Pay for Freight Factoring is a service where trucking companies receive consistent cash flow by selling their accounts receivable to a factoring company at a fee. Regardless of the size of the business, factoring helps trucking companies stay on top of their expenses and grow their business.

Factoring works by the factoring company paying the trucking company upfront for their invoices, and then collecting payment from the customers. Freight factoring is a viable option for trucking companies looking to increase their cash flow and maintain financial stability.

Credit: ecapital.com

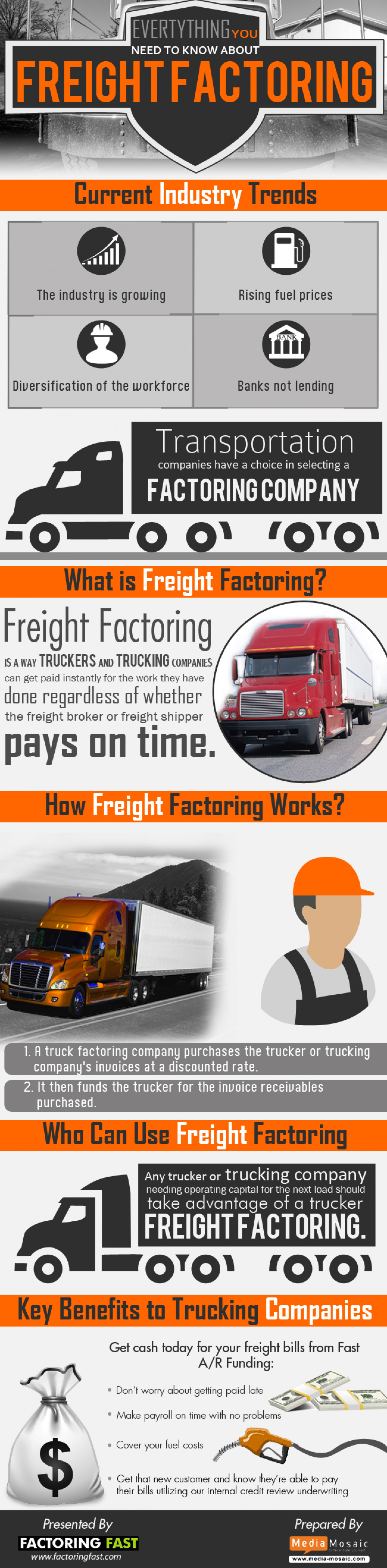

What Is Freight Factoring?

Freight factoring is a financial solution that allows trucking companies to get paid on their outstanding invoices immediately, rather than waiting for their clients to pay. It involves selling the unpaid invoices to a factoring company at a discounted rate, in exchange for immediate cash. The factoring company then collects payment from the clients on behalf of the trucking company.

Freight factoring offers several key benefits for trucking companies:

- Consistent cash flow: By receiving immediate payment for their invoices, trucking companies can maintain a steady cash flow to cover their operational expenses, such as fuel, maintenance, and driver salaries.

- Fueling business growth: With immediate access to working capital, trucking companies can invest in expanding their operations, investing in new trucks, hiring more drivers, or taking on more clients.

- Avoiding collection efforts: Rather than spending time and resources on chasing down late payments from clients, trucking companies can offload this responsibility to the factoring company, allowing them to focus on their core business.

- Flexible and scalable: Factoring services can be tailored to the needs of each trucking company, allowing them to factor all their invoices or select specific ones as needed. This flexibility enables scalability to accommodate changes in business volume.

- Reduced credit risk: Factoring companies often perform credit checks on clients, helping trucking companies minimize the risk of non-payment or bad debts. This can help protect their bottom line and promote financial stability.

Overall, freight factoring provides trucking companies with a valuable financial tool to streamline their cash flow, improve their financial stability, and fuel business growth.

Credit: in.pinterest.com

How Does Freight Factoring Work?

Freight factoring is a way for trucking companies to receive consistent cash flow by selling their unpaid invoices to a factoring company. This provides instant access to working capital and helps businesses grow. The factoring company charges a fee for its services, and the trucking company pays them if the customer doesn’t pay the invoice.

Process Of Freight Factoring

Freight factoring is a financial service that allows trucking companies to access immediate cash for their unpaid freight invoices. The process of freight factoring involves three key parties: the trucking company (also known as the carrier), the factoring company, and the customer.

Here’s a breakdown of how freight factoring works:

- The trucking company delivers the freight and generates an invoice for the customer.

- The trucking company sells the invoice to the factoring company. This is known as the factoring transaction.

- The factoring company advances a percentage of the invoice value, typically around 80-90%, to the trucking company upfront. This provides immediate cash flow for the carrier.

- The factoring company takes responsibility for collecting payment from the customer on the unpaid invoice. They become the new owner of the invoice.

- Once the customer pays the invoice, the factoring company deducts their fees and returns the remaining balance to the trucking company.

Who Pays The Factoring Company?

In the trucking industry, there are two types of freight factoring: recourse and non-recourse factoring.

| Type of Factoring | Payment Responsibility |

|---|---|

| Recourse Factoring | If the customer ultimately doesn’t pay the invoice, the trucking company pays the factoring company. |

| Non-Recourse Factoring | If the customer doesn’t pay the invoice, the factoring company absorbs the loss and the trucking company is not responsible for payment. |

It’s important for trucking companies to understand the terms and conditions of the factoring agreement, as it determines their liability for unpaid invoices.

In conclusion, freight factoring is a beneficial financial solution for trucking companies to manage their cash flow and access immediate funds for their unpaid invoices. By selling their invoices to a factoring company, carriers can ensure they have the working capital necessary to cover expenses and grow their business. So, whether it’s recourse or non-recourse factoring, understanding the payment responsibility is key to making informed decisions.

Contact Us

If you have any questions or want to know more about freight factoring, contact us.

Cost Of Freight Factoring

Freight factoring is a financial solution that allows trucking companies to get immediate cash flow by selling their accounts receivable to a factoring company. But how much does freight factoring actually cost? Let’s explore the factors that affect freight factoring rates and some common rates that trucking companies often encounter.

Factors Affecting Freight Factoring Rates

Several factors can influence the rates charged by freight factoring companies. These factors include:

- Client’s Creditworthiness: The creditworthiness of the trucking company’s clients can impact the factoring rate. If the clients have a history of late payments or defaulting on their invoices, the factoring rates may be higher.

- Invoice Volume and Amount: The total volume and amount of invoices to be factored can also affect the rate. Higher volumes and larger invoice amounts may result in lower factoring rates.

- Industry and Reputation: The trucking company’s industry and overall reputation can impact the rates offered by factoring companies. Companies with a strong track record and positive industry reputation are often offered more favorable rates.

- Length of Factoring Agreement: The length of the factoring agreement can also play a role in determining the rates. Longer-term agreements may result in lower rates compared to shorter-term agreements.

Common Freight Factoring Rates

While rates can vary depending on the factors mentioned above, there are some common freight factoring rates that trucking companies typically encounter. These rates may range from:

| Invoice Amount | Factoring Rate |

|---|---|

| Less than $10,000 | 2% – 5% |

| $10,000 – $50,000 | 1.5% – 3% |

| Above $50,000 | 1% – 2% |

Keep in mind that these rates are just an approximate range and can vary based on the unique circumstances of each trucking company.

Freight factoring can be a valuable financial tool for trucking companies, providing them with the working capital they need to cover expenses and grow their business. By understanding the factors that affect freight factoring rates and the common rates in the industry, trucking companies can make informed decisions about partnering with a factoring company.

Credit: visual.ly

Choosing A Freight Factoring Company

If you’re in the transportation industry, choosing the right freight factoring company is crucial for steady cash flow and business growth. Freight factoring involves selling your accounts receivables to a third-party company at a discount in exchange for immediate funds. When it comes to selecting a freight factoring company for your business, there are several factors to consider to ensure you make the best choice.

Factors To Consider

- Industry Experience: Look for a company with experience in the transportation and freight industry to ensure they understand your unique business needs.

- Customer Service: Choose a factoring company known for excellent customer service and responsiveness to your inquiries and concerns.

- Advance Rates: Consider the advance rates offered by the factoring company, as this determines the percentage of your invoice amount you receive upfront.

- Fees and Rates: Compare the factoring fees, discount rates, and any additional charges to find the most cost-effective solution for your business.

- Contract Terms: Review the contract terms carefully, including the length of the agreement, cancellation policies, and any potential penalties.

- Technology and Tools: Assess the technological capabilities and tools offered by the factoring company for streamlined invoice processing and payment tracking.

Top Freight Factoring Companies

| Company | Website |

|---|---|

| RTS Financial | www.rtsfinancial.com |

| Porter Freight Funding | www.porterfreightfunding.com |

| CoreFund Capital LLC | www.corefundcapital.com |

| Riviera Finance | www.rivierafinance.com |

Is Freight Factoring Worth It?

Freight factoring can be a valuable financial tool for trucking companies, providing them with the flexibility and liquidity they need to manage their cash flow effectively. However, it’s essential to weigh the benefits against the potential drawbacks to determine if it’s the right choice for your business. Let’s explore the benefits for trucking companies and the factors to consider when evaluating whether freight factoring is worth it.

Benefits For Trucking Companies

Freight factoring offers several advantages for trucking companies:

- Improved Cash Flow: Factoring enables companies to access immediate funds by selling their accounts receivable, providing the necessary capital to cover expenses such as fuel, maintenance, and payroll.

- Elimination of Payment Delays: Instead of waiting for customers to settle invoices, factoring allows trucking companies to receive prompt payment, reducing the impact of slow-paying clients on their operations.

- Financial Stability: By maintaining a predictable and steady cash flow, factoring helps trucking businesses navigate unforeseen challenges and ensures the continuity of their operations.

Factors To Consider

When evaluating the worth of freight factoring, consider the following factors:

- Costs and Fees: While factoring provides immediate cash, it’s essential to assess the associated fees and determine whether the benefits outweigh the expenses.

- Customer Relationships: Some trucking companies may be concerned about how their customers perceive invoice factoring. Assess the impact on client relationships and the potential implications for long-term partnerships.

- Business Growth: Evaluate how factoring can support your company’s expansion, sustainability, and profitability in the long run.

Frequently Asked Questions Of Pay For Freight Factoring

How Much Does Freight Factoring Cost?

The cost of freight factoring varies based on factors such as the volume of invoices and the creditworthiness of the customers. Contact freight factoring companies to get specific rates.

Is Freight Factoring Worth It?

Freight factoring is worth it for trucking companies as it helps them maintain consistent cash flow and grow their businesses. Whether you have a small or large business, having access to working capital for expenses is always beneficial. Factoring companies charge a fee for their services, and the trucking company pays if the customer doesn’t pay the invoice.

How Do You Pay A Factoring Company?

To pay a factoring company in the trucking industry, you will usually incur a fee for their services. There are two types of factoring: recourse and non-recourse. In recourse factoring, if the customer doesn’t pay, the trucking company pays the factoring company.

It’s important to consider these fees when factoring invoices.

Who Pays The Factoring Company In Trucking?

The factoring company in trucking charges a fee for its services. If the customer doesn’t pay the invoice, the trucking company pays the factoring company.

Conclusion

Freight factoring is a valuable solution for trucking companies of all sizes to maintain a steady cash flow and grow their businesses. It provides immediate access to working capital, allowing them to cover expenses like fuel costs and driver wages.

With flexible and low factoring rates, truckers can get paid instantly and focus on their operations. Freight factoring is a reliable and efficient way to manage finances in the trucking industry.