Engaged Factoring is a financial transaction where a business sells its invoices at a discount to a third party called a factor. It helps businesses meet their immediate cash needs.

Factoring is a common practice in business to overcome cash flow challenges by converting accounts receivable into immediate cash. Engaged Factoring in Austin, Texas, offers invoice factoring services to various industries, including trucking, staffing, telecom, and oilfield services. With Engaged Financial, businesses can benefit from their expertise and grow their operations.

Through their invoice factoring program, businesses can receive advances on their invoices and improve their cash flow. Engaged Factoring makes factoring simple and accessible for businesses, helping them get paid faster and maintain their financial stability.

Introduction To Engaged Factoring

Engaged Factoring is a financial transaction where a business sells its accounts receivable at a discount to a third party, known as a factor, to meet its immediate cash needs. It is a solution to help businesses grow and manage their cash flow efficiently.

What Is Engaged Factoring?

Engaged Factoring is a financial solution that helps businesses improve their cash flow by selling their accounts receivable (invoices) to a third party called a factor. The factor purchases these invoices at a discount, providing immediate funds to the business. This type of debtor finance allows businesses to access working capital without waiting for their customers to pay their invoices. Engaged Factoring is especially beneficial for small and medium-sized businesses that face cash flow challenges due to long payment terms or delayed payments from customers.Benefits Of Engaged Factoring

There are several benefits to using Engaged Factoring as a financial tool for businesses: 1. Improved Cash Flow: Engaged Factoring provides businesses with immediate funds, allowing them to meet their financial obligations, invest in growth opportunities, and cover daily expenses. This improved cash flow can help businesses manage their operations more effectively and seize new business opportunities. 2. Faster Access to Funds: Unlike traditional financing options, Engaged Factoring offers quick access to funds. Once the factor verifies the invoices, businesses can receive payment within 24 to 48 hours. This speedy access to funds can help businesses avoid cash flow gaps and keep their operations running smoothly. 3. Reduced Risk of Bad Debt: Engaged Factoring transfers the risk of non-payment or bad debt to the factor. The factor assumes responsibility for collecting the outstanding payments from the customers, allowing businesses to focus on their core operations without worrying about late or non-payment issues. 4. Flexibility and Scalability: Engaged Factoring provides businesses with flexibility and scalability. As the business grows and generates more invoices, the factor can increase the funding available. This scalability allows businesses to access the necessary working capital to support their growth and expansion plans. 5. Credit Protection: Engaged Factoring often includes credit protection services, where the factor performs credit checks on customers and provides insurance against non-payment. This credit protection can help businesses mitigate the risk of customer insolvency or default, ensuring that they receive payment for their goods or services. In conclusion, Engaged Factoring is a valuable financial solution for businesses looking to improve cash flow, access immediate funds, reduce the risk of bad debt, and enjoy flexibility and scalability. By leveraging the benefits of Engaged Factoring, businesses can focus on their growth and success while meeting their financial obligations.

Credit: www.powerreviews.com

Different Types Of Factoring In Business

When it comes to different types of factoring in business, Engaged Factoring is a popular option. Engaged Factoring is a financial transaction where a business sells its accounts receivable at a discount to a third party, providing immediate cash flow.

This type of factoring helps businesses meet their present and immediate cash needs.

Invoice Factoring

Invoice factoring is a type of factoring that is commonly used in business. In this process, a business sells its accounts receivable, or invoices, to a third party at a discounted rate. This allows businesses to access immediate cash by converting their unpaid invoices into working capital. The factoring company then collects payment from the customers directly. It is a popular choice among businesses that have outstanding invoices with long payment terms, as it provides a reliable and quick cash flow solution.

Freight Factoring

Freight factoring, also known as transportation factoring or trucking factoring, is specifically designed for companies in the transportation industry. It involves selling unpaid invoices from completed loads to a factoring company at a discount. The factoring company then provides immediate cash to the trucking company, enabling them to cover fuel costs, driver wages, maintenance, and other essential expenses. This type of factoring is advantageous for transportation businesses as it helps them maintain a steady cash flow and continue operating efficiently.

Factoring In Banking

Factoring also plays a crucial role in the banking industry. Banks use factoring as a financial tool to manage their working capital and mitigate risks. In factoring in banking, the bank purchases accounts receivable or invoices from businesses, allowing them to receive cash upfront instead of waiting for payment from their customers. This enables businesses to bridge the gap between delivering their products or services and receiving payment, ensuring smooth operations and liquidity. Factoring in banking is an effective strategy for both the bank and the business, as it provides financial stability and reduces the bank’s exposure to potential defaults.

How Engaged Factoring Works

Engaged Factoring is a financial solution that allows businesses to improve their cash flow by selling their outstanding accounts receivable, also known as invoices, to a third-party finance company. This process provides instant access to a significant portion of the invoice amount, which can be used to cover operational expenses and invest in growth opportunities.

The Process Of Engaged Factoring

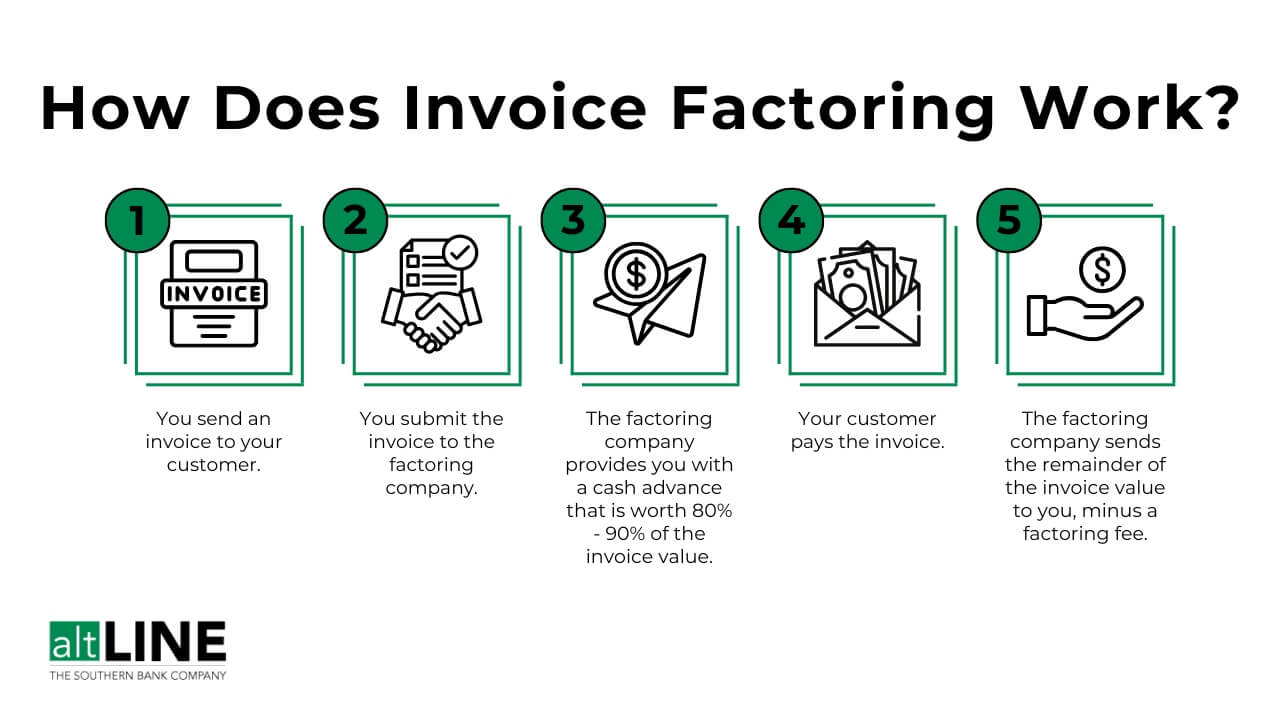

The process of Engaged Factoring involves a few key steps:

- Application: The business applies for Engaged Factoring by submitting an application to the finance company. This application typically includes information about the business, its customers, and the invoices to be factored.

- Verification: The finance company verifies the authenticity and validity of the invoices submitted by the business. This verification process ensures that the invoices are genuine and will be paid by the customers.

- Funding: Once the verification process is complete, the finance company provides an initial funding amount to the business, usually a percentage of the total invoice value. The remaining amount, minus fees, will be provided when the customers pay their invoices.

- Collections: The finance company takes over the responsibility of collecting payment from the customers on behalf of the business. This allows the business to focus on its core operations while the finance company manages the collection process.

- Final Payment: Once the customers pay their invoices, the finance company deducts its fees and transfers the remaining amount to the business. The business can then use this payment to settle any outstanding debts or invest in further growth.

Steps To Factor Your Invoices

If you’re considering Engaged Factoring for your business, here are the steps to factor your invoices:

- Research: Start by researching different finance companies that offer Engaged Factoring services. Look for reputable companies with experience in your industry and positive reviews from other clients.

- Application: Once you have chosen a finance company, complete the application process by providing the required information about your business, customers, and invoices.

- Verification: The finance company will verify the authenticity and validity of your invoices to ensure they qualify for factoring.

- Funding: After verification, the finance company will provide you with an initial funding amount based on a percentage of your invoice value.

- Collection: The finance company will take over the collection process from your customers, allowing you to focus on your core operations.

- Final Payment: Once your customers pay their invoices, the finance company will deduct its fees and transfer the remaining amount to you.

Engaged Factoring offers a flexible and reliable way to improve cash flow and manage working capital for businesses of all sizes. By leveraging this financial solution, businesses can overcome cash flow challenges, seize growth opportunities, and achieve their full potential.

Choosing The Right Factoring Company

Choosing the right factoring company is crucial for maintaining a healthy cash flow and securing the financial stability of your business. With numerous options available, it’s essential to consider various factors to ensure you select the ideal factoring company that aligns with your specific business needs. This article will help you navigate through the considerations for selecting a factoring company and highlight some of the top factoring companies in the USA.

Considerations For Selecting A Factoring Company

1. Industry Expertise: Look for a factoring company with experience in your industry to benefit from their specialized knowledge and tailored services.

2. Funding Flexibility: Ensure the factoring company offers flexible funding options that can accommodate your business growth and fluctuating cash flow demands.

3. Customer Service: Assess the responsiveness and accessibility of the factoring company’s customer support to address any queries or concerns promptly.

4. Transparent Terms: Choose a factoring company that provides clear and transparent terms, including fee structures, contract terms, and any additional charges.

5. Reputation and Reliability: Research the reputation and reliability of the factoring company by reviewing client testimonials and industry ratings to ensure trustworthiness.

Top Factoring Companies In The Usa

When considering the top factoring companies in the USA, it’s essential to evaluate their track record, client satisfaction, and range of services. Some of the leading factoring companies in the USA that have demonstrated consistent reliability and excellence in the industry include:

- Engaged Financial LLC: Offering specialized factoring services for various industries such as trucking, staffing, telecom, and oilfield services, Engaged Financial stands out for its tailored solutions and commitment to client growth.

- Sunbelt Finance: With a focus on supporting small to medium-sized businesses, Sunbelt Finance provides flexible factoring solutions and personalized attention to meet diverse business needs.

- BlueVine: Known for its user-friendly interface and quick funding options, BlueVine offers a seamless factoring experience for businesses of all sizes, particularly in the realm of invoice factoring.

By carefully considering these top factoring companies, you can make an informed decision based on your business requirements, ultimately ensuring a beneficial partnership that fosters financial stability and growth.

Success Stories And Testimonials

Success stories and testimonials are the heart of Engaged Factoring, providing real-life experiences and case studies that demonstrate the positive impact our services have on businesses. Client experiences with Engaged Factoring showcase the tangible benefits of improved cash flow, increased working capital, and enhanced financial stability. Whether you are a small business, a mid-sized company, or a larger enterprise, these success stories and testimonials highlight the transformative power of Engaged Factoring.

Client Experiences With Engaged Factoring

Engaged Factoring has a wide array of satisfied clients who have experienced firsthand the outstanding advantages of our services. By leveraging factoring, businesses have overcome cash flow challenges, maintained steady operations, and unlocked growth opportunities. Our client experiences underscore the reliability and effectiveness of Engaged Factoring in providing tailored financial solutions that align with the unique needs of each business.

Case Studies Of Improved Cash Flow

Through case studies, Engaged Factoring demonstrates how businesses with varying financial situations have achieved remarkable improvements in cash flow management. These studies delve into real-world scenarios, illustrating how factoring has facilitated prompt payment on invoices, minimized financial strain, and fostered sustainable business expansion. The case studies exemplify how Engaged Factoring empowers companies to thrive in dynamic and competitive market environments.

Credit: rockcontent.com

Credit: altline.sobanco.com

Frequently Asked Questions Of Engaged Factoring

What Does Factoring Mean In Business?

Factoring in business means selling accounts receivable (invoices) to a third party at a discount to meet immediate cash needs.

What Is An Example Of Factoring Process?

Factoring in business is when a company sells its invoices to a third party at a discount to meet immediate cash needs. For example, a business sells $10,000 worth of invoices to a factor for $9,000 in cash. They receive immediate funds while the factor collects payment from customers.

What Are The Different Types Of Factoring In Banking?

In banking, there are different types of factoring: recourse and non-recourse factoring. Factoring allows a business to sell its accounts receivable at a discount to meet its immediate cash needs.

What Is Factoring In Trucking?

Freight factoring, also known as transportation or trucking factoring, involves a third party purchasing invoices at a discount and providing an advance payment upon delivery. This helps trucking companies meet immediate cash needs.

Conclusion

Factoring is a smart and efficient financial solution for businesses in need of immediate cash. By selling their accounts receivable to a third party at a discounted rate, businesses can meet their present cash needs and continue operating smoothly. Engaged Financial is a leading invoice factoring company that offers tailored solutions to various industries, including trucking, staffing, telecom, and oilfield services.

With Engaged Financial’s expertise and support, businesses can grow and achieve their financial goals. Say goodbye to cash flow problems and hello to sustainable growth with Engaged Financial.