses:

- Improved cash flow: By receiving immediate funds from the bank, businesses can meet their financial obligations and invest in growth opportunities.

- Reduced credit risk: Banks assume the responsibility of collecting payments from customers, reducing the risk of non-payment and bad debts for businesses.

- Streamlined operations: With the bank managing accounts receivable and collections, businesses can focus on core operations without the need to chase late payments.

- No additional debt: Invoice factoring is not a loan, so businesses don’t incur additional debt on their balance sheets.

In conclusion, invoice factoring is a financial service provided by banks that allows businesses to improve cash flow and access working capital by selling their outstanding invoices. It offers numerous benefits, including improved cash flow, reduced credit risk, streamlined operations, and no additional debt.

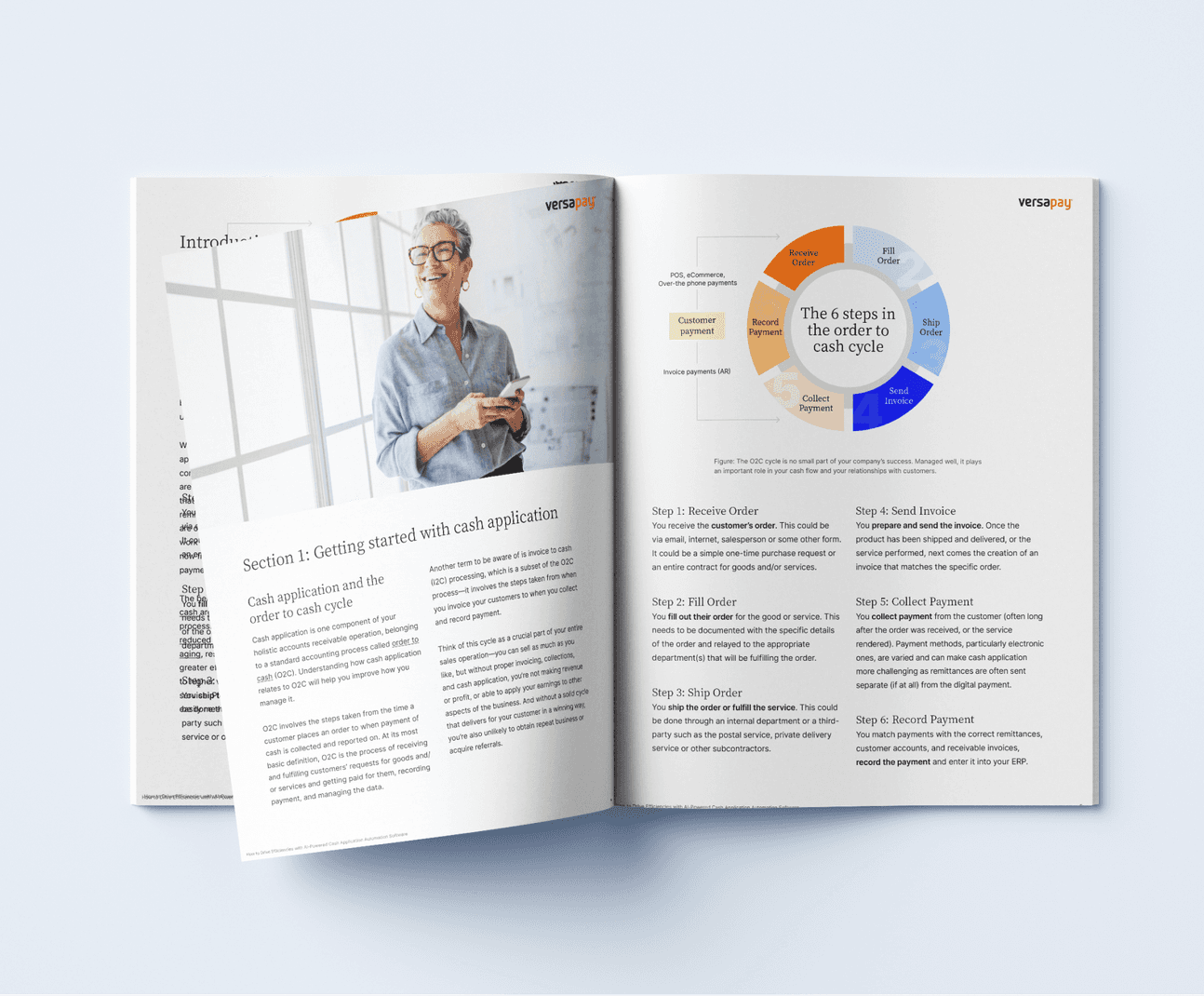

Credit: www.versapay.com

How Do Banks Factor Invoices?

Banks may engage in invoice factoring to offer financing to businesses in need of working capital, allowing them to generate income without the risks associated with traditional lending. Invoice factoring is an ideal solution for businesses seeking faster invoice payments, improved cash flow, and reduced time spent collecting late payments.

Reasons For Banks To Factor Invoices

Banks may choose to factor invoices for various reasons. One key motive is to provide financing to businesses that are in need of working capital. By funding invoices, banks can generate income without the risks associated with traditional lending.

Generating Income Without Traditional Lending

Factoring invoices allows banks to generate income without relying solely on traditional lending methods. Instead of providing loans, banks purchase invoices from businesses. This provides immediate cash flow to the companies, while the banks earn income from the fees charged for the service.

By adopting this approach, banks can diversify their revenue streams and mitigate the risks that come with lending. They can avoid the potential losses associated with businesses defaulting on loans or failing to meet repayment obligations.

Risks Associated With Factoring

While factoring invoices can be a profitable strategy for banks, it is not without risks. Banks must carefully assess the creditworthiness of the businesses whose invoices they factor. The creditworthiness of the clients whose invoices are being purchased is crucial, as it impacts the likelihood of repayment.

If the businesses whose invoices are factored cannot fulfill their payment obligations, it can result in financial losses for the banks. Therefore, each invoice must be thoroughly evaluated to ensure that the risk of non-payment is minimized.

Moreover, banks need to establish effective risk management practices to monitor the payment status of factored invoices. This helps identify potential delinquencies or defaults early on, allowing appropriate actions to be taken to mitigate potential losses.

Despite the risks, many banks see invoice factoring as a viable strategy to support businesses and generate income. By carefully assessing creditworthiness and implementing robust risk management practices, banks can leverage invoice factoring to provide financing to businesses and earn revenue without relying solely on traditional lending methods.

Is Invoice Factoring A Good Idea?

Invoice factoring with banks can be a smart choice for businesses looking to improve cash flow, release money from invoices more quickly, and spend less time chasing late payments. By using outstanding invoices as collateral, banks can provide financing without taking on the risks associated with traditional lending.

Improving Cash Flow

Invoice factoring can be a great solution for businesses looking to improve their cash flow. By selling their unpaid invoices to a factoring company, businesses can receive a cash advance, often within 24 to 48 hours. This immediate injection of funds allows businesses to meet their financial obligations, pay suppliers, and invest in growth opportunities.

Releasing Money From Invoices

One of the biggest advantages of invoice factoring is the ability to release money from invoices quickly. Instead of waiting for weeks or even months for clients to pay, businesses can get immediate access to a significant portion of the invoice amount. This can be particularly useful for small businesses that rely heavily on regular cash flow to cover operational costs and avoid financial strain.

Reducing Time Spent On Late Payments

Chasing late payments can be time-consuming and frustrating for businesses. With invoice factoring, businesses can offload the responsibility of collecting payment to the factoring company. The factoring company takes on the task of following up with clients and ensuring timely payment, allowing business owners to focus their time and energy on other critical tasks such as growing their business and serving their clients.

Credit: www.facebook.com

Factoring Services Offered By Banks

Invoice factoring, commonly offered by banks, is a service designed to provide businesses with immediate working capital by using their outstanding invoices as collateral. By unlocking funds tied up in unpaid invoices, companies can improve cash flow and access the capital needed to fund growth and ongoing operations. Banks provide a range of factoring services, offering tailored solutions to meet the specific financing needs of different businesses.

Bank Factoring (accounts Receivable Funding)

Bank factoring, also known as accounts receivable funding, enables businesses to leverage their unpaid invoices to secure immediate capital. This method of financing allows companies to free up cash flow quickly and efficiently, providing them with the liquidity needed to cover operational costs and investments. By partnering with banks for factoring services, businesses can mitigate the impact of delayed payments and streamline their cash management processes.

Collateralizing Loans And Lines Of Credit

Collateralizing loans and lines of credit using outstanding invoices as security is a common practice offered by banks. This approach allows businesses to use their accounts receivable as collateral to secure funding for various purposes, including expansion, inventory management, and day-to-day operating expenses. By leveraging their unpaid invoices, companies can access flexible financing solutions tailored to their unique financial needs, helping them overcome cash flow challenges and capitalize on growth opportunities.

Using Outstanding Invoices As Security

Banks offer the option to use outstanding invoices as security, ensuring payment on the amount borrowed. By utilizing their accounts receivable as collateral, businesses can demonstrate creditworthiness and secure financing based on the value of their outstanding invoices. This streamlined approach to funding allows companies to expedite the capital acquisition process and address immediate financial needs without relying on traditional lending methods.

Qualifying For Invoice Factoring

Qualifying for invoice factoring is an essential process for businesses seeking to improve cash flow and maintain working capital. By understanding the qualifying factors and requirements for invoice factoring, businesses can expedite the funding process and benefit from a steady stream of cash flow.

Requirements For Factoring

When seeking to qualify for invoice factoring, businesses must ensure they meet specific requirements to secure funding. These requirements typically include having a minimum monthly invoice volume and conducting business-to-business transactions.

Invoices To Factor

The invoices eligible for factoring should be for completed services or delivered goods. Additionally, they should be free of any liens or encumbrances, ensuring that the receivables are clear and eligible for factoring.

Creditworthy Clients

Factoring companies often evaluate the creditworthiness of the businesses’ clients whose invoices are being factored. This assessment is crucial as it helps determine the likelihood of timely payment on the invoices.

Completion Of Factoring Application

Businesses seeking invoice factoring need to complete a thorough factoring application, providing essential details about the company and its operations. This application process allows factoring companies to assess the business’s financial stability and suitability for funding.

Credit: www.zoho.com

Frequently Asked Questions For Invoice Factoring Banks

Do Banks Do Invoice Factoring?

Banks may offer invoice factoring to help businesses with working capital needs. It allows businesses to receive immediate cash by selling their invoices to the bank, without the risks associated with traditional lending. Invoice factoring can improve cash flow and reduce time spent chasing late payments.

Is Invoice Factoring A Good Idea?

Invoice factoring can be a good idea for businesses looking to improve cash flow, release money from invoices quickly, and spend less time chasing late payments. It provides financing and working capital without the risks associated with traditional lending. Banks may offer invoice factoring services as a way to generate income.

What Are The Factoring Services Offered By Banks?

Banks offer factoring services to provide financing for businesses, using outstanding invoices as security.

How Do You Qualify For Invoice Factoring?

To qualify for invoice factoring, your company needs invoices, creditworthy clients, a completed factoring application, an accounts receivable aging report, a business bank account, a tax ID number, and personal identification.

Conclusion

Invoice factoring through banks can be a beneficial solution for businesses in need of working capital. With the ability to release money from invoices quickly, improve cash flow, and reduce time spent chasing late payments, invoice factoring can provide a valuable boost to financial stability.

By collateralizing loans and lines of credit using outstanding invoices as security, banks offer a secure and reliable means of financing. To qualify, businesses should have invoices to factor, creditworthy clients, and complete the factoring application process. Invoice factoring with banks offers a convenient and effective option for businesses seeking financial support.

Pingback: Maximizing Efficiency and Safety with Gantry Crane Technology