Bill discounting and factoring differ in terms of responsibility and services offered. In bill discounting, the business retains the responsibility of collecting payments from debtors, while in factoring, the factor handles the collections.

Factoring also provides a more comprehensive range of services beyond financing, such as credit checks, collections, and bookkeeping. This makes factoring a more comprehensive and convenient option for businesses looking for additional support beyond just financing.

Credit: www.trevipay.com

Introduction To Bill Discounting And Factoring

Effective cash flow management is essential for the smooth operation and growth of any business. Two popular methods that businesses can employ to optimize their cash flow are bill discounting and factoring. In this blog post, we will provide an overview of these financial strategies and explore their definitions, importance, and differences.

Definition Of Bill Discounting

Bill discounting, also known as invoice discounting, is a financial arrangement where a business sells its unpaid invoices to a financial institution or lender at a discounted rate. In simple terms, the business receives immediate cash by trading their outstanding invoices to a third party, who then collects the payments from the debtors at the full amount. This enables the business to access funds quickly and improve its cash flow.

Definition Of Factoring

Factoring, on the other hand, is a broader financial arrangement that not only involves the sale of unpaid invoices but also includes additional services provided by the factor. In addition to providing immediate cash by purchasing invoices, the factor takes over the responsibility of collecting payments from the debtors. Factoring companies also offer credit checks, collections, and bookkeeping services to assist businesses in managing their receivables effectively.

Importance Of Maximizing Cash Flow

Maximizing cash flow is crucial for businesses of all sizes and industries. By leveraging bill discounting and factoring, businesses can:

- Access immediate cash: Bill discounting and factoring provide businesses with immediate liquidity, allowing them to overcome cash flow gaps and meet their financial obligations.

- Improve working capital: By converting outstanding invoices into cash, businesses can enhance their working capital, which is essential for day-to-day operations, investments, and growth.

- Optimize business operations: With improved cash flow, businesses can strengthen their purchasing power, negotiate better deals, and take advantage of growth opportunities.

- Maintain financial stability: Managing cash flow effectively through bill discounting and factoring helps businesses maintain stability, navigate economic fluctuations, and prevent financial difficulties.

Ultimately, bill discounting and factoring are valuable financial tools that allow businesses to improve their cash flow, access immediate funds, and streamline their operations. By understanding their definitions and importance, businesses can make informed decisions and explore the best financing options to meet their unique needs.

Key Differences Between Bill Discounting And Factoring

When it comes to financing options for businesses, bill discounting and factoring are two common choices. While they both involve the sale of invoices to receive immediate funds, there are some key differences between the two. Understanding these differences can help businesses make an informed decision about which option is best suited for their needs.

Responsibility

In bill discounting, the business retains the responsibility of collecting payments from debtors. This means that the business is in charge of following up with customers, ensuring timely payments, and managing the collection process. On the other hand, in factoring, the factor handles the collections. The factor takes on the responsibility of following up with and collecting payments from the business’s customers. This can free up valuable time and resources for the business, allowing them to focus on other aspects of operations.

Range Of Services

While both bill discounting and factoring provide immediate cash flow by selling invoices, factoring offers a more comprehensive range of services beyond financing. In addition to providing funding, factoring companies often offer services such as credit checks, collections, and bookkeeping. These additional services can be beneficial for businesses that may not have the resources or expertise to handle these tasks internally. In contrast, bill discounting focuses solely on the financing aspect, without the additional services that factoring offers.

Type Of Transaction

In bill discounting, the transaction is treated as a loan. The business essentially receives a loan from the financing institution, using the invoices as collateral. The repayment of the loan is typically made by the business through the collection of payments from their customers. On the other hand, in factoring, the transaction is treated as a sale. The business sells the invoices to the factoring company at a discount, and the factoring company assumes ownership of the invoices. This distinction can have implications for the accounting treatment and financial reporting of the transaction for the business.

In conclusion, although both bill discounting and factoring provide businesses with access to immediate funds by selling their invoices, there are significant differences in terms of responsibility, range of services, and the type of transaction. Understanding these differences is crucial for businesses to choose the financing option that best meets their needs and goals.

Benefits Of Bill Discounting

Bill discounting is a financing option that offers various benefits for businesses. This form of short-term financing allows companies to improve their cash flow, gain flexibility, and manage their working capital effectively. Let’s take a closer look at the key advantages of bill discounting:

Short-term Financing

One of the main benefits of bill discounting is that it provides businesses with immediate access to cash. When companies have outstanding invoices or bills receivable, they can submit these documents to a financial institution for discounting. The financial institution advances a certain percentage of the invoice value to the business, allowing them to receive funds before the actual due date. This short-term financing arrangement helps businesses meet their immediate financial needs, such as paying suppliers, covering operational expenses, or investing in growth opportunities.

Improved Cash Flow

Bill discounting significantly improves cash flow for businesses. Instead of waiting for customers to pay their invoices on time, companies can receive a portion of the invoice value upfront. This injects immediate liquidity into the business, enabling them to manage their cash flow effectively. With improved cash flow, businesses can meet their financial obligations, bridge the gap between billing and collection, and operate smoothly without facing any cash crunches. They don’t have to rely on customer payments for working capital needs, as bill discounting provides a reliable source of short-term financing.

Flexibility

Another advantage of bill discounting is the flexibility it offers to businesses. Unlike traditional loans or lines of credit, bill discounting allows companies to choose which invoices they want to discount. They have the freedom to select invoices based on their cash flow needs or the particular customers they want to prioritize. This flexibility empowers businesses to efficiently manage their working capital and allocate funds where they are most needed. Bill discounting provides businesses with the control and freedom to access cash as and when required, without any restrictions or limitations.

In conclusion, bill discounting offers several benefits for businesses, including short-term financing, improved cash flow, and flexibility. By utilizing this method, companies can unlock the value of their outstanding invoices and gain access to immediate funds, which helps in managing day-to-day operations and fueling growth.

Advantages Of Factoring

Factoring can provide several advantages for businesses looking to improve their cash flow and reduce credit risk. Here are some of the key benefits that factoring offers:

Comprehensive Services

Factoring provides a more comprehensive range of services beyond financing, such as credit checks, collections, and bookkeeping. Rather than just receiving immediate funds for their invoices, businesses can also benefit from additional support in managing their accounts receivable, which can help streamline their operations and improve their overall financial management.

Outsourced Collections

One of the major advantages of factoring is the outsourced collections service it provides. By having the factor handle the collections from customers, businesses can save time and resources that would otherwise be spent on chasing payments. This allows them to focus on their core operations and growth strategies without the burden of managing accounts receivable.

Reduced Credit Risk

Factoring also helps in reducing credit risk for businesses. Factors typically conduct credit checks on the debtor companies and assume the credit risk for the invoices they purchase. This significantly lowers the risk of bad debts and non-payment, providing businesses with greater financial stability and predictability.

Factors To Consider When Choosing Between Bill Discounting And Factoring

Choosing between bill discounting and factoring requires careful consideration of factors such as responsibility for collecting payments and the range of services offered. In bill discounting, the business retains the responsibility of collecting payments, whereas factoring includes services such as credit checks and collections.

Factors to Consider When Choosing Between Bill Discounting and Factoring Business Needs One of the first factors to consider when choosing between bill discounting and factoring is your business needs. Assess your business’s financial position and short-term cash flow requirements. If you need immediate access to cash and are comfortable maintaining the responsibility of collecting payments from your debtors, bill discounting may be suitable for you. On the other hand, if you seek a more comprehensive range of services beyond financing, such as credit checks, collections, and bookkeeping, factoring might be the better choice. Customer Relationship Consider your customer relationship when evaluating bill discounting and factoring options. With bill discounting, your business retains the responsibility of collecting payments from your debtors. This means your customer relationships remain primarily under your control, and your customers may not be aware of the financing arrangement. However, in factoring, the factor handles the collections, which may impact your customer interactions. It’s essential to weigh the implications for maintaining positive customer relationships when choosing between the two financing options. Cost Analysis Another critical factor when deciding between bill discounting and factoring is cost analysis. Both options come with their associated costs, and it’s important to compare the overall expenses. Bill discounting typically involves lower costs, as it is a simpler form of financing where the main service is providing short-term funds. On the other hand, factoring, with its additional services like credit checks and collections, may come with higher costs. Carefully assessing the total costs involved in each option is crucial in making an informed decision. In your decision-making process, evaluate your business needs, customer relationship considerations, and conduct a thorough cost analysis to determine the most suitable financing option between bill discounting and factoring. By taking these factors into account, you can make an informed decision that aligns with your business’s requirements and objectives. Each aspect plays a crucial role in determining which of the two financing options will best support your business’s growth and financial stability.

Credit: fastercapital.com

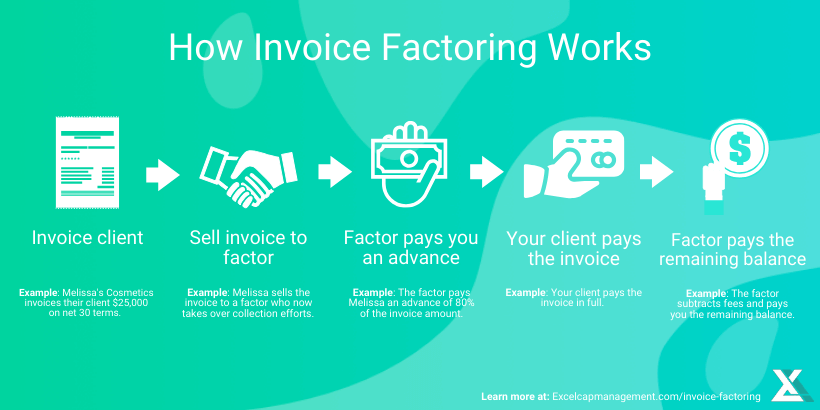

Credit: www.excelcapmanagement.com

Frequently Asked Questions For Bill Discounting And Factoring

What Is The Difference Between Bill Factoring And Bill Discounting?

The main difference between bill factoring and bill discounting is the responsibility of collecting payments from debtors. In bill discounting, the business retains this responsibility, while in factoring, it is handled by the factor. Factoring also offers additional services beyond financing, such as credit checks, collections, and bookkeeping.

What Is A Bill Discounting?

Bill discounting is a financing option where a business sells its unpaid invoices to a bank or a financial institution at a discount. The business retains the responsibility for collecting payments from debtors. It is different from factoring, where the factor handles the collections and offers additional services like credit checks and bookkeeping.

What Is The Difference Between Export Factoring And Invoice Discounting?

Export factoring and invoice discounting differ in terms of responsibility and services provided. In bill discounting, the business is responsible for collecting payments from debtors, while in factoring, the factor handles the collections. Factoring also offers additional services such as credit checks, collections, and bookkeeping beyond financing.

Is Invoice Discounting Cheaper Than Factoring?

Invoice discounting is cheaper than factoring as it doesn’t involve additional services like credit checks and collections. The business retains the responsibility of collecting payments, making it a cost-efficient option.

Conclusion

To summarize, bill discounting and factoring are two distinct financing options with key differences. In bill discounting, the responsibility of collecting payments from debtors lies with the business, while in factoring, the factor takes care of collections. Furthermore, factoring offers additional services like credit checks and bookkeeping.

While invoice factoring may be slightly more expensive than discounting, it provides the benefit of a collections service. Understanding these variances can help businesses make informed decisions about their financing needs.