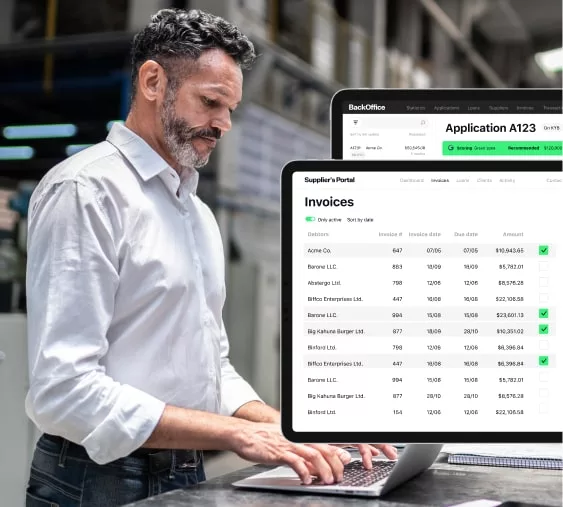

Invoice Factoring Software is a modern, cloud-based solution that helps factors grow revenue, reduce risk, and improve customer trust. With features like easy integration, intelligent factoring, and accessible software, it provides a fast and efficient way to manage invoices and services.

FactorCloud, built by factors for factors, offers a user-friendly platform that streamlines the factoring process. HES FinTech also provides top-notch invoice factoring software, offering services for various industries such as freight and medical factoring. FactorView is another powerful and simple factoring software that focuses on accounts receivable and invoice management.

These software options enhance cash flow, optimize invoice processing, and provide a seamless experience for businesses engaged in invoice factoring. There are multiple software solutions available that cater to the unique needs of invoice factoring, providing a boost to businesses’ financial management and growth.

What Is Invoice Factoring?

Invoice factoring is a financial solution that allows businesses to access immediate working capital by selling their outstanding invoices to a factoring company. It is an effective way for companies to improve cash flow and bridge the funding gap caused by slow-paying customers.

Explanation Of Invoice Factoring

Invoice factoring involves three main parties: the business that sells the invoices (the seller), the customers who owe the outstanding payments, and the factoring company that purchases the invoices (the factor). Here’s a step-by-step breakdown of how invoice factoring works:

- The seller provides goods or services to their customers as per usual.

- The seller raises invoices for the goods or services provided.

- The invoices are then sold to the factoring company.

- The factoring company pays the seller a percentage of the total invoice value upfront, typically within 24 to 48 hours.

- The factoring company takes control of the invoices and becomes responsible for collecting the outstanding payments from the customers.

- Once the customers pay the factoring company, the remaining balance, minus the factoring fees, is returned to the seller.

Benefits Of Invoice Factoring

Invoice factoring offers several benefits to businesses:

- Improved cash flow: By receiving immediate payment for invoices, businesses can cover expenses, invest in growth, and maintain a stable cash flow.

- Reduced risk: The factoring company assumes the risk of non-payment, protecting the seller from bad debt and potential financial losses.

- Flexible funding: Invoice factoring provides a flexible financing option that grows with the business’s sales volume. As the business generates more invoices, they can increase their funding by selling more invoices.

- Customer retention: Factoring allows businesses to offer longer payment terms to their customers, promoting customer loyalty and maintaining strong relationships.

- Time-saving: By outsourcing the accounts receivable function to the factoring company, businesses can save time and resources spent on collections and focus on core operations.

With these benefits, businesses can optimize their cash flow, manage working capital effectively, and accelerate growth.

Credit: hesfintech.com

Types Of Invoice Factoring

When it comes to invoice factoring, there are two main types that businesses can choose from – recourse factoring and non-recourse factoring. Although they serve the same purpose of providing businesses with immediate access to working capital, these types differ in several ways, including typical fees, qualification requirements, and who is responsible for nonpayment.

Recourse Factoring

Recourse factoring is the more common type of invoice factoring. In this arrangement, the business selling its invoices, known as the seller, assumes the responsibility if the customer does not pay the invoice. Therefore, the seller “recourses” the invoice back to themselves and must repay the factor the outstanding amount.

Non-recourse Factoring

Non-recourse factoring, on the other hand, provides the seller with more protection. In this type of arrangement, the factor assumes the risk if the customer does not pay the invoice. This means that the factor absorbs the loss and the seller does not have to repay the outstanding amount.

Now that you understand the two main types of invoice factoring, it’s important to carefully consider which one is best suited for your business. Recourse factoring is generally more accessible and has lower fees, but it also comes with more risk for the seller. On the other hand, non-recourse factoring provides more protection for the seller but may come with higher fees and stricter qualification requirements.

In conclusion, choosing the right type of invoice factoring is crucial for businesses looking to improve their cash flow and ensure financial stability. By considering the advantages and disadvantages of recourse and non-recourse factoring, businesses can make an informed decision that aligns with their unique needs and goals.

How To Set Up Invoice Factoring

Setting up invoice factoring involves providing goods or services to customers, invoicing them, and then selling those invoices to a factoring company who will collect payment directly from the customers. FactorCloud offers modern and accessible factoring software and services to help businesses grow revenue, reduce risk, and improve customer trust.

Providing Goods Or Services

When it comes to setting up invoice factoring, the first step is to provide goods or services to your customers in the normal way. Whether you are a trucking company, staffing agency, or oilfield service provider, you need to fulfill your customers’ needs and deliver quality products or services.

Invoicing Customers

Once you have provided goods or services, the next step is to invoice your customers for those goods or services. This involves creating a detailed invoice that includes the description and cost of the provided goods or services, along with any applicable taxes or fees. Make sure to clearly state the payment terms and due date on the invoice to ensure timely payment.

Selling Invoices To A Factoring Company

After you have generated invoices for your customers, you can “sell” these invoices to a factoring company. The factoring company will review the invoices and make an offer to purchase them at a discounted rate. This allows you to receive immediate cash flow instead of waiting for your customers to make payment.

Direct Payment By Customers To The Factoring Company

Once the factoring company has purchased your invoices, the final step is for your customers to make payment directly to the factoring company. This ensures that the factoring company receives the full payment for the invoices, deducts their fee, and passes on the remaining amount to you. It simplifies the payment process and allows you to focus on growing your business.

Top Features Of Invoice Factoring Software

Fast And Easy Accessibility

Accessing invoice factoring software should be quick and straightforward. Users need a platform that provides fast and easy access to their invoices and financial data.

Integrations With Other Systems

It is essential for invoice factoring software to seamlessly integrate with other systems to ensure smooth and efficient operations. Integration capabilities enhance the software’s functionality and make it compatible with various business processes and tools.

Freight Factoring Services

The software should offer specialized services tailored to the freight industry. It should provide specific features that address the unique invoicing needs of freight companies, such as load tracking, carrier payments, and fuel advances.

Medical Factoring Services

For healthcare organizations, medical factoring services are crucial. The software should include features designed to meet the invoicing and funding requirements of medical practices, clinics, and healthcare providers.

Comparison Of Invoice Factoring Software

Compare and choose the best invoice factoring software to streamline your billing and revenue management processes. Discover user-friendly tools with easy integration, modern cloud-based solutions, and intelligent features designed to grow your business.

Factorcloud

FactorCloud is a versatile invoice factoring software that streamlines cash flow management for businesses. It offers comprehensive features such as customizable reporting, real-time data tracking, and seamless integration with accounting systems.

Factorview.com

FactorView.com stands out with its user-friendly interface and intuitive invoice factoring process. With its automation capabilities and transparent dashboard, it provides a seamless experience for businesses seeking efficient cash flow management.

Solifi

Solifi excels in providing advanced factoring solutions, including risk management tools and customizable funding options. Its robust platform offers a range of analytics and forecasting tools to optimize cash flow management.

Comarch Factoring

Comarch Factoring offers a comprehensive suite of functionalities for businesses looking to optimize their invoice factoring processes. With its scalable solutions and innovative features, it caters to the diverse needs of businesses in various industries.

Credit: www.genio.ac

Credit: capstonetrade.com

Frequently Asked Questions Of Invoice Factoring Software

Does Quickbooks Offer Invoice Factoring?

No, QuickBooks does not offer invoice factoring services.

What Are The 2 Types Of Invoice Factoring?

There are two types of invoice factoring: recourse and non-recourse factoring. These differ in fees, qualification requirements, and who is responsible for nonpayment. Recourse factoring is more common and involves the business being responsible for any unpaid invoices. Non-recourse factoring shifts the responsibility to the factoring company.

Is Invoice Factoring Profitable?

Yes, invoice factoring can be profitable by providing immediate access to working capital and improved cash flow. It allows businesses to cover funding gaps and keep loyal customers on longer payment terms while still improving cash flow to help grow the business.

How Do I Set Up An Invoice Factoring?

To set up invoice factoring, provide goods or services, invoice your customers, then sell the invoices to a factoring company. The factoring company collects payment directly from your customers.

Conclusion

Invoice factoring software is a valuable tool for businesses looking to improve their cash flow and streamline their billing processes. With features like easy integration, fast accessibility, and intelligent factoring services, these software solutions help reduce risk, increase revenue, and enhance customer trust.

Whether you’re in the trucking, staffing, telecom, or oilfield services industry, invoice factoring software provides the necessary tools to manage and grow your business effectively. FactorCloud and FactorView are just a few examples of reliable and user-friendly factoring software options available in the market.