Factoring invoices can be a good idea for businesses looking to improve their cash flow by accessing immediate working capital, although it comes with disadvantages such as restrictions on funding and additional costs for ending the arrangement.

Credit: fastercapital.com

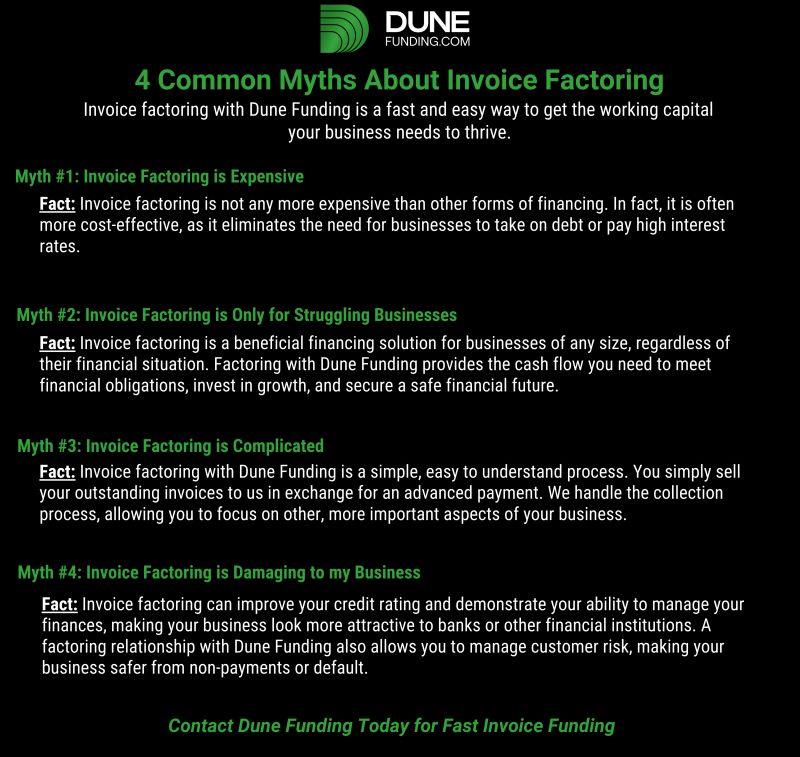

Benefits Of Invoice Factoring

Invoice factoring is a financial solution that allows businesses to improve their cash flow and access working capital quickly. By selling their outstanding invoices to a factoring company, businesses can receive immediate funds, which can be used to address their funding gaps and support their growth. Let’s explore the key benefits of invoice factoring in detail:

Immediate Access To Working Capital

One of the primary advantages of invoice factoring is the ability to gain immediate access to working capital. Instead of waiting for weeks or months for customers to pay their invoices, businesses can sell these invoices to a factoring company and receive an upfront payment.

This instant infusion of cash allows businesses to meet their financial obligations, pay suppliers on time, and seize opportunities for growth. Whether you need funds to hire additional staff, invest in new equipment, or expand your operations, invoice factoring can provide the working capital you need without the hassle of applying for traditional loans.

Improved Cash Flow

Another significant benefit of invoice factoring is the improvement in cash flow. Slow-paying customers can hinder the flow of cash into your business, limiting your ability to operate efficiently and take advantage of growth opportunities. By factoring your invoices, you can ensure a consistent cash flow by receiving immediate payments for your outstanding accounts receivable.

This improved cash flow enables you to better manage your day-to-day operations, pay your bills on time, and invest in the growth of your business. With a steady stream of cash coming in, you can focus on expanding your customer base, increasing your production capacity, and improving your overall competitiveness in the market.

Ability To Keep Longer Payment Terms

Invoice factoring also offers the advantage of allowing businesses to offer longer payment terms to their customers without negatively impacting their cash flow. Many businesses struggle with the dilemma of wanting to extend payment terms to attract and retain customers, but needing the funds to operate effectively.

By factoring your invoices, you can keep your customers happy by offering them flexible payment terms while ensuring that you have sufficient funds to cover your own expenses. This can be particularly beneficial for businesses that work with large corporate clients who typically require longer payment terms.

Helps Cover Funding Gap

Lastly, invoice factoring helps businesses bridge their funding gap by providing immediate funds for their outstanding invoices. It can be frustrating and challenging when you have invoices due but have to wait for payment from your customers. This delay can cause cash flow issues and hinder your ability to meet your financial obligations.

With invoice factoring, you can cover the gap between invoicing and receiving customer payments. This allows you to continue operating smoothly, paying your suppliers, and funding your growth initiatives, even if your customers take longer to pay their invoices.

In conclusion, invoice factoring offers several benefits to businesses, including immediate access to working capital, improved cash flow, the ability to offer longer payment terms, and assistance in covering funding gaps. By leveraging invoice factoring, businesses can optimize their financial management and support their growth strategies in a fast and efficient manner.

Credit: www.linkedin.com

Disadvantages Of Invoice Factoring

While invoice factoring can provide immediate access to working capital and help improve cash flow for businesses, it is essential to consider the potential drawbacks associated with this financing option. Understanding the disadvantages of invoice factoring can help you make an informed decision for your business needs. Here are some notable disadvantages to keep in mind:

Restrictions On Funding

One of the disadvantages of invoice factoring is that factors may impose restrictions on funding. Factors might restrict funding against poor quality debtors or poor debtor spread, which means you will need to manage funding fluctuations accordingly. This can impact your ability to access funds when needed and may limit your financial flexibility.

End Of Arrangement

Ending an arrangement with a factor can also come with its challenges. If you decide to terminate the factoring agreement, you will be required to pay off any money that the factor has advanced you on invoices that the customer has not yet paid. This can potentially create a financial burden, especially if you are not prepared to settle the outstanding amount.

Costs Of Factoring Invoices

The cost of invoice factoring is another consideration to be aware of. Factors typically charge a fee for their services, which can range from 1% to 5% of the invoice value. These fees can add up over time and reduce the overall profitability of your business. It is essential to assess the cost of factoring in relation to the benefits and potential gains you can attain.

High Risk Of Non-payment

Factoring involves transferring the responsibility of collecting invoices to the factor, which also means assuming the risk of non-payment or late payment. This risk is particularly high in non-recourse factoring, where the factor does not have the right to collect money from the original business if the customer fails to pay the invoice. It is crucial to carefully assess the creditworthiness of your customers to mitigate the risk of non-payment.

Understanding the disadvantages of invoice factoring can provide you with a comprehensive perspective on whether this financing option is suitable for your business. While factoring can offer immediate cash flow relief, it is essential to weigh the potential drawbacks against the benefits to make an informed decision.

:max_bytes(150000):strip_icc()/Investopedia_Factor_Final_Blue-1eaca17d9ba34c62a2dcc84521fd1597.jpg)

Credit: www.investopedia.com

Frequently Asked Questions For Is Factoring Invoices A Good Idea

What Are The Disadvantages Of Invoice Factoring?

Disadvantages of invoice factoring include funding restrictions for poor quality debtors, managing funding fluctuations, and needing to pay off advanced funds if customers haven’t paid yet.

How Much Does It Cost To Factor Invoices?

The cost of factoring invoices typically ranges from 1% to 5%. It varies based on the invoice amount and other factors.

Why Do Companies Use Invoice Factoring?

Companies use invoice factoring to access immediate working capital, cover funding gaps from slow-paying customers, improve cash flow, and extend payment terms to loyal customers while growing their business. Factoring companies assume the risk and responsibility of collecting invoices, benefitting businesses with poor credit.

Is Factoring High Risk?

Factoring can be high risk as factoring companies assume the responsibility of collecting invoices and the risk of non-payment. This risk is particularly high with non-recourse factoring where the factoring company cannot collect from the original business if the customer doesn’t pay.

Conclusion

Invoice factoring can be a beneficial solution for businesses looking to improve their cash flow and manage funding fluctuations. By partnering with a factoring company, businesses can access immediate working capital and ensure a steady flow of funds even with slow-paying customers.

However, it’s important to consider the disadvantages, such as potential restrictions on funding and the need to pay off advanced invoices if customers haven’t paid yet. Overall, carefully weighing the pros and cons of invoice factoring will help businesses make an informed decision that aligns with their financial goals.