Selling accounts receivable, also known as factoring, is the process of selling outstanding invoices at a discount in exchange for immediate cash flow. Factoring allows companies to improve their cash flow by accessing funds quickly while waiting for payment from customers.

This short-term solution is typically used by businesses with a brief need for cash flow, lasting two years or less. By partnering with a factoring company, businesses can sell their accounts receivable at a discounted rate and receive a cash advance.

This enables small businesses to ensure steady cash flow and meet their financial obligations.

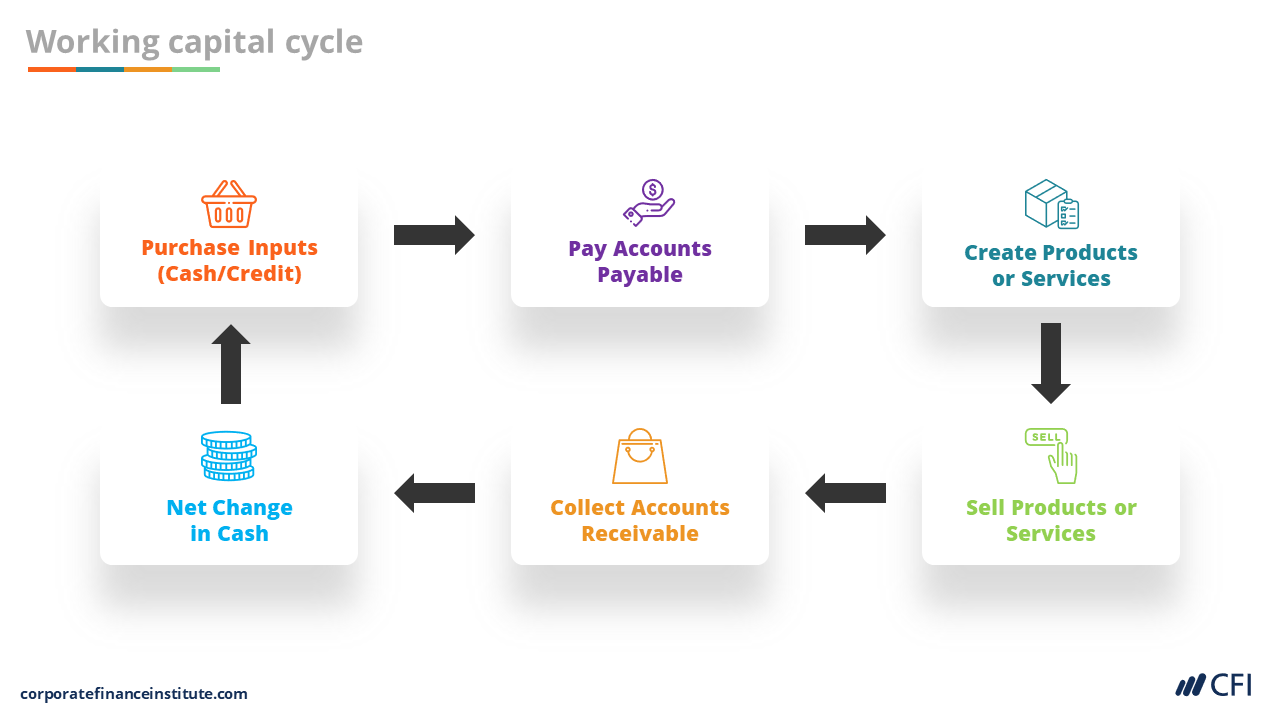

Credit: corporatefinanceinstitute.com

What Is Selling Of Accounts Receivable?

Factoring, also known as accounts receivable factoring or invoice factoring, is the process of selling accounts receivable at a discounted rate to a third-party company called a factor. This allows businesses to receive immediate cash flow while the factor waits for payment.

Explanation Of Selling Receivables

When a business sells its accounts receivable, it essentially means that it is transferring the right to collect payment from its customers to another party. This can be done through a process called factoring, where the business sells its outstanding invoices to a factor at a discount in exchange for immediate cash. Selling accounts receivable is a way for companies to improve their cash flow, especially when they are in need of immediate funds.

Factoring: Selling Accounts Receivables At A Discount

Factoring is a common method used for selling accounts receivables. It involves selling the outstanding invoices to a factor, which is typically a financial institution or a specialized factoring company. The factor then takes over the responsibility of collecting payment from the customers.

However, it’s important to note that when selling accounts receivables through factoring, the business typically receives only a percentage of the total invoice value. The factor keeps a certain portion as a fee for providing immediate cash and assuming the risk of collecting the payment from customers.

This discount that is applied to the accounts receivables is based on various factors such as the creditworthiness of the customers, the overall sales volume, and the time it takes for customers to pay. Generally, the higher the credit risk associated with the customers, the higher the discount rate.

Factoring is often considered a short-term solution, typically lasting no longer than two years. It is suitable for businesses that have a short-term need for cash flow and can benefit from immediate access to funds.

By selling accounts receivables, businesses can improve their cash flow and meet their immediate financial obligations. It allows them to convert their outstanding invoices into immediate cash, which can be used for various purposes, such as paying suppliers, investing in business expansion, or managing day-to-day operational expenses.

Overall, selling accounts receivables through factoring can be a valuable strategy for businesses looking to manage their cash flow effectively and ensure smooth operations.

Credit: fastercapital.com

How To Record Selling Accounts Receivable

When recording the selling of accounts receivable, a journal entry is made to credit the sales value and debit the assets. This process, known as factoring or invoice factoring, allows companies to improve cash flow by selling their outstanding invoices at a discount.

It provides quick access to funds while waiting for payment.

When it comes to recording the selling of accounts receivable, it’s important to follow the proper journal entry process. This ensures that the transaction is accurately recorded in your financial records. There are two key components to this journal entry: a credit to sales and a debit to assets.Credit To Sales

To record the sale of accounts receivable, you need to credit the sales account. This reflects the revenue generated from the sale. The amount of the credit will depend on the total value of the accounts receivable that you are selling. By recording this credit entry, you are acknowledging the increase in your company’s sales.Debit To Assets

Simultaneously, you need to debit the assets account. This reflects the decrease in the accounts receivable that you are selling. The amount of the debit will also depend on the total value of the accounts receivable being sold. By recording this debit entry, you are acknowledging the decrease in the amount of money owed to you by your customers. These two journal entries, the credit to sales and the debit to assets, balance each other out and ensure that your financial statements accurately reflect the selling of your accounts receivable. Below, you can find a simplified table showcasing how this journal entry should be recorded:| Account | Debit | Credit |

|---|---|---|

| Sales | 0 | Amount of the accounts receivable |

| Accounts Receivable | Amount of the accounts receivable | 0 |

Benefits Of Selling Accounts Receivable

Selling accounts receivable can provide numerous benefits for businesses. In this article, we will explore some of the key advantages of selling accounts receivable.

Improved Cash Flow

One of the primary benefits of selling accounts receivable is the improved cash flow it brings to businesses. When you sell your invoices to a factoring company, you receive immediate cash in exchange. This allows you to access funds quickly and use the money for various purposes such as paying suppliers, investing in new equipment, or expanding your operations.

Selling accounts receivable helps avoid the wait for customers to pay their outstanding invoices. Instead of having to wait for 30, 60, or even 90 days for payment, you can receive payment immediately. This improved cash flow can help your business stay afloat, meet its financial obligations, and seize new opportunities without the burden of delayed payments.

Quick Access To Funds

Another advantage of selling accounts receivable is the quick access to funds it provides. When you sell your invoices, you don’t have to go through the lengthy process of applying for traditional loans or credit lines. Instead, you can turn your unpaid invoices into immediate cash, which can be crucial for businesses that need capital urgently.

Selling accounts receivable through factoring also eliminates the risk of bad debts. The factoring company assumes the responsibility of collecting payments from your customers. This alleviates the need for your business to spend time and resources on chasing down late payments or dealing with customers who default on their payments.

In conclusion, the benefits of selling accounts receivable are improved cash flow and quick access to funds. By selling your invoices, you can overcome cash flow gaps, enhance your financial stability, and ensure smooth operations for your business.

:max_bytes(150000):strip_icc()/Cashconversioncycle-f39bee15fd174aae897c72466b2449ff.jpg)

Credit: www.investopedia.com

Process Of Selling Accounts Receivable

Selling of Accounts Receivable can be a strategic move for businesses to maintain a healthy cash flow and ensure financial stability. By selling their outstanding invoices to a third-party, companies can obtain immediate access to cash, which can then be reinvested into the business for growth and expansion. The process of selling accounts receivable, also known as factoring, involves partnering with a factoring company and receiving a cash advance against the outstanding invoices.

Partnership With A Factoring Company

When a business decides to sell its accounts receivable, it typically partners with a factoring company. This partnership involves the business selling its unpaid invoices to the factoring company at a discount. The factoring company then takes over the responsibility of collecting the outstanding payments from the customers. This collaboration allows the business to access immediate funds, while the factoring company assumes the risk associated with collecting the payments.

Receiving Cash Advance

Upon entering into an agreement with the factoring company, the business receives a cash advance against the value of the outstanding invoices. The amount of the cash advance is usually a percentage of the total invoice value, and it provides the business with the necessary liquidity to meet its immediate financial obligations or invest in growth opportunities. By receiving the cash advance, businesses can effectively manage their cash flow and ensure continuity in their operations.

Considerations For Selling Accounts Receivable

Selling accounts receivable, also known as factoring, can be a beneficial financial solution for businesses in need of immediate cash flow. However, before making the decision to sell your accounts receivable, it’s important to consider various factors that may impact the process and the overall financial health of your company. Understanding these considerations can help you determine whether selling accounts receivable is the right choice for your business.

Short-term Solution

Factoring is a short-term solution for businesses looking to improve their cash flow. It typically involves selling outstanding invoices to a third-party factor at a discount in exchange for immediate funds. This quick infusion of cash can help businesses address pressing financial needs, such as covering operating expenses or funding new projects. However, it’s crucial to assess whether the short-term benefits align with your long-term financial goals.

Factors To Evaluate

- Customer Relationships: Consider how factoring may impact your relationships with customers. The third-party factor will be responsible for collecting the outstanding invoices, potentially altering the communication dynamics with your clients.

- Costs and Fees: Evaluate the overall financial implications of factoring, including the fees and discounts associated with selling accounts receivable. Compare these costs to the immediate cash benefits to determine the net impact on your company’s bottom line.

- Creditworthiness of Clients: Assess the creditworthiness of your clients, as factors may consider this when determining the discount rate for purchasing your invoices. A higher risk of non-payment from clients could result in less favorable terms for factoring.

- Long-Term Financial Strategy: Align the decision to sell accounts receivable with your company’s long-term financial strategy. Consider how factoring may impact your ability to secure traditional financing or future growth opportunities.

Before deciding to sell your accounts receivable, carefully weigh these considerations to determine the potential impact on your business and financial stability.

Frequently Asked Questions On Selling Of Accounts Receivable

How Do You Record Selling Accounts Receivable?

When recording the sale of accounts receivable, a journal entry is made. The value of the sale is recorded as a credit to sales, while the amount receivable is recorded as a debit to assets. These entries balance each other out.

This process is known as factoring, where the accounts receivable are sold at a discount in exchange for immediate cash.

What Is The Selling Of Accounts Receivable Known As?

The selling of accounts receivable is known as factoring. It involves selling the outstanding invoices at a discounted rate in exchange for immediate cash flow. Factoring helps improve cash flow for businesses.

What Is Sale Of Accounts Receivable?

The sale of accounts receivable, also known as factoring, involves a company selling its outstanding invoices to a factor at a discount in exchange for immediate cash. This can help improve cash flow and provide quick access to funds, although it’s typically a short-term solution.

Why Do Companies Sell Accounts Receivable?

Companies sell accounts receivable to improve cash flow. This provides quick access to funds while waiting for payment. Selling receivables is known as factoring, where a company sells its invoices to a factor at a discount in exchange for immediate cash.

Conclusion

To improve cash flow and access immediate funds, businesses have the option to sell their accounts receivable. This process, known as factoring, involves partnering with a third-party company to buy the outstanding invoices at a discounted rate. While not suitable for every business, factoring provides a short-term solution for companies in need of quick cash flow.

By selling accounts receivable, businesses can improve their financial liquidity and meet their immediate financial obligations.