Canadian Factoring Companies provide a solution for businesses in Canada to access working capital by using their accounts receivable as collateral, without taking out a loan. These factoring companies offer services such as invoice financing and payroll funding for businesses of all sizes, including trucking and temporary staffing companies.

Some of the best factoring companies in Canada include FundThrough, Riviera Finance, eCapital, and RTS Financial, with factoring rates ranging from 1% to 5%. Choosing the right factoring company is crucial for businesses to maintain a steady cash flow, and FactoringClub and GoodFirms provide lists of top factoring services in Canada to help businesses find the most suitable option.

By partnering with a reputable factoring company, businesses can overcome cash flow issues and ensure their operations run smoothly.

Credit: www.sportingnews.com

.jpg)

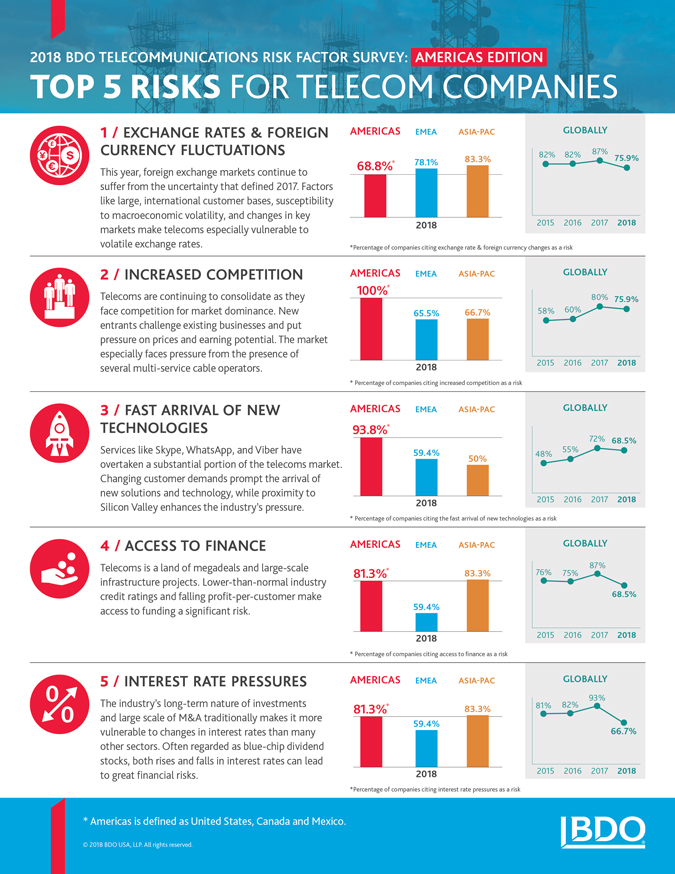

Credit: www.bdo.com

Frequently Asked Questions Of Canadian Factoring Companies

What Is The Factoring Rate In Canada?

The factoring rate in Canada ranges from 1% to 5%. Factoring companies in Canada provide invoice financing that allows businesses to access working capital in exchange for their accounts receivable. This non-loan form of funding is known as invoice factoring.

Who Is The Number 1 Factoring Company?

The number 1 factoring company is subjective and may vary depending on factors such as industry, location, and specific needs. It is recommended to research and compare different factoring companies to find the best fit for your specific requirements.

What Percentage Do Factoring Companies Take?

Factoring companies in Canada typically take a percentage of 1% to 5% for their services.

Which Factoring Company Is The Best For Trucking?

The best factoring company for trucking is subjective and depends on individual business needs. Some top options include FundThrough, Riviera Finance, and eCapital. It is recommended to evaluate each company’s services and rates to find the best fit for your trucking business.

Conclusion

Whether you’re a small business owner or a start-up, finding the right factoring company in Canada is essential for your business growth. With the services provided by reputable companies like FundThrough, Riviera Finance, and eCapital, you’ll have access to working capital and steady cash flow.

Don’t let cash flow issues hold your business back. Take advantage of invoice factoring and get the funding you need to thrive. Choose a reliable factoring company in Canada and experience the benefits firsthand. Get the info you need and make an informed decision for your business.