The invoice factoring market provides businesses with immediate access to working capital by selling their unpaid invoices to a third party at a discount. This helps to improve cash flow and cover funding gaps caused by slow-paying customers, allowing businesses to grow and maintain longer payment terms with their customers.

Invoice factoring is a profitable solution that can benefit any business looking to release money from their invoices more quickly and spend less time chasing late payments. With the invoice factoring market poised for exponential growth globally, businesses can leverage this alternative financing option to optimize their cash flow and drive business growth.

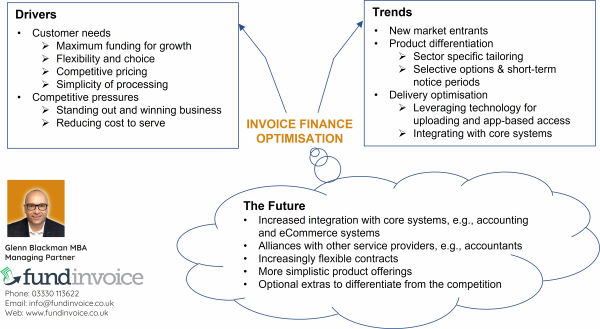

Credit: www.fundinvoice.co.uk

Key Trends In The Invoice Factoring Market

The invoice factoring market has been experiencing several key trends that are shaping the industry and transforming the way businesses manage their cash flow. In this section, we will explore three important trends that are driving the growth of the invoice factoring market.

Technological Advancements

Technological advancements have played a significant role in revolutionizing the invoice factoring industry. With the introduction of innovative software and platforms, businesses now have access to more efficient and streamlined processes for managing their invoices. These technological advancements have enabled faster invoice processing, reduced human error, and improved overall efficiency in the invoice factoring process. As a result, businesses can now access the funds they need more quickly and easily, helping them maintain a healthy cash flow.

Integration Of Artificial Intelligence

In recent years, there has been a growing integration of artificial intelligence (AI) in the invoice factoring market. AI technology is being utilized to automate various tasks and decision-making processes involved in invoice factoring. For example, AI algorithms can analyze invoice data, assess the creditworthiness of customers, and predict payment patterns. By leveraging AI, invoice factoring companies can make more accurate credit decisions and minimize the risk of non-payment. This integration of AI not only improves the efficiency and accuracy of the factoring process but also reduces the administrative burden on businesses.

Growing Popularity Of Online Platforms

Another noteworthy trend in the invoice factoring market is the growing popularity of online platforms. These platforms allow businesses to easily submit their invoices, track the status of their funding, and communicate with factoring companies. Online platforms have made the invoice factoring process more convenient, transparent, and accessible for businesses of all sizes. Moreover, these platforms offer real-time data analytics and reporting, enabling businesses to gain valuable insights into their cash flow and make more informed decisions. With the increasing digitization of business processes, the demand for online invoice factoring platforms is expected to continue to rise.

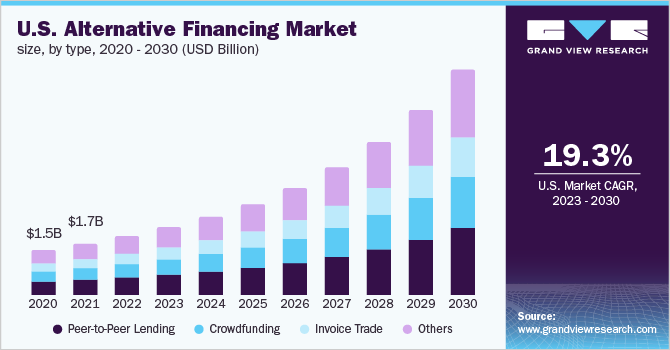

Credit: www.grandviewresearch.com

Factors Driving The Growth Of The Invoice Factoring Market

The growth of the invoice factoring market is driven by increasing small and medium-sized enterprises seeking working capital solutions. Additionally, the demand for improved cash flow and the flexibility offered by invoice factoring services are also contributing to market expansion.

Increasing Need For Working Capital

The invoice factoring market is experiencing significant growth due to the increasing need for working capital among businesses. In today’s competitive business landscape, maintaining healthy cash flow is crucial for long-term success. However, many companies often face challenges when it comes to collecting payments from customers in a timely manner.

With invoice factoring, businesses can sell their outstanding invoices to a third-party factoring company in exchange for immediate cash. This allows companies to bridge the funding gap caused by slow-paying customers and access the working capital they need to cover operational expenses, invest in growth opportunities, and meet their financial obligations.

Rise In Small And Medium-sized Enterprises (smes)

The invoice factoring market is also being driven by the rise in small and medium-sized enterprises (SMEs) that are seeking alternative financing solutions. Traditionally, SMEs have faced challenges in accessing affordable financing from traditional banking institutions, which often have stringent lending criteria.

Invoice factoring provides SMEs with a viable alternative to bank loans, as it allows them to leverage their accounts receivable to unlock immediate funds. This is particularly beneficial for SMEs that may not have extensive credit histories or collateral to secure traditional loans. The flexibility and accessibility offered by invoice factoring make it an attractive financing option for SMEs looking to meet their cash flow needs.

Preference For Non-banking Financial Institutions

Another factor contributing to the growth of the invoice factoring market is the increasing preference for non-banking financial institutions. Many businesses, especially those in the SME sector, are opting for alternative financing sources outside of traditional banks.

This shift can be attributed to various reasons, including the more streamlined application processes, faster approvals, and flexibility offered by non-banking financial institutions. Invoice factoring companies, in particular, are known for their specialized expertise in evaluating and managing accounts receivable, making them reliable partners for businesses seeking efficient cash flow solutions.

The preference for non-banking financial institutions, coupled with the unique benefits provided by invoice factoring, is driving the growth of the market and attracting businesses across various industries and sectors.

Challenges And Limitations In The Invoice Factoring Market

While invoice factoring can offer numerous benefits to businesses, there are also some challenges and limitations that need to be considered. These challenges can affect the overall efficiency and profitability of the invoice factoring market.

Risk Of Default By Debtors

One major challenge in the invoice factoring market is the risk of default by debtors. When a business sells its invoices to a factoring company, it transfers the responsibility of collecting payments to the factoring company. However, there is always a possibility that the debtors may fail to make the payments on time or not make them at all. This can lead to financial losses for the factoring company and the business that sold the invoices.

Complexity In Assessing Creditworthiness

Another challenge in the invoice factoring market is the complexity in assessing the creditworthiness of the debtors. Factoring companies need to evaluate the financial stability and payment history of the businesses that owe the invoices. This requires extensive research and analysis, which can be time-consuming and require additional resources. The complexity in assessing creditworthiness makes it challenging for factoring companies to identify reliable debtors and minimize the risk of default.

Regulatory Constraints

Furthermore, regulatory constraints pose limitations in the invoice factoring market. Different jurisdictions have specific regulations and legal frameworks that govern invoice factoring transactions. These regulations can vary in terms of disclosure requirements, interest rates, collection practices, and other factors. Factoring companies need to ensure compliance with these regulations, which adds complexity and potentially limits their operations in certain markets.

Overall, while invoice factoring can be a valuable financial tool for businesses, it is important to consider the challenges and limitations that exist in the market. By addressing these challenges and finding effective solutions, businesses and factoring companies can optimize the benefits and mitigate the risks associated with invoice factoring.

Credit: www.mdpi.com

Future Outlook And Opportunities For The Invoice Factoring Market

Future Outlook and Opportunities for the Invoice Factoring MarketThe future of the invoice factoring market is bright as it continues to evolve and expand globally, presenting lucrative opportunities for businesses. Emerging trends and innovations are reshaping the landscape, paving the way for further growth and development. Let’s delve into the key areas that are driving the future growth and opportunities within the invoice factoring market.

Expanding Global Market PresenceExpanding Global Market Presence

The invoice factoring market is witnessing a significant expansion of its global presence, as businesses across various industries recognize the benefits of leveraging this financing solution. With the increasing globalization of trade and commerce, there is a growing demand for flexible and accessible working capital solutions, driving the adoption of invoice factoring on a global scale.

Emergence of Invoice Factoring as a Mainstream Financing OptionEmergence Of Invoice Factoring As A Mainstream Financing Option

Invoice factoring is swiftly emerging as a mainstream financing option, gaining traction among small and medium-sized enterprises (SMEs) as well as larger corporations. The evolving financial landscape and the need for efficient working capital management have propelled the prominence of invoice factoring as a go-to solution for businesses seeking to maintain healthy cash flow and unlock the value of their accounts receivable.

Innovation and Diversification in Service OfferingsInnovation And Diversification In Service Offerings

The invoice factoring industry is undergoing a phase of rapid innovation and diversification in its service offerings, catering to the evolving needs of businesses. Factoring companies are integrating advanced technologies, such as digital platforms and automated processes, to streamline operations and enhance the overall customer experience. Additionally, the diversification of service offerings, including non-recourse factoring and industry-specific solutions, is further extending the appeal and usability of invoice factoring across diverse sectors.

Frequently Asked Questions For Invoice Factoring Market

Is Invoice Factoring Profitable?

Invoice factoring can be profitable for businesses as it provides immediate access to working capital and improves cash flow by converting unpaid invoices into cash. It allows businesses to cover funding gaps caused by slow-paying customers and enables them to extend longer payment terms to loyal customers while still growing their business.

What Is The Future Of Invoice Factoring?

The future of invoice factoring looks promising, with increased demand for immediate access to working capital. It offers improved cash flow and allows businesses to maintain longer payment terms with customers. Invoice factoring is a good solution for releasing money quickly and growing your business.

What Is The Factoring Rate For Invoices?

The factoring rate for invoices varies depending on the factors such as the industry, creditworthiness of the customer, and the volume of invoices being factored. It is usually a percentage of the total value of the invoice, ranging from 1% to 5%.

Factoring rates can be negotiated with the factoring company.

Is Invoice Factoring Good?

Invoice factoring can be a good idea for businesses looking to release funds from their invoices more quickly, improve cash flow, and spend less time chasing late payments. It provides immediate access to working capital, helps cover funding gaps caused by slow-paying customers, and allows businesses to keep loyal customers on longer payment terms.

Conclusion

The invoice factoring market offers businesses a valuable solution for managing cash flow and accessing immediate working capital. By selling unpaid invoices to a third party, businesses can bridge the funding gap caused by slow-paying customers and improve cash flow.

Furthermore, invoice factoring allows businesses to maintain longer payment terms with loyal customers while still fueling growth. As the global market for invoice factoring continues to grow, businesses can take advantage of this alternative financing option to optimize their financial operations.