Invoice factoring is a type of invoice finance where you sell your company’s outstanding invoices to a third party to improve cash flow and revenue stability. The factoring company pays you most of the invoiced amount upfront and collects payment directly from your customers.

It is a good option for businesses looking to release funds from their invoices quickly and reduce time spent chasing late payments. Invoice factoring is a popular financing option for businesses looking to improve their cash flow and ensure a stable revenue stream.

By selling their outstanding invoices to a third party, known as a factoring company, businesses can receive upfront payments for their invoices, instead of waiting for their customers to pay. This allows businesses to access the funds they need immediately, improving their financial position and helping them meet their operational expenses without delays. We will explore the concept of invoice factoring and provide examples of how it works in practice. By understanding the process and benefits of invoice factoring, businesses can make informed decisions about their financing options.

Credit: www.forbes.com

Understanding Invoice Factoring

Invoice factoring is a type of invoice finance where you “sell” some or all of your company’s outstanding invoices to a third party as a way of improving your cash flow and revenue stability. This financing option allows you to receive most of the invoiced amount immediately, while the factoring company takes care of collecting payment directly from your customers. In this section, we will delve deeper into what invoice factoring is, how it works, whether it is a good idea for your business, and how you can set it up.

What Is Invoice Factoring?

Invoice factoring is a financial solution that provides businesses with quick access to the funds tied up in their unpaid invoices. Instead of waiting for customers to pay, the company can sell those invoices to a factoring company at a discounted rate. This allows businesses to improve their cash flow and ensure a steady stream of revenue.

How Does Invoice Factoring Work?

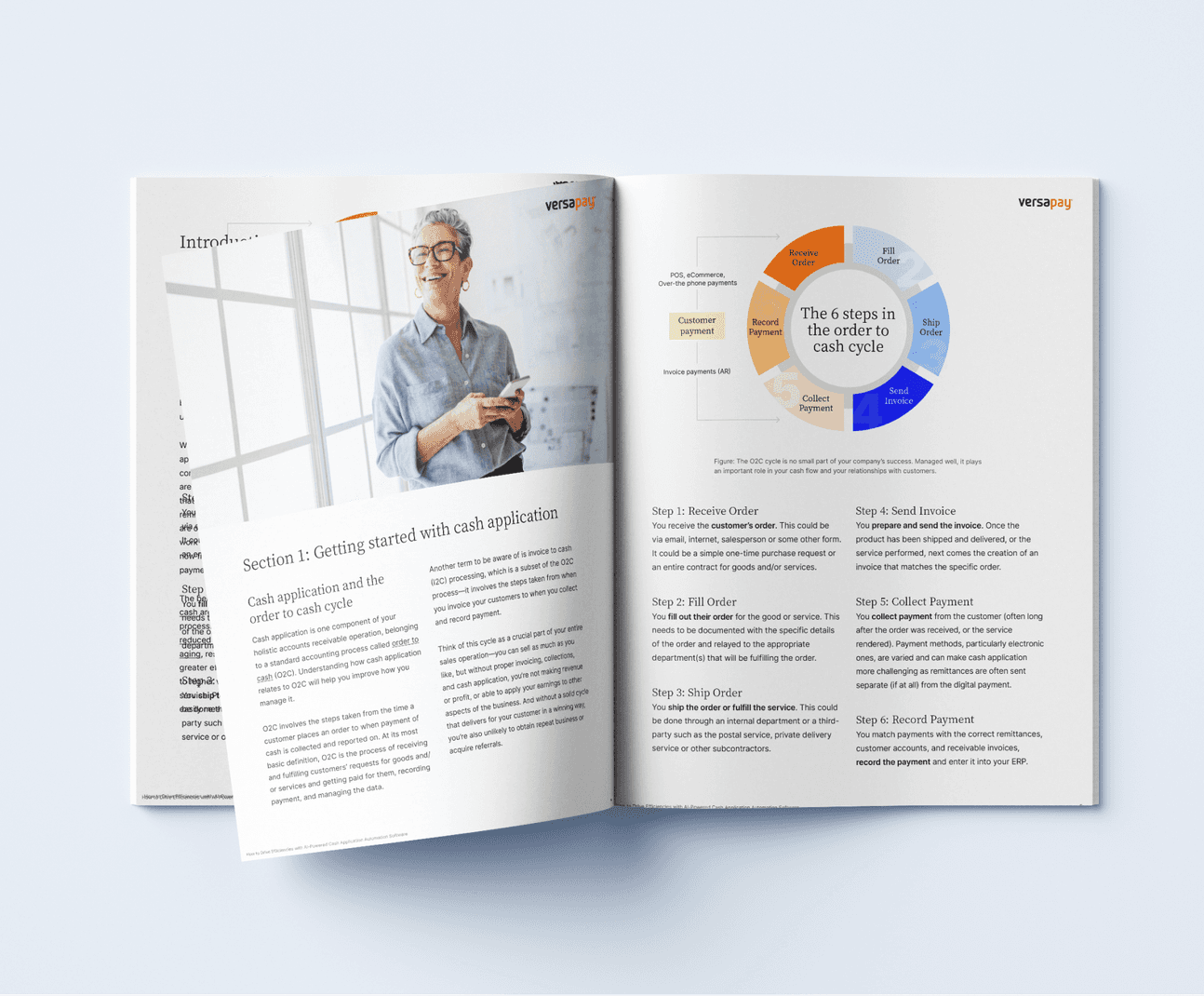

Invoice factoring works by following a simple process. First, you provide goods or services to your customers as usual and issue invoices to them. Then, you sell these invoices to a factoring company, who advances you a significant portion of the invoice value upfront, typically around 80% to 90%. The factoring company then assumes the responsibility of collecting payment from your customers. Once the customers pay, the factoring company deducts their fees and remits the remaining portion of the invoice amount to you, providing you with the remaining 10% to 20%.

Is Invoice Factoring A Good Idea?

Invoice factoring can be a beneficial option for businesses looking to release cash from their invoices more quickly, improve cash flow, and reduce the time spent chasing late payments. It can provide a steady influx of cash to support business operations, investments, and growth opportunities. However, it is essential to consider the cost of factoring, compare it with the benefits, and assess whether it aligns with the specific needs and goals of your business.

How Do I Set Up An Invoice Factoring?

Setting up invoice factoring involves a straightforward process. First, you provide goods or services to your customers and issue invoices as usual. Then, you find a reputable factoring company that suits your business needs. You proceed by submitting the invoices you wish to sell to the factoring company, along with any required documentation. Once approved, the factoring company will advance you a portion of the invoice value and take over the collection process. Your customers will then pay the factoring company directly, and you will receive the remaining funds, minus the factoring fees. It is crucial to research and choose a reliable factoring partner to ensure a smooth and mutually beneficial relationship.

Credit: www.facebook.com

Invoice Factoring Example

Invoice factoring is a popular financing option for small businesses that struggle with cash flow issues. It involves selling your unpaid invoices to a third-party company, known as a factor, in exchange for immediate cash. This allows you to access the funds tied up in outstanding invoices, improving your financial stability and allowing you to cover operational expenses or invest in growth opportunities.

Invoice Factoring Examples

Let’s take a look at a few invoice factoring examples to help you understand how it works in practice:

| Business | Invoice Amount | Factor Advance | Remaining Amount |

|---|---|---|---|

| ABC Manufacturing | $10,000 | $8,000 | $2,000 |

| XYZ Services | $5,000 | $4,000 | $1,000 |

In the first example, ABC Manufacturing has an outstanding invoice of $10,000. They sell this invoice to a factor, who advances them $8,000 upfront. The factor collects the full amount from ABC Manufacturing’s customer and takes a small fee for their services. Once the payment is received, the factor pays the remaining $2,000 to ABC Manufacturing.

Similarly, in the second example, XYZ Services sells a $5,000 invoice to a factor and receives a $4,000 advance. The factor collects the payment from XYZ Services’ customer and keeps a small portion as their fee. After deducting the fee, the factor pays the remaining $1,000 to XYZ Services.

How Much Can A Factor Provide?

The amount a factor can provide depends on various factors, such as your business’s sales volume, creditworthiness, and the quality of your invoices. Typically, factors advance around 70-90% of the invoice value upfront, with the remaining amount paid once the customer settles the invoice.

Factoring Vs Other Types Of Financing

Invoice factoring provides several advantages over other types of financing, such as traditional bank loans or lines of credit:

- Quick access to cash: Unlike traditional financing options that involve time-consuming application processes, invoice factoring allows businesses to access funds quickly, providing immediate relief for cash flow issues.

- No debt incurred: Invoice factoring is not a loan. Instead, it leverages your outstanding invoices to secure funding. This means you don’t have to worry about repayments or accumulating debt.

- No personal guarantees: Invoice factoring is based on the creditworthiness of your customers, not your business or personal credit history. This means you can access funding even if you have limited credit history or have been denied traditional financing options.

Overall, invoice factoring offers a flexible and accessible financing solution for small businesses in need of working capital. By converting your unpaid invoices into immediate cash, you can maintain steady cash flow and focus on growing your business.

Choosing The Right Invoice Factoring

Invoice factoring is a type of invoice finance that allows businesses to improve cash flow by selling outstanding invoices to a third party. The factoring company pays a majority of the invoiced amount immediately, then collects payment directly from customers.

It’s a great solution for businesses looking to release money from invoices quickly and reduce time spent chasing late payments.

In the world of small business finances, invoice factoring has become increasingly popular as a way to improve cash flow and revenue stability. But with so many options available, how do you choose the right invoice factoring company? In this section, we will explore some essential tips to consider when selecting an invoice factoring provider, as well as the differences between invoice factoring and spot factoring, and invoice factoring and contract factoring.Tips For Choosing The Right Invoice Factoring Company

When selecting an invoice factoring company, there are a few key factors to keep in mind to ensure you make the right decision for your business. Here are some tips to help you make an informed choice:- Assess your specific needs: Before diving into the search for an invoice factoring company, take the time to evaluate your business’s unique requirements. Determine the volume of invoices you have, the average size of your invoices, and the industries you work with. This information will help you find a factoring company that specializes in your field.

- Research potential providers: Once you have a clear understanding of your needs, start researching different invoice factoring companies. Look for reputable providers with a track record of success and positive customer reviews. Check if they have experience in your industry and if they offer the services you require.

- Compare rates and fees: The cost of invoice factoring can vary widely between providers. Request quotes from several companies and compare their rates and fees. Pay attention to any hidden charges or additional costs that may not be immediately apparent.

- Consider customer support: A reliable factoring company should provide excellent customer support. Look for a provider that offers prompt and efficient communication, as well as a dedicated account manager who can answer your questions and address any concerns that may arise.

- Read the contract carefully: Before signing any agreements, thoroughly read and understand the terms and conditions of the contract. Pay attention to factors such as the minimum volume requirement, cancellation policies, and any penalties for late payments.

Invoice Factoring Vs. Spot Factoring

While invoice factoring and spot factoring are both viable options for businesses looking to improve cash flow, there are key distinctions between the two. Spot factoring allows businesses to choose specific invoices to sell to a factoring company on a case-by-case basis. This flexibility can be advantageous for businesses that only need immediate funding for certain invoices, rather than their entire sales ledger. In contrast, invoice factoring involves selling all outstanding invoices to a factoring company, providing consistent cash flow and minimizing administrative tasks.Invoice Factoring Vs. Contract Factoring

In the realm of invoice factoring, contract factoring can offer unique benefits depending on your business needs. With invoice factoring, businesses can secure immediate funding by selling their invoices to a factoring company. Alternatively, contract factoring involves entering into a long-term agreement with a factoring company, typically spanning several months to a year. This arrangement provides businesses with a reliable source of cash flow, making it ideal for industries with consistent invoicing patterns or long-term projects. By understanding the differences between spot factoring and contract factoring, you can choose the option that best aligns with your business’s financial objectives and requirements. Remember to consider factors such as your cash flow needs, the volume of invoices you generate, and the level of control you wish to maintain over your accounts receivable. While invoice factoring presents an excellent opportunity for small businesses to optimize their cash flow, choosing the right invoice factoring company is crucial. By following these tips and understanding the differences between spot factoring and contract factoring, you can make an informed decision that suits your business’s specific needs.

Credit: www.versapay.com

Benefits And Drawbacks Of Invoice Factoring

Invoice factoring, also known as accounts receivable factoring, is a financing solution that allows businesses to sell their outstanding invoices to a third-party financial company, known as the factor, in exchange for immediate cash. This can help businesses with cash flow issues and provide a reliable source of working capital to maintain operations and grow their business. However, like any financial tool, invoice factoring comes with its share of benefits and drawbacks.

Pros And Cons Of Invoice Factoring

Pros

- Immediate access to cash: Invoice factoring provides immediate funding, enabling businesses to have quick access to cash flow.

- Improved cash flow: By converting accounts receivable into cash, businesses can improve their cash flow and have the resources to cover operating expenses, invest in growth opportunities, or meet payroll demands.

- No debt: Invoice factoring is not a loan, so it does not add debt to the balance sheet, allowing businesses to maintain healthy debt-to-equity ratios.

- Outsourced credit control: Factoring companies often take on the responsibility of credit control, chasing unpaid invoices, and handling collections, freeing up businesses from time-consuming administrative tasks.

Cons

- Cost: The service fee associated with invoice factoring can be higher compared to traditional business loans or lines of credit, impacting the overall profitability of the business.

- Customer relationships: Some business owners may worry about the impact on customer relationships when a third-party factor gets involved in collecting invoices on their behalf.

- Dependence: Becoming reliant on invoice factoring as the primary source of working capital may hinder a business’s ability to secure long-term financing at favorable terms.

Additional Fees Associated With Invoice Factoring

When entering into an invoice factoring arrangement, businesses should be aware of potential additional fees, such as:

| Fee Type | Description |

|---|---|

| Factoring Fee | A percentage of the invoice amount charged as a service fee for the factor’s financing. |

| Advance Fee | A fee charged for the initial funding provided by the factor, typically a percentage of the total invoice value. |

| Wire Transfer Fee | A fee for the wire transfer of funds to the business bank account. |

Invoice Factoring For Small Business Owners

Invoice factoring can be a game-changing financial solution for small and medium-sized business owners. It offers a way to unlock the cash tied up in outstanding invoices without taking on additional debt, enabling businesses to bridge the gap between providing goods or services and receiving payment. Here’s a closer look at how invoice factoring can be the key to fueling the growth and success of your business.

How Invoice Factoring Can Fund Your Small Or Medium-sized Business

The accessibility and flexibility of invoice factoring make it an ideal funding solution for small or medium-sized businesses. By selling your unpaid invoices to a factoring company, you can quickly access a substantial portion of the invoice value, alleviating cash flow constraints and providing the means to cover operational expenses, invest in growth opportunities, and manage daily business operations without delay.

Invoice Factoring Popularity

Invoice factoring has gained significant popularity among small business owners due to its efficiency in addressing cash flow challenges. Many businesses are turning to invoice factoring to expedite cash flow cycles, reduce reliance on traditional banking institutions, and support business growth without acquiring more debt.

Guide To Invoice Factoring For Small Business Owners

- Understand the factoring process: Familiarize yourself with the steps involved in invoice factoring to maximize its benefits.

- Choose the right factoring company: Research and select a reputable factoring company that aligns with your business needs and provides favorable terms.

- Review the agreement terms: Ensure clarity on the fee structure, advance rates, and any additional costs associated with the factoring arrangement.

- Utilize funds strategically: Direct released funds towards essential business operations, growth initiatives, or addressing immediate financial obligations to optimize their impact on your business.

Frequently Asked Questions For Invoice Factoring Example

How Does Invoice Factoring Work?

Invoice factoring involves selling some or all of your company’s outstanding invoices to a third party to improve cash flow. The factoring company pays you most of the invoiced amount upfront and collects payment directly from your customers. It’s a way to obtain immediate funds and reduce time spent chasing late payments.

How Do You Calculate Invoice Factoring?

Invoice factoring is calculated by determining the total outstanding amount of invoices, then selling those invoices to a third-party factoring company. The factoring company pays a percentage of the total invoice value upfront, typically around 80-90%, and collects payment directly from the customers.

The factoring fees and rates are deducted from the remaining invoice amount. Ultimately, invoice factoring helps improve cash flow and provides stability to businesses.

Is Invoice Factoring A Good Idea?

Invoice factoring can be a good idea for businesses looking to improve cash flow and save time on chasing late payments. By selling outstanding invoices to a third party, businesses can access immediate funds and let the factoring company collect payments from customers.

This helps stabilize revenue and increase cash flow quickly.

How Do I Set Up An Invoice Factoring?

To set up invoice factoring, provide goods or services, invoice customers, sell invoices to a factoring company, and the company collects payments directly from customers. This improves cash flow and saves time on payment collection. Invoice factoring is a way to release money from invoices quickly.

Conclusion

Invoice factoring is a valuable solution for businesses looking to improve cash flow and revenue stability. By selling outstanding invoices to a third party, businesses can receive immediate payment and avoid the hassle of chasing late payments. Whether it’s for growth, payroll, or unexpected expenses, invoice factoring provides flexibility and financial stability for small businesses.

Consider exploring invoice factoring as a way to optimize your cash flow and focus on growing your business.