Payroll factoring is a financing solution where a factor purchases a company’s invoices in exchange for immediate cash, allowing the company to boost working capital and avoid long payment terms. This enables businesses to cover payroll expenses and maintain a steady cash flow.

By selling their outstanding receivables, companies can access the funds they need without waiting for customers to pay their invoices. Payroll factoring provides a reliable source of cash for staffing firms, temporary agencies, and other businesses that experience fluctuations in their payroll obligations.

It offers quick and easy access to funds, helping businesses meet their financial obligations and grow their operations.

Credit: altline.sobanco.com

What Is Payroll Factoring?

Payroll factoring is a financing solution where a company sells its outstanding invoices to a factoring company for immediate cash. This helps businesses improve their working capital and avoid delays in payment terms. With payroll factoring, companies can ensure they have enough funds to cover payroll expenses and maintain a healthy cash flow.

Definition Of Payroll Factoring

Payroll Factoring, also known as Invoice Factoring or Accounts Receivable Factoring, is a financial solution that allows businesses to receive immediate cash by selling their outstanding invoices to a third-party company called a factor. The factor then takes responsibility for collecting the payment from the customers who owe the invoices. In return, the business receives a percentage of the total invoice amount upfront, providing quick access to working capital without the need to wait for payment from clients. It allows businesses to bridge the gap between the time they issue invoices and when they receive payment, helping them to cover their operational expenses, including payroll, more efficiently.

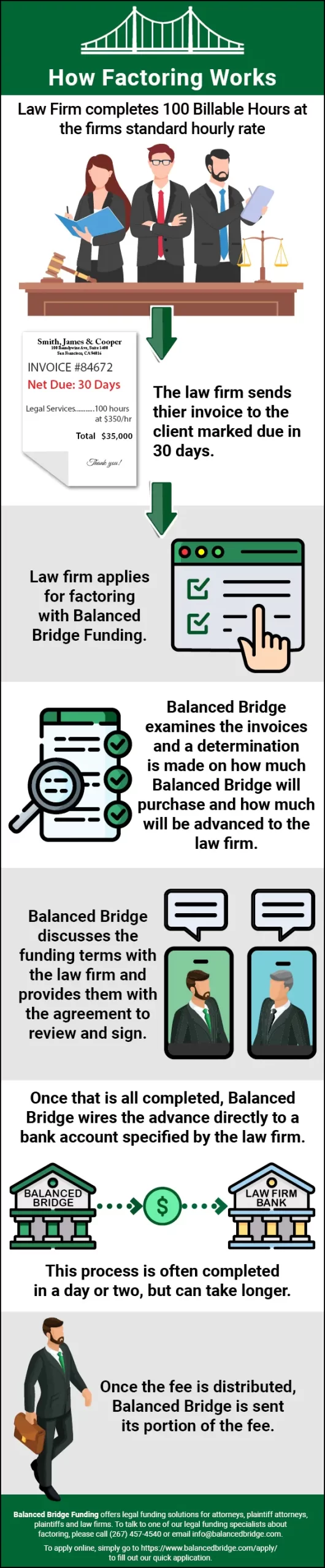

How Payroll Factoring Works

In the process of payroll factoring, a business first partners with a reputable factoring company. Once approved, the business can upload their outstanding invoices to the factoring company’s system. The factor then verifies the validity of the invoices and assesses the creditworthiness of the business’s customers. Based on this evaluation, the factor offers an advance payment, typically ranging from 70% to 90% of the total invoice value.

Once the advance payment is made, the factor takes over the responsibility of collecting the payment from the customers. The customers are informed about the change in the payment instructions, and they make their payments directly to the factor. Once the customers pay the full invoice amount, the factor deducts their fees, including a discount fee, and remits the remaining amount to the business.

One of the advantages of payroll factoring is that it eliminates the need for businesses to wait for extended periods to receive payments from their customers. This, in turn, enables businesses to maintain a consistent cash flow and cover their immediate expenses, such as paying their employees’ salaries on time. Payroll factoring is especially beneficial for businesses that operate in industries with long payment terms or those that experience seasonal fluctuations in revenue.

Additionally, payroll factoring helps businesses reduce the risk of bad debts by transferring the responsibility of collecting payments to the factoring company. This allows businesses to focus on their core operations and growth without the burden of chasing late or non-paying customers.

In summary, payroll factoring offers businesses a reliable and convenient way to access immediate cash flow by selling their outstanding invoices. It provides much-needed working capital to cover expenses, including payroll, and allows businesses to maintain a healthy financial position, even in challenging times.

Credit: www.balancedbridge.com

Benefits Of Payroll Factoring

Payroll factoring can provide numerous benefits for businesses, offering immediate access to cash, improved cash flow management, and no financials or credit checks required. These advantages make payroll factoring an attractive solution for companies looking to maintain a steady cash flow and ensure timely payment of their employees.

Immediate Access To Cash

One of the primary benefits of payroll factoring is the immediate access to cash it provides. When businesses factor their invoices, they can receive a percentage of the value of those invoices up front. This allows them to access the funds they need to cover payroll expenses, purchase inventory, or invest in growth opportunities.

With payroll factoring, there is no need to wait for weeks or months for customers to make invoice payments. Instead, businesses can get the cash they need within days, helping them to meet their financial obligations on time and maintain smooth operations.

Improved Cash Flow Management

Payroll factoring also helps businesses improve their cash flow management. By getting immediate access to cash, companies can ensure that they have sufficient funds to cover their payroll obligations, even if customers delay their invoice payments.

With a steady cash flow, businesses can avoid cash flow gaps that could lead to late payment of employee salaries or missed opportunities for growth. By leveraging payroll factoring, companies can better manage their cash flow and have the peace of mind that they can meet their financial commitments.

No Financials Or Credit Checks Required

One of the standout advantages of payroll factoring is that it does not require financials or credit checks. Traditional financing options, such as bank loans, often involve a lengthy application process and stringent criteria that businesses must meet. This can be challenging, particularly for small businesses or those with less-than-perfect credit.

Payroll factoring, on the other hand, focuses on the creditworthiness of a business’s customers rather than its own financial status. This means that even businesses with limited financial history or less-than-ideal credit can still qualify for payroll factoring. By eliminating the need for financials and credit checks, this funding option provides a more accessible solution for businesses in need of immediate cash flow support.

In conclusion, payroll factoring offers immediate access to cash, improves cash flow management, and eliminates the need for financials or credit checks. These benefits make it an attractive funding solution for businesses of all sizes, helping them maintain a steady cash flow and meet their payroll obligations on time.

Payroll Factoring Vs. Payroll Funding

Payroll Factoring provides a solution for businesses to obtain immediate capital by selling outstanding invoices, boosting working capital and avoiding long payment terms. It offers a hassle-free way to manage payroll and maintain cash flow.

Differences Between Payroll Factoring And Payroll Funding

Payroll factoring and payroll funding are two financing options available for businesses to manage their payroll expenses. While both options can provide the necessary funds to cover payroll, there are some key differences between them.

- Payroll Factoring: With payroll factoring, a factoring company purchases your outstanding invoices in exchange for immediate cash. This allows you to boost your working capital and avoid delays in payment. The factoring company takes over the responsibility of collecting payments from your customers.

- Payroll Funding: Payroll funding, on the other hand, involves obtaining a loan or line of credit specifically to cover payroll expenses. This type of funding usually requires you to have a good credit history and may involve collateral. You are responsible for repaying the loan or credit line.

Pros And Cons Of Payroll Factoring And Payroll Funding

Payroll Factoring:

- Pros:

- Immediate cash flow: Payroll factoring provides immediate funds to cover payroll expenses, ensuring that your employees are paid on time.

- Improved working capital: By selling your outstanding invoices, you can access the cash you need to manage your operations and grow your business.

- No additional debt: Unlike payroll funding, factoring does not create additional debt for your business.

- Cons:

- Cost: Factoring companies charge fees for their services, which can eat into your profit margin.

- Loss of control: When you choose payroll factoring, the factoring company takes over the responsibility of collecting payments from your customers. This means you no longer have control over the payment process.

- Pros:

- Flexibility: Payroll funding options can be tailored to your specific business needs and allow you to maintain control over your finances.

- Credit-building opportunity: Successfully repaying a loan or credit line can help improve your credit score, making it easier to secure future funding.

- Cons:

- Additional debt: Payroll funding involves taking on additional debt, which can impact your business’s financial health.

- Interest rates: Loans or credit lines come with interest rates, meaning you’ll need to factor in the cost of borrowing when considering this option.

- Credit requirements: Payroll funding often requires a good credit history, which may limit accessibility for businesses with poor credit.

Payroll Funding:

How To Use Payroll Factoring: A Step-by-step Guide

Using payroll factoring can be a straightforward process that offers businesses quick access to the funds tied up in their outstanding invoices. By following a step-by-step approach, you can make use of this financial tool to effectively manage your cash flow and meet your business obligations. Here’s a detailed guide on how to use payroll factoring:

Find A Reputable Payroll Factoring Company

Start by researching and selecting a reputable payroll factoring company that aligns with your business needs and offers competitive terms. Consider factors such as industry experience, customer reviews, and transparency in the factoring process.

Submit Your Invoices For Review And Approval

Once you’ve chosen a payroll factoring company, submit your outstanding invoices for review and approval. The factoring company will assess the creditworthiness of your customers and verify the validity of the invoices before offering a financing agreement.

Receive Cash Advances Based On The Value Of Your Invoices

After approval, the factoring company will provide you with immediate cash advances based on the value of your outstanding invoices. This injection of funds can help alleviate cash flow constraints and empower you to meet payroll obligations and other operational expenses.

Repay The Advances According To The Agreed Terms

As your customers settle their invoices, the repayment of the advances occurs according to the agreed terms with the factoring company. This could involve a percentage of each invoice being held back as a reserve, and the remaining balance being disbursed to you once the customer pays in full.

Choosing The Right Payroll Factoring Company

Payroll factoring is a powerful solution for businesses to maintain steady cash flow and effectively manage their payroll operations. However, choosing the right payroll factoring company is crucial to ensure a seamless and beneficial partnership. The process involves thorough evaluation and consideration of various aspects to determine the most suitable fit for your business. Below are key factors to keep in mind when selecting a payroll factoring company.

Consider The Company’s Experience And Reputation

When choosing a payroll factoring company, it’s essential to assess their experience and reputation in the industry. Look for a company that has a proven track record of successfully meeting the needs of businesses similar to yours. Research their length of operation, client testimonials, and industry recognition to gauge their reliability and expertise in the field.

Evaluate The Terms And Rates Offered

Thoroughly review the terms and rates offered by the payroll factoring company. Pay attention to factors such as the advance rate, discount rate, and any additional fees involved. It’s crucial to choose a company that offers competitive and transparent pricing, ensuring that the financial arrangement aligns with your business’s financial goals and requirements.

Read And Understand The Contract

Before committing to a payroll factoring company, carefully read and understand the contract terms. Pay close attention to clauses related to the duration of the agreement, termination options, and any potential penalties or fees. Ensure that you fully comprehend the terms and conditions to avoid any future complications or misunderstandings.

Check For Additional Services Or Benefits

Explore the range of additional services or benefits offered by the payroll factoring company. Some companies may provide value-added services such as credit checks, collection assistance, or online account management tools. Assessing these offerings can assist in determining the overall convenience and support provided by the company beyond basic factoring services.

Credit: ecapital.com

Frequently Asked Questions Of Payroll Factoring

How Does Payroll Factoring Work?

Payroll factoring works by partnering with a factoring company that purchases your invoices in exchange for cash. This helps boost working capital and avoids payment delays. Factoring allows businesses to obtain immediate capital based on future income from accounts receivable or business invoices.

It does not guarantee covering payroll expenses like payroll funding does.

What Is Pay Factoring?

Pay factoring is when a financing partner, known as a factor, purchases your invoices in exchange for cash. This helps boost working capital and avoids delayed payment terms. It allows businesses to obtain immediate capital based on future income from accounts receivables.

What Are The Rates For Factoring Payroll?

The rates for factoring payroll vary based on the factoring company and terms. Factors include transaction fees, discount fees, and minimum volume requirements. It’s best to contact a factoring company directly for specific rate information. Payroll factoring allows businesses to obtain immediate capital based on future income from accounts receivables.

What Is Factoring And How Does It Work?

Factoring is a financing option where a company sells its invoices to a factoring company for immediate cash. The factoring company then collects payment directly from the customers.

Conclusion

Payroll factoring is a valuable financing solution for businesses looking to improve their cash flow and sustain steady growth. With the help of a factoring company, businesses can sell their outstanding invoices in exchange for immediate cash, allowing them to cover expenses, such as payroll, without delays.

This eliminates the stress of managing unpaid invoices and helps businesses maintain a stable financial position. By utilizing payroll factoring, businesses can focus on their core operations and achieve their goals faster. Don’t let cash flow issues hinder your business’s growth potential; explore the benefits of payroll factoring today.