Invoice factoring is when a business transfers its outstanding invoices to a factoring firm in exchange for immediate cash, with the firm providing an advance payment upon issuing the invoice and paying the remaining amount, minus a small fee, once they collect payment from the customer. This method is used to improve cash flow, release money from invoices more quickly, and reduce the time spent chasing late payments.

It is not considered debt as it involves selling the collection rights to unpaid invoices that the business already owns. Invoice factoring is a type of invoice finance that helps improve cash flow and revenue stability by selling outstanding invoices to a third party.

Credit: fastercapital.com

What Is Invoice Factoring?

Invoice factoring is a financial arrangement in which a business sells its outstanding invoices to a factoring firm in exchange for immediate cash. This allows businesses to access funds without waiting for their customers to pay, improving cash flow and reducing the time spent on chasing late payments.

Definition

Invoice factoring is when a business turns over its outstanding invoices to a factoring firm in exchange for immediate cash. The factoring firm pays an advance, which is a partial payment, as soon as the business issues an invoice. Once the factoring firm collects the payment from the customer, they will pay the remaining amount to the business, minus a small fee.

How It Works

Invoice factoring works by following a simple process. When a business issues an invoice to a customer, they can choose to sell that invoice to a factoring firm. The factoring firm will then pay the business an advance within a short period of time, typically within a few days. Once the factoring firm collects the payment from the customer, they will pay the remaining amount to the business, minus a fee for their services.

Advantages

Invoice factoring offers several advantages for businesses:

- Improved cash flow: By receiving immediate payment for their outstanding invoices, businesses can improve their cash flow and have access to funds for various purposes, such as paying suppliers or investing in growth.

- Reduced administrative burden: Invoice factoring eliminates the need for businesses to spend time and resources on chasing late payments. The factoring firm takes over the responsibility of collecting payments from customers.

- No debt creation: Invoice factoring is not considered a debt as businesses are selling their invoices rather than borrowing money. This can be advantageous for businesses trying to avoid taking on additional debt.

- Flexibility: Invoice factoring is flexible and can be used by businesses of all sizes and industries. It can be a viable financing option for both start-ups and established companies.

Overall, invoice factoring provides businesses with a way to access funds quickly and improve their cash flow without taking on additional debt. It offers flexibility and eliminates the administrative burden of chasing late payments, allowing businesses to focus on their core operations and growth.

Is Invoice Factoring A Good Idea?

Invoice factoring is a beneficial solution for businesses looking to improve cash flow and reduce the time spent chasing late payments. By turning over outstanding invoices to a factoring firm, businesses can receive immediate cash advances in exchange for a small fee, allowing them to release money from their invoices more quickly.

Improving Cash Flow

Invoice factoring can be a smart move for businesses looking to improve their cash flow. By turning over outstanding invoices to a factoring firm, you can receive immediate cash in exchange. This advance payment can help you cover expenses, invest in growth opportunities, and meet financial obligations without waiting for customers to make payments. With improved cash flow, you can run your business more smoothly and confidently.Quicker Access To Funds

One of the key benefits of invoice factoring is the ability to access funds quickly. Instead of waiting for customers to pay their invoices, you can receive an advance payment as soon as you issue the invoice. This can significantly reduce the time it takes to receive payment and help you avoid cash flow gaps. With quicker access to funds, you can maintain a steady flow of working capital and seize opportunities as they arise.Less Time Chasing Payments

Another advantage of invoice factoring is that it allows you to spend less time chasing late payments. When you partner with a factoring firm, they take on the responsibility of collecting payments from your customers. This frees up your time and resources, allowing you to focus on other important aspects of your business, such as sales, operations, and customer service. By outsourcing the task of payment collection, you can minimize the stress and frustration that often comes with late-paying customers. In conclusion, invoice factoring can be a good idea for businesses looking to improve cash flow, access funds more quickly, and spend less time chasing payments. It provides a convenient and efficient way to release money from outstanding invoices, giving you the financial flexibility and peace of mind to grow your business. Consider exploring invoice factoring as a viable option to optimize your cash flow management.Difference Between Factoring And Financing

When it comes to managing cash flow and improving financial stability, businesses often turn to factoring and financing solutions. While both options can provide immediate funds, it’s important to understand the difference between factoring and financing to make an informed decision for your business. Let’s explore the definitions, requirements, and examples of factoring and financing.

Definition

Factoring: Factoring is when a business turns over its outstanding invoices to a factoring firm in exchange for immediate cash. The factoring firm pays an advance (a partial payment) as soon as you issue an invoice. Once they collect the payment from the customer, they will pay you the remaining amount, minus a small fee.

Financing: Financing allows a business to obtain immediate capital or money based on the future income attributed to a particular amount due on an account receivable or a business invoice. Accounts receivables represent money owed to the company from its customers for sales made on credit.

Requirements

Factoring:

- The business must have outstanding invoices that are due from customers.

- The factoring firm usually requires a minimum monthly invoice volume.

- The invoices must be from creditworthy customers.

- The factoring firm may require a personal guarantee from the business owner.

Financing:

- The business must have account receivables or invoices from creditworthy customers.

- The financing company may require a minimum invoice amount.

- The business may need to provide financial statements or other documentation.

- The financing company may perform a credit check on the business and its customers.

Examples

Factoring:

| Factoring Firm | Requirements | Fee |

|---|---|---|

| FundThrough | Minimum monthly invoice volume of $10,000 | 2% of the invoice amount |

| Riviera Finance | Invoices from creditworthy customers | 1-5% of the invoice amount |

Financing:

| Financing Company | Requirements | Interest Rate |

|---|---|---|

| ABC Financing | Invoices from creditworthy customers | 10% per annum |

| XYZ Capital | Minimum invoice amount of $5,000 | 8% per annum |

Is Invoice Factoring Considered Debt?

When considering the financial implications of invoice factoring, one might wonder whether it is akin to taking on additional debt. However, it is crucial to understand that invoice factoring operates on a different premise, offering businesses an alternative way to access funds without incurring traditional debt.

Selling Collection Rights

Invoice factoring isn’t creating a debt: you’re simply selling the collection rights to a debt you already own — unpaid invoices — in exchange for faster access to those funds.

Faster Access To Funds

One of the primary advantages of invoice factoring is the expedited access to funds. By leveraging unpaid invoices, businesses can unlock much-needed capital without assuming additional debt. This streamlined process allows for enhanced liquidity and improved cash flow.

Not Creating Additional Debt

It’s essential to recognize that invoice factoring differs from traditional borrowing arrangements as it does not result in the generation of new debt. Instead, it provides a mechanism to leverage existing assets to secure immediate financial support.

How To Explore Invoice Factoring Options

When it comes to exploring invoice factoring options, it’s essential to conduct thorough research, compare fees, and evaluate terms and conditions. By understanding how to navigate through these factors, businesses can make informed decisions that are aligned with their financial requirements. Let’s dive into the key steps of exploring invoice factoring options.

Researching Factoring Companies

Before making any decisions, it’s crucial to research and assess different factoring companies. Look for companies that have a strong track record, positive client testimonials, and a transparent process. Verify their credibility by checking for industry certifications and accreditations.

Comparing Fees

When comparing factoring companies, pay close attention to their fee structures. Ensure that you understand all the costs involved, including discount fees and processing fees. Look for a company that offers competitive rates without compromising on the quality of services provided.

Evaluating Terms And Conditions

Thoroughly review the terms and conditions outlined by each factoring company. Check for any hidden clauses or obligations that may impact your business. Pay attention to factors such as contract length, recourse and non-recourse factoring options, and any potential penalties for early contract termination.

Credit: fundtap.co

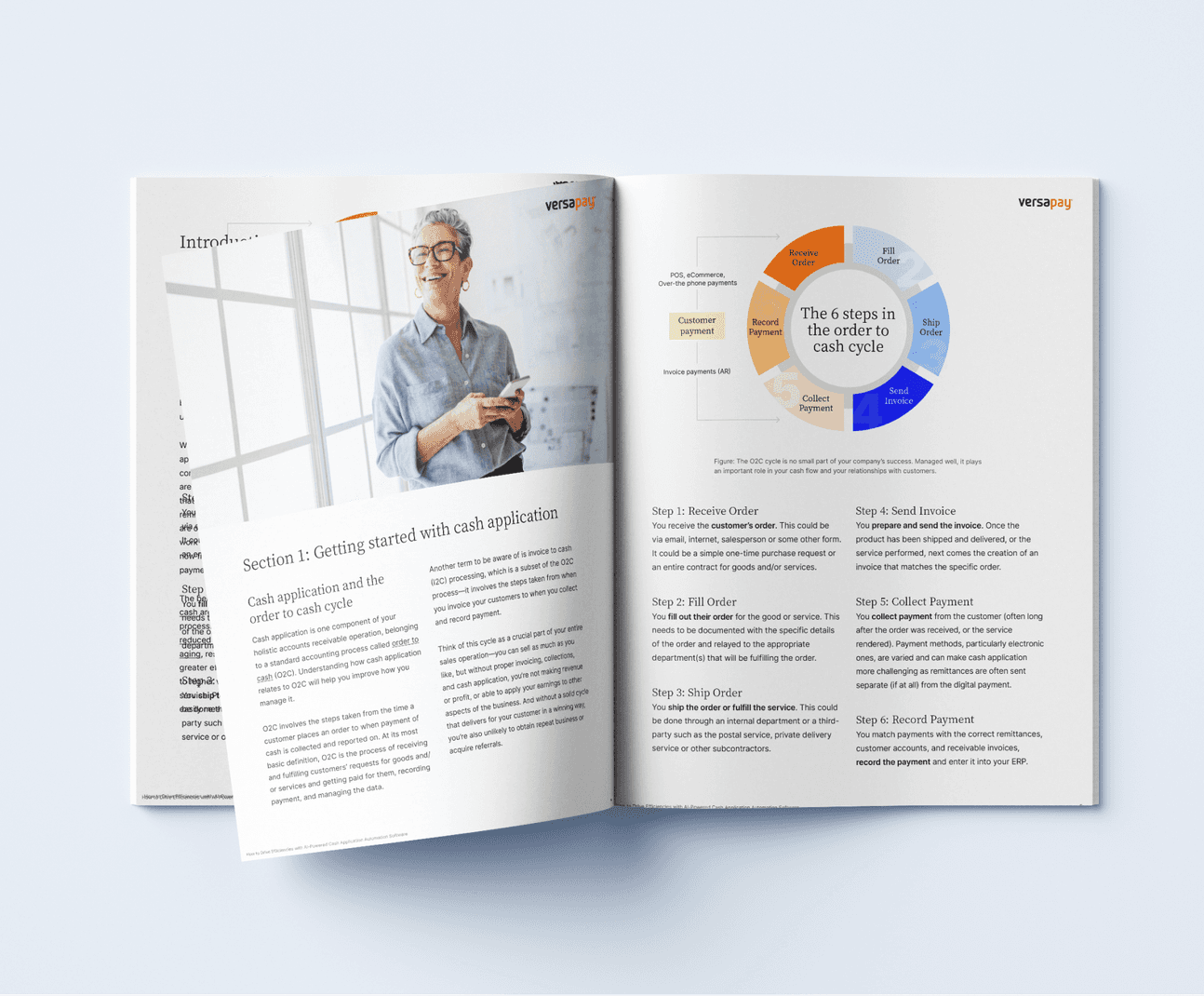

Credit: www.versapay.com

Frequently Asked Questions For Invoice Factoring Def

What Is Meant By Invoice Factoring?

Invoice factoring is when a business exchanges its outstanding invoices for immediate cash with a factoring firm. The firm provides an advance payment when you issue an invoice, and once they collect payment from the customer, they pay you the remaining amount, minus a small fee.

Is Invoice Factoring A Good Idea?

Invoice factoring can be a good idea for businesses looking to get money from their invoices quickly, improve cash flow, or reduce time spent chasing late payments. It involves turning outstanding invoices over to a factoring firm in exchange for immediate cash, with the firm providing an advance and paying the remaining amount, minus a fee, once they collect payment from the customer.

What Is Factoring And How Does It Work?

Invoice factoring is when a business gives its unpaid invoices to a factoring firm for immediate cash. The firm pays an advance and collects payment from customers. They then pay the remaining amount to the business, minus a fee. It’s a way to access capital quickly based on future income from accounts receivable.

Is Invoice Factoring Considered Debt?

Invoice factoring is not considered debt. It involves selling collection rights to unpaid invoices for faster access to funds.

Conclusion

Invoice factoring is a valuable financial solution for businesses that need immediate access to cash flow. By turning over their outstanding invoices to a factoring firm, businesses can receive an advance payment and alleviate the pressure of waiting for customer payments.

The factoring firm assumes the responsibility of collecting the payment, allowing businesses to focus on their operations. Invoice factoring boosts cash flow, improves financial stability, and reduces the time spent on chasing late payments. It is an effective strategy for businesses looking to manage their finances more efficiently and effectively.