Invoice factoring in Europe is a method of increasing a company’s cash flow by selling its invoices to a third party at a discounted rate to overcome short-term liquidity demands. It is an alternative financing method that allows businesses to get the money for unpaid invoices and boost their turnover.

This financing solution is often regarded as an alternative to traditional factoring and provides businesses with the cash flow they need to grow and develop. With invoice factoring, businesses can avoid the stress and financial strain caused by unpaid invoices, allowing them to focus on their core operations and business growth.

What Is Invoice Factoring?

Invoice factoring is a method of increasing cash flow by selling invoices at a discounted rate to overcome short-term liquidity demands. It is an alternative financing method that allows businesses to receive money for unpaid invoices, boosting their turnover and helping them grow.

Definition

Invoice factoring is a method of increasing the operational cash flow of an organization by selling its invoices (accounts receivable) to a third party at a discounted rate to overcome its short-term liquidity demands. This alternative financing method allows businesses to access the money tied up in their unpaid invoices and convert it into immediate cash.

How It Works

The process of invoice factoring involves three main parties: the business (seller), the debtor (customer), and the factoring company (buyer). Here’s a step-by-step overview of how it works:

- The business delivers goods or services to its customers and generates invoices for the amount owed.

- The business decides to factor its invoices and enters into an agreement with a factoring company.

- The factoring company verifies the invoices and advances a percentage of the total value (usually around 80-90%) to the business, providing immediate cash flow.

- The factoring company becomes responsible for collecting payment from the debtor.

- Once the debtor pays the invoice, the factoring company deducts its fees and releases the remaining balance to the business.

This process allows businesses to access funds quickly without relying on traditional loans or credit lines. It also relieves them from the burden of chasing late payments and managing accounts receivable.

Benefits

Invoice factoring offers a range of benefits for businesses, including:

- Improved Cash Flow: By converting unpaid invoices into immediate cash, businesses can ensure a steady flow of funds for their operations.

- Flexibility: Invoice factoring is a flexible financing solution that grows with the business. The funding available is directly tied to the volume of invoices, allowing businesses to access more cash as their sales increase.

- Reduced Collection Efforts: Factoring companies take on the responsibility of collecting payments, freeing up valuable time and resources for business owners to focus on core operations.

- No Debt: Unlike traditional loans, invoice factoring does not create debt for businesses. It is a form of asset-based financing that leverages the value of invoices, making it an attractive option for companies without a strong credit history.

- Fast Access to Funds: Invoice factoring provides businesses with quick access to funds, typically within 24-48 hours. This helps them meet immediate financial obligations or take advantage of growth opportunities without delay.

Overall, invoice factoring offers businesses a convenient and efficient way to optimize their cash flow and maintain financial stability.

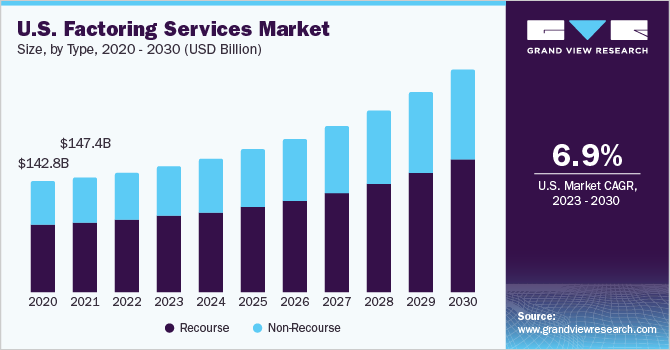

Credit: www.grandviewresearch.com

Invoice Factoring In Europe

Invoice factoring is a smart financial solution that can help businesses in Europe overcome their short-term liquidity demands and increase their operational cash flow. By selling their invoices, also known as accounts receivable, to a third party at a discounted rate, businesses can obtain immediate funds to support their day-to-day operations and growth.

Overview

Invoice factoring allows businesses to convert their unpaid invoices into immediate cash, providing them with the necessary working capital to meet their financial obligations and invest in their future success. It is a popular financing method for companies of all sizes and industries in Europe, offering flexibility and convenience.

Market Growth

The invoice factoring market in Europe has been experiencing steady growth in recent years, as businesses recognize the benefits and advantages it offers. With increasing competition and evolving business landscapes, invoice factoring has become a reliable and efficient way for companies to manage their cash flow and maintain a healthy financial position.

Key factors driving the growth of the invoice factoring market in Europe include:

- Rising awareness and adoption of alternative financing solutions among businesses

- Increasing need for quick access to working capital

- Challenges in obtaining traditional bank loans and credit facilities

- Flexible terms and tailored solutions offered by invoice factoring providers

Factoring Providers

There are numerous factoring providers in Europe that offer invoice factoring services to businesses of all sizes. These providers specialize in managing and financing accounts receivable, ensuring that businesses receive timely payments for their invoices.

Some well-known invoice factoring providers in Europe include:

| 1. Universal Funding | 4. Comarch |

| 2. America’s Factors | 5. Scale Funding |

| 3. Vertex Partners & Integrations | 6. SME Invoice Finance |

These providers offer a range of services, including invoice verification, credit control, and collections, providing businesses with comprehensive solutions to manage their accounts receivable effectively.

Invoice factoring in Europe is a valuable financial tool that can help businesses overcome cash flow challenges and unlock their growth potential. With a growing market, businesses have access to a variety of factoring providers offering tailored solutions to meet their specific needs and requirements.

Regulation Of Invoice Factoring

Invoice factoring is a popular financing method for businesses looking to improve their cash flow by selling their invoices to a third party at a discounted rate. However, not all countries have specific regulations in place for invoice factoring. In this section, we will explore the regulation frameworks for invoice factoring in the United States and the United Kingdom.

Regulation In The Us

In the United States, invoice factoring companies are not regulated by a formal government body. Instead, most legitimate factoring companies are members of associations where they self-regulate their collective and individual activities. This self-regulation ensures compliance with ethical and professional standards, providing businesses with a level of assurance when engaging with factoring services. However, it’s important for businesses to conduct due diligence and choose a reputable factoring company to avoid any potential risks.

Regulation In The Uk

Unlike the United States, invoice factoring is not currently regulated in the United Kingdom by the Financial Conduct Authority (FCA) or any other government body. This lack of regulation makes it crucial for businesses to carefully select a legitimate factoring provider. While there may not be formal regulations, reputable factoring providers often adhere to industry best practices and maintain high ethical standards. Therefore, businesses should thoroughly research and choose a factoring service provider with a solid track record and positive client reviews.

Credit: www.americanexpress.com

Alternatives To Invoice Factoring

Discover the alternatives to invoice factoring in Europe. Explore options such as invoice financing, Comarch e-Invoicing Solution, and invoice factoring services offered by reputable companies like America’s Factors and Month-to-Month Factoring. Boost your cash flow with these alternative methods.

Invoice Financing

When looking for alternatives to invoice factoring, invoice financing can be an attractive option. This method allows businesses to acquire immediate funds by using their outstanding invoices as collateral. By obtaining a percentage of the invoice’s value upfront, companies can alleviate cash flow issues and continue their operations smoothly.

Other Financing Options

Aside from invoice financing, there are various other financing options available for businesses. These can include traditional bank loans, lines of credit, asset-based lending, and crowdfunding. Each of these alternatives presents its own unique advantages and considerations, catering to diverse financial needs and preferences.

Potential Table Representation| Financing Option | Advantages | Considerations |

|---|---|---|

| Bank Loans | Lower interest rates | Strict eligibility criteria |

| Lines of Credit | Flexible access to funds | Variable interest rates |

| Asset-Based Lending | Utilizes company assets | Higher collateral requirements |

| Crowdfunding | Community support and exposure | Uncertain funding success |

Choosing The Right Factoring Provider

When it comes to choosing the right factoring provider, businesses must consider several factors to ensure they make an informed decision. Selecting a reliable factoring partner is crucial for optimizing cash flow and maintaining financial stability. Before committing to a factoring agreement, thorough due diligence is essential to guarantee a positive and mutually beneficial relationship with the chosen provider.

Factors To Consider

- Reputation and Experience: Examine the provider’s track record and industry experience.

- Flexibility: Ensure the provider offers flexible terms that suit your business needs.

- Customer Service: Evaluate the level of support and responsiveness provided by the factoring company.

- Cost and Fees: Compare the fees and rates offered by different providers to find the most cost-effective solution.

- Specialization: Consider providers with expertise in your industry for tailored services.

Due Diligence

Engaging in comprehensive due diligence is crucial before finalizing an agreement with an invoice factoring provider. This process involves conducting thorough research, verifying credentials, and assessing the financial stability of the factoring company. The due diligence stage should also include a review of contract terms and conditions to ensure transparency and minimize any potential risks. By meticulously scrutinizing the provider’s background and practices, businesses can mitigate the likelihood of disputes and instill confidence in the partnership.

Credit: www.netsuite.com

Frequently Asked Questions Of Invoice Factoring Europe

What Is Invoice Factoring Uk?

Invoice factoring UK is a method of improving cash flow by selling unpaid invoices to a third party at a discounted rate. It is not regulated in the UK.

What Is The Alternative To Invoice Factoring?

Invoice financing is an alternative to invoice factoring. It helps businesses improve cash flow by getting immediate payment for invoices from a third party at a discounted rate.

Is Invoice Factoring Regulated In The Us?

Yes, invoice factoring companies in the US are not regulated by a formal government body. They typically self-regulate through industry associations.

Is Factoring Regulated In The Uk?

Yes, factoring is not currently regulated in the UK. It’s essential to choose a legitimate provider as no asset based finance is regulated by the Financial Conduct Authority.

Conclusion

Invoice factoring in Europe is an effective method of boosting operational cash flow for organizations by selling their invoices at a discounted rate. This alternative financing method allows businesses to overcome short-term liquidity demands and grow their operations. Unlike other forms of finance, invoice factoring is currently not regulated in the UK, making it important to choose a legitimate provider.

By partnering with reputable factoring companies, businesses can benefit from increased cash flow and take their operations to new heights. Boost your turnover and keep your business running smoothly with invoice factoring in Europe.