When it comes to invoice financing accounting treatment, businesses should record the amount sold as a credit in accounts receivable, the cash received as a debit in the cash account, the paid factoring fee as a debit loss, and the amount retained by the factoring company in the debit-due account. This allows for accurate recording of the factoring transaction.

Invoice financing is an accounting method that allows businesses to borrow against their accounts receivable to generate cash quickly. With invoice financing, a company can use an invoice or invoices as collateral to obtain a loan from a financing company.

This differs from traditional bank loans as no collateral is required, and businesses can access funds before customers have paid their invoices. Accounting for factored receivables involves distinct treatment compared to bank loans, as these two financing arrangements have different characteristics. The accounting effect is to credit accounts receivable and debit the factor control account, showing the transfer of the debt.

Credit: altline.sobanco.com

Introduction To Invoice Financing

Invoice financing is an accounting method that allows businesses to borrow against their accounts receivable, helping generate cash quickly. This process involves using invoices as collateral to secure a loan from a financing company.

What Is Invoice Financing?

Invoice financing is an accounting method that allows businesses to borrow against their accounts receivable, enabling them to generate cash quickly. With invoice financing, a company can use one or multiple invoices as collateral to secure a loan from a financing company. This method is especially beneficial for businesses that experience cash flow challenges due to slow-paying customers. By leveraging their outstanding invoices, businesses can access immediate funds that can be reinvested into the company’s operations or used to cover expenses.

How Does Invoice Financing Work?

Invoice financing works by providing businesses with an immediate advance on the value of their outstanding invoices. The process typically involves the following steps:

- The business selects the invoices it wants to finance and submits them to a financing company.

- The financing company verifies the validity of the invoices and assesses the creditworthiness of the customers.

- Once approved, the financing company advances a percentage (usually around 80-90%) of the invoice value to the business.

- The business can then use the advanced funds to address immediate financial needs.

- When the customer pays the invoice, the financing company receives the payment directly.

- The financing company then deducts the fees agreed upon with the business and remits the remaining balance to the business.

This process provides businesses with quick access to much-needed working capital without having to wait for their customers to pay their invoices. It eliminates the gap between invoicing and receiving payment, allowing businesses to maintain a healthy cash flow and continue with their daily operations.

Accounting Treatment Of Invoice Financing

Invoice financing is an accounting method that allows businesses to borrow against their accounts receivable and generate quick cash. It is a valuable financial strategy that provides companies with immediate working capital by using their invoices as collateral for obtaining a loan from a financing company.

Recording The Factoring Transaction

When it comes to recording the factoring transaction, it is essential to accurately document the details to maintain proper accounting records. For this purpose, the following steps should be followed:

- Record the amount sold as a credit in the accounts receivable account.

- Record the cash received as a debit in the cash account.

- Record the paid factoring fee as a debit loss.

- Record the amount retained by the factoring company in the debit-due account.

By adhering to these steps, businesses can ensure that their financial records accurately reflect the factoring transaction and maintain the integrity of their accounting practices.

Journal Entry For Invoice Payment

Once the customer pays the invoice, it is necessary to record the transaction in the company’s books using a journal entry. The journal entry for an invoice payment should be correctly documented, and the appropriate accounts should be debited and credited:

- Debit the sales account to reflect the amount received from the customer.

- Credit the accounts receivable account to reduce the outstanding balance.

By recording the invoice payment accurately, businesses can maintain clear and up-to-date information about their receivables and cash inflows.

Difference Between Invoice Factoring And A Loan

It is important to note that invoice factoring is not considered a loan. Unlike traditional loans, invoice factoring does not require collateral. Instead, it allows businesses to receive immediate cash by selling their invoices to a factoring company at a discounted rate. This enables companies to access the funds they need without incurring debt or risking their assets.

On the other hand, a loan involves borrowing money from a lender, which requires collateral and repayment with interest over a specific period. While both options provide access to financing, invoice factoring offers unique advantages for businesses seeking quick cash flow solutions.

In conclusion, understanding the accounting treatment of invoice financing is crucial for businesses to accurately record and manage their financial transactions. By correctly documenting the factoring transaction, implementing journal entries for invoice payments, and recognizing the differences between invoice factoring and loans, businesses can optimize their accounting processes and maintain healthy financial records.

Benefits Of Invoice Financing

Invoice financing is an accounting method that allows businesses to borrow against their accounts receivable, providing quick access to cash. By using invoices as collateral, businesses can secure loans from financing companies and meet their immediate financial needs. Invoice financing offers a flexible and efficient solution for managing cash flow and maintaining business operations.

Quick Access To Cash

Invoice financing offers businesses a fast and efficient way to access cash flow. Instead of waiting for customers to pay their outstanding invoices, businesses can sell these invoices to a financing company and receive immediate cash. This quick access to cash can help businesses cover essential expenses, such as paying suppliers or meeting payroll obligations, without having to wait for lengthy payment cycles.

Improves Cash Flow Management

By utilizing invoice financing, businesses can significantly improve their cash flow management. With regular cash injections from financing companies, businesses can bridge the gap between invoice issuance and customer payment. This ensures a steady flow of working capital, allowing businesses to run their operations smoothly and seize growth opportunities.

Eliminates The Need For Collateral

Unlike traditional bank loans, invoice financing does not require collateral. This means that businesses can unlock working capital without having to pledge assets such as property or equipment. The invoice itself serves as the collateral, making it an accessible funding option for small and medium-sized businesses that may not have significant assets to offer as security.

Flexible Financing Options

One of the key advantages of invoice financing is the flexibility it offers to businesses. Unlike rigid loan structures, invoice financing can be tailored to meet the specific needs of each business. From selective invoice financing to whole turnover facilities, businesses can choose the financing option that best aligns with their cash flow requirements. This flexibility ensures that businesses can access the right amount of funding when they need it, without being tied into long-term commitments.

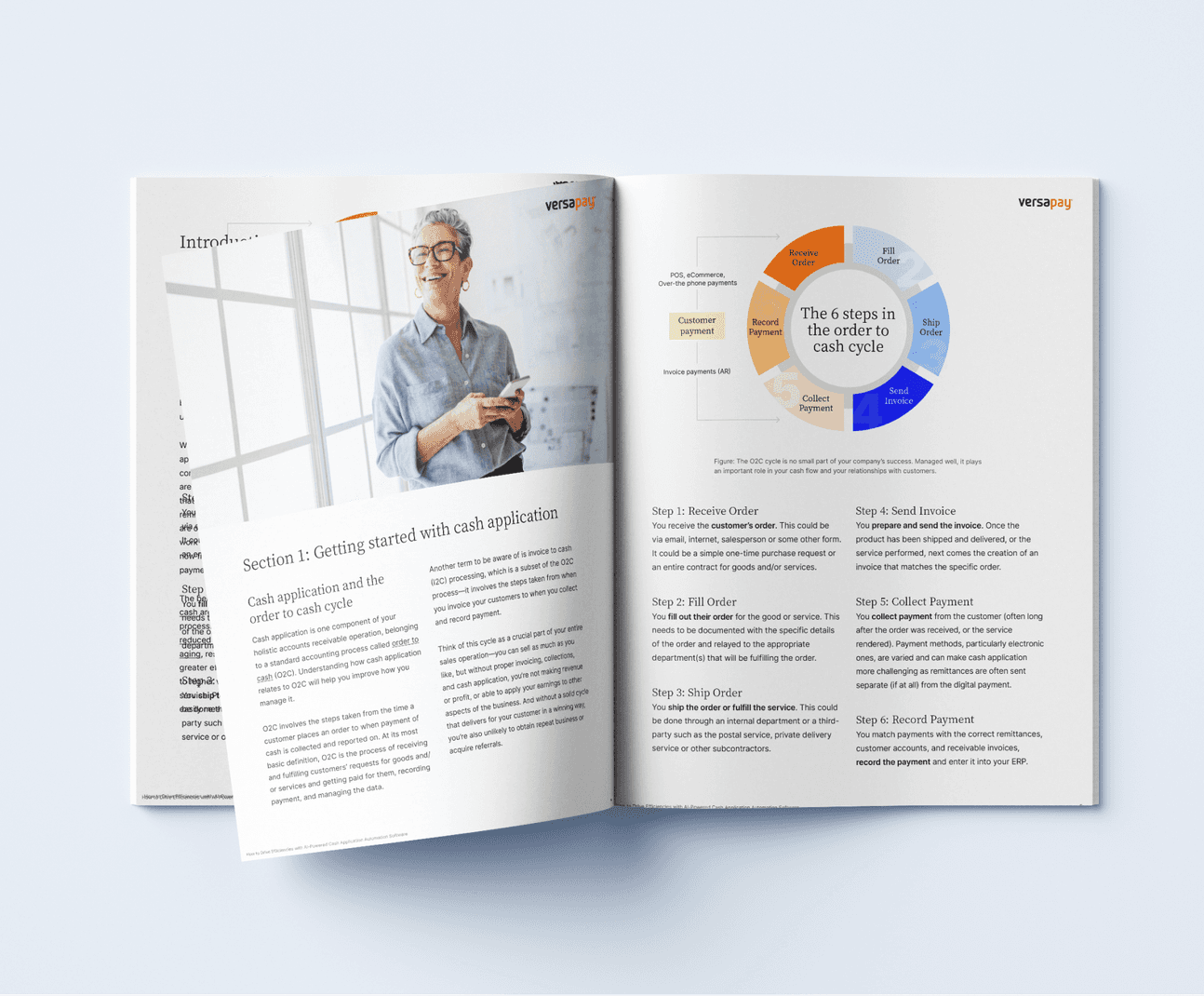

Credit: www.versapay.com

Accounting Challenges And Considerations

Accounting for invoice financing involves recording the amount sold as a credit in accounts receivable, the cash received as a debit in the cash account, and the factoring fee as a debit loss. Invoice financing allows businesses to borrow against their accounts receivable to generate cash quickly.

Managing due accounts Proper management of due accounts is crucial in invoice financing as it involves tracking and reconciling the outstanding invoices. This requires diligence in verifying the accuracy of the due amounts, adhering to payment terms, and maintaining a clear record of the outstanding balances. Monitoring cash flow Effective monitoring of cash flow is essential in invoice financing to ensure that the inflow from factored invoices aligns with the business’s operational and financial needs. It involves regular assessment of cash flow patterns to identify any discrepancies and take immediate actions to mitigate any potential liquidity issues. Maintaining accurate records Accurate record-keeping is paramount to ensure transparency and accountability in invoice financing. This includes maintaining detailed records of factored and outstanding invoices, fees paid to financing companies, and any additional charges incurred. Clear and precise documentation is necessary to facilitate seamless reconciliation and auditing processes. Understanding the impact on financial statements Understanding the impact of invoice financing on financial statements is crucial. Finance leaders need to evaluate how factoring arrangements affect key financial metrics such as accounts receivable, liquidity ratios, and profitability. This evaluation ensures that the financial statements present a true and fair view of the business’s financial position while factoring in the impact of invoice financing. `Best Practices In Invoice Financing Accounting

When it comes to invoice financing, proper accounting treatment is crucial for maintaining financial transparency and accuracy. Implementing best practices in invoice financing accounting ensures efficient management of funds and can help in making informed financial decisions. Let’s delve into some essential best practices for invoice financing accounting.

Working Closely With Your Accountant

Collaborating with your accountant is paramount in effectively managing invoice financing. Your accountant can provide valuable insights and expertise in ensuring that the financing transactions are accurately recorded and reported. With their assistance, you can navigate the complexities of accounting treatments related to invoice financing.

Utilizing Accounting Software

Utilizing robust accounting software tailored for invoice financing can streamline the recording and tracking of transactions. Well-designed accounting software can help in automating the entry and reconciliation processes, reducing the chances of errors and ensuring accurate financial records.

Regularly Reconciling Accounts

Regular reconciliation of accounts is fundamental in ensuring the accuracy of financial records. By routinely reconciling the accounts receivable, cash, and factoring fees, discrepancies and errors can be promptly identified and rectified, contributing to the integrity of financial data.

Seeking Professional Advice When Needed

Due to the complexity of invoice financing accounting, seeking professional advice from accounting experts or consultants is advisable. Professional guidance can help in resolving intricate accounting issues and ensuring compliance with accounting standards and regulations.

:max_bytes(150000):strip_icc()/invoice-e524b818ade24effb189a44b3f013098.jpg)

Credit: www.investopedia.com

Frequently Asked Questions For Invoice Financing Accounting Treatment

How Do You Record Invoice Financing?

To record invoice financing, follow these steps for accurate accounting: 1. Credit the accounts receivable for the amount sold. 2. Debit the cash account for the cash received. 3. Debit the loss account for the factoring fee paid. 4. Debit the due account for the amount retained by the factoring company.

What Is The Journal Entry For Invoice Payment?

When paying an invoice, debit accounts receivable and credit sales account in the journal entry.

Is Invoice Factoring Considered A Loan?

Invoice factoring is not a loan, as no collateral is required. Once payment is collected, the factoring company pays out the remaining invoice value minus a small factoring fee. It’s a way to quickly generate cash by borrowing against accounts receivable.

What Is An Invoice Financing?

Invoice financing is a method where businesses borrow against their accounts receivable, using invoices as collateral to get a loan quickly. It allows companies to generate cash before customers have paid their invoices.

Conclusion

To accurately record invoice financing transactions, businesses must follow a simple accounting method. The amount sold is recorded as a credit in accounts receivable, the cash received is recorded as a debit in the cash account, and the factoring fee is recorded as a debit loss.

Additionally, the amount retained by the factoring company is recorded in the debit-due account. This clear and concise accounting approach ensures accurate and transparent financial records for businesses utilizing invoice financing.