A factoring company provides immediate cash to businesses by purchasing their outstanding invoices from slow-paying customers, boosting their cash flow and providing resources to pay expenses and take on new clients. It is worth considering if your company needs immediate funds and is facing cash flow issues.

The best factoring companies include AltLINE, FundThrough, RTS Financial, eCapital, TCI Business Capital, and Riviera Finance. Factoring is a quick and easy process that can benefit various industries, such as trucking businesses. It works by providing upfront cash against invoices, eliminating the need to wait for customers to pay.

Overall, factoring companies offer a valuable solution for businesses in need of immediate funds.

Credit: www.itmagination.com

What Is Factoring?

A factoring company purchases outstanding invoices from businesses to provide immediate cash and improve cash flow. Some of the top factoring companies include AltLINE, FundThrough, RTS Financial, eCapital, and TCI Business.

Definition Of Factoring:

Factoring is a financial service provided by specialized companies called factoring companies. It involves selling your accounts receivable, such as invoices, to the factoring company in exchange for immediate cash. In simple terms, factoring allows companies to convert their unpaid invoices into immediate cash flow.How Does Factoring Work?

Factoring works in a straightforward manner. Here’s a step-by-step breakdown of how the process usually unfolds:- The business provides goods or services to its customers and generates invoices for payment.

- The business chooses to work with a factoring company and submits the invoices to the factoring company.

- The factoring company evaluates the invoices and verifies the creditworthiness of the customers.

- Once approved, the factoring company advances a percentage of the invoice value to the business, typically ranging from 70% to 90%.

- The factoring company then takes over the responsibility of collecting payment from the customers.

- When the customers pay the invoices, the factoring company deducts its fees and remits the remaining balance to the business.

Benefits Of Factoring:

Factoring offers several benefits for businesses, and these include:- Improved Cash Flow: The most significant benefit of factoring is that it provides immediate cash to businesses, fixing their cash flow issues. This infusion of funds enables companies to pay their expenses, meet payroll, and take on new clients.

- Reduced Credit Risk: The factoring company assumes the credit risk associated with the invoices, reducing the business’s exposure to bad debts. This allows businesses to focus on their core operations without worrying about collecting payment.

- Flexible Financing: Factoring is a flexible financing option that grows with your business. The amount of funding available increases as your sales and invoices increase. This scalability makes factoring an ideal solution for businesses experiencing rapid growth.

- Streamlined Operations: By outsourcing accounts receivable management to the factoring company, businesses can free up valuable time and resources. The factoring company handles the time-consuming tasks of billing, collections, and credit checks, allowing businesses to focus on their core competencies.

Credit: medium.com

Types Of Factoring Companies

Factoring companies play a crucial role in assisting businesses in managing their cash flow. They provide immediate funds by purchasing outstanding invoices, allowing businesses to bridge the gap between invoicing and receiving payment. Depending on the industry and specific needs, there are different types of factoring companies available to provide tailored solutions.

Freight Factoring Companies

Freight factoring companies specialize in providing factoring services specifically for trucking businesses. These companies understand the unique challenges faced by trucking companies such as long payment cycles, fuel costs, and maintenance expenses. By purchasing freight invoices at a discounted rate, trucking businesses can receive immediate cash to cover their operational expenses and focus on growing their operations.

- RTS Financial

- Riviera Finance

- TAFS, Inc

- Porter Freight Funding

- Apex Capital Corp

- CoreFund Capital LLC

Invoice Factoring Companies

Invoice factoring companies offer their services to a wide range of industries and businesses. These companies purchase outstanding invoices from businesses across various sectors, giving them the cash they need to fuel growth, meet payroll, and cover other day-to-day expenses. Invoice factoring provides businesses with a flexible and efficient way to manage their cash flow without waiting for customer payments.

- FundThrough

- OTR Solutions

- Fundbox

- Bibby Financial Services

- Riviera Finance

Factoring Companies In The Uk

Factoring companies in the UK offer their services to businesses operating in the United Kingdom. These companies understand the unique financial landscape and regulations in the UK, allowing them to provide tailored factoring solutions for businesses of all sizes. Whether it’s funding growth, managing cash flow, or improving working capital, factoring companies in the UK offer a range of services to support businesses in their financial needs.

- Kriya

- Lloyds Bank

- Close Brothers Invoice Fin…

- Metro Bank

- Mitsubishi HC Capital UK PLC

- HSBC

Choosing The Best Factoring Company

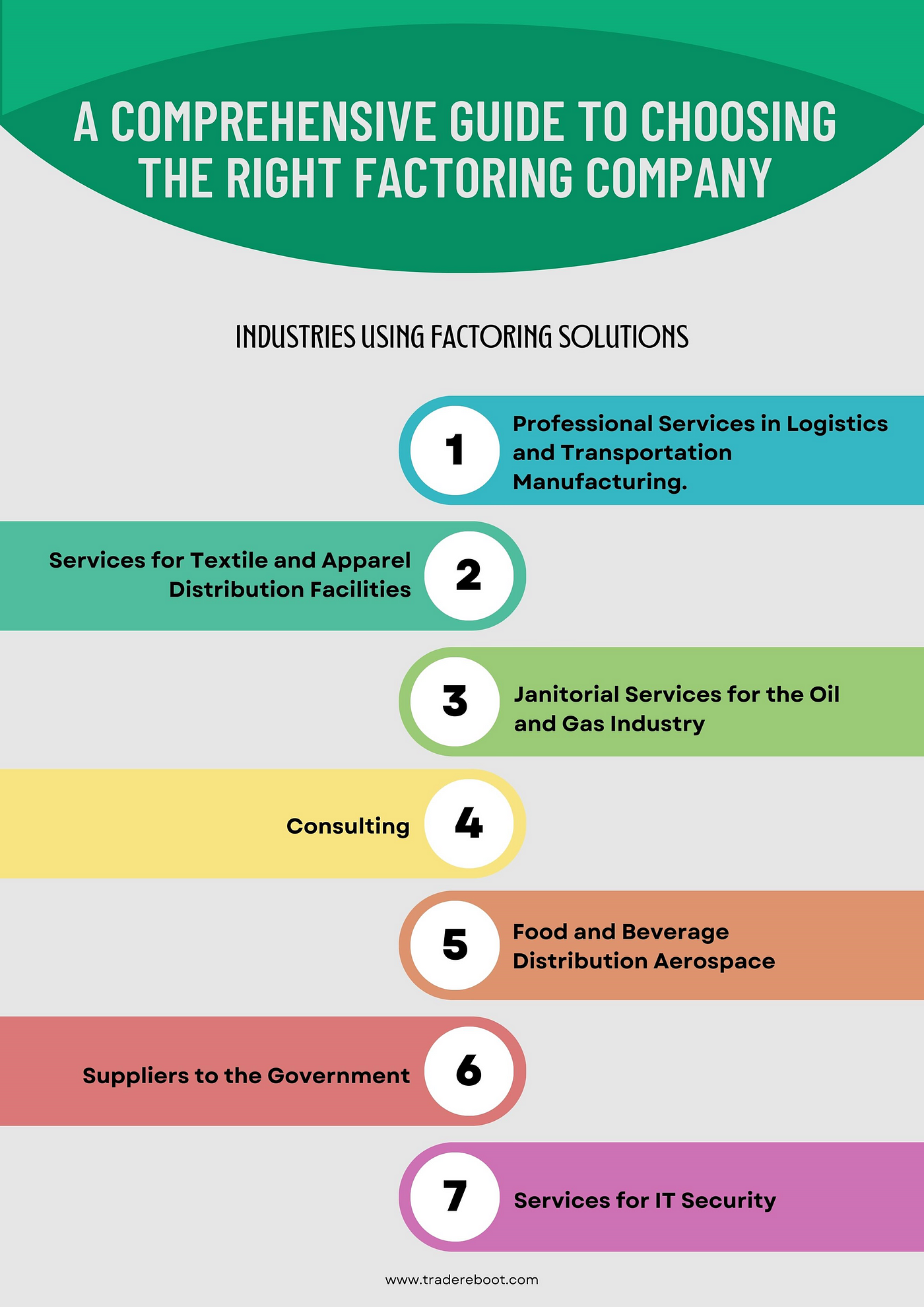

When it comes to managing cash flow, factoring can be a valuable solution for businesses. Factoring companies provide quick and accessible financing options by purchasing your outstanding invoices and providing you with immediate cash. However, with numerous factoring companies in the market, choosing the best one for your business can be a challenging task. In this article, we will explore the factors to consider when selecting a factoring company, highlight some of the top factoring companies in the industry, and identify the best factoring companies for specific industries.

Factors To Consider

When choosing a factoring company, there are various factors that you should consider to ensure you make the right decision for your business. These factors include:

- Industry Expertise: Look for a factoring company that specializes in your specific industry. Different industries have unique requirements and regulations, so working with a factoring company that understands your industry can provide invaluable insights and support.

- Funding Speed: Speed is crucial when it comes to cash flow management. Evaluate the funding speed of different factoring companies to ensure they can provide the financing you need in a timely manner.

- Terms and Fees: Carefully review the terms and fees offered by each factoring company. Pay attention to factors such as discount rates, reserve amounts, and any additional charges. Compare these details to find the most cost-effective solution for your business.

- Customer Support: Excellent customer support is essential when partnering with a factoring company. Look for a company that provides responsive and reliable customer service to address any concerns or questions you may have.

- Reputation and Reviews: Research the reputation and reviews of each factoring company you are considering. Read testimonials and reviews from other businesses in your industry to gain insights into their experiences with the company.

Top Factoring Companies

Here are some of the top factoring companies known for their excellent services and industry expertise:

| Company | Industry | Key Features |

|---|---|---|

| altLINE | Various Industries | Large invoice factoring |

| FundThrough | Software Integration | Fast and easy funding |

| Riviera Finance | In-person Factoring | Personalized service |

| RTS Financial | Trucking Businesses | Specialized services for the trucking industry |

| eCapital | Fast Funding | Quick and accessible financing |

| Universal Funding Corporation | Large Invoices | Caters to businesses with large invoice volumes |

Best Factoring Companies For Specific Industries

Here are some of the best factoring companies for specific industries:

- Trucking Industry: RTS Financial

- Software Industry: FundThrough

- Construction Industry: Far West Capital

- Consulting Industry: Clarity Factoring

These companies have extensive experience and expertise in their respective industries, making them excellent choices for businesses in those sectors.

Reaching out to multiple factoring companies, comparing their offerings, and considering the factors discussed above will help you find the best factoring company suited to your business needs. Remember to analyze your specific requirements and choose a reputable company that aligns with your goals.

Credit: medium.com

Cost Of Factoring

When considering the option of working with a factoring company, understanding the cost involved is crucial. The cost of factoring plays a significant role in determining the financial impact it will have on your business. How factoring companies charge and factors that affect factoring fees are essential aspects that must be carefully evaluated to make an informed decision.

How Factoring Companies Charge

Factoring companies typically charge a fee, also known as a discount rate, for their services. This fee is a percentage of the total invoice value and can range anywhere from 1% to 5% or even higher. The specific rate charged by a factoring company may depend on various factors such as the industry, the volume of invoices, and the creditworthiness of the customers.

Factors That Affect Factoring Fees

Several factors can influence the fees charged by factoring companies. These may include the creditworthiness of your customers, the average invoice size, the volume of invoices factored, and the duration it takes for invoices to be paid. Additionally, the industry in which your business operates and the overall risk associated with your invoices may also impact the factoring fees.

Is Factoring Worth It?

Factoring companies, such as eCapital and RTS Financial, offer immediate cash to businesses by purchasing outstanding invoices. This helps improve cash flow, pay expenses, and take on new clients, making it worth considering for companies looking to boost their financial resources.

Pros And Cons Of Factoring

Factoring can provide immediate cash flow for businesses, helping them cover expenses and take on new clients without waiting for outstanding invoices to be paid. However, it comes with certain drawbacks, such as higher fees compared to traditional financing options.

Benefits For Businesses

- Improved Cash Flow: Factoring allows businesses to access cash quickly, enabling them to meet financial obligations and pursue growth opportunities.

- Reduced Risk: By outsourcing credit and collections functions to a factoring company, businesses can mitigate the risk of non-payment by customers.

- Flexibility: Factoring is adaptable to the business’s needs, making it suitable for seasonal fluctuations or rapid growth periods.

Factors To Consider Before Choosing Factoring

- Costs: Consider the fees associated with factoring and compare them to other financing options to determine the most cost-effective solution.

- Customer Relationships: Understand how factoring may impact relationships with customers, as the factoring company will be handling collections.

- Long-Term Viability: Evaluate whether factoring aligns with the long-term financial goals and stability of the business.

Frequently Asked Questions For Factoring Company

How Much Does A Factoring Company Cost?

A factoring company’s cost may vary. Contact a factoring company to get specific pricing details.

Are Factoring Companies Worth It?

Factoring companies are worth it because they provide immediate cash, help fix cash flow issues, and give resources to pay expenses and take on new clients. They are beneficial for businesses looking to boost cash flow and improve financial stability.

What’s The Best Factoring Company?

The best factoring companies include AltLINE, FundThrough, RTS Financial, eCapital, TCI Business Capital, and Riviera Finance.

How Do Factoring Companies Pay You?

Factoring companies pay you by purchasing your outstanding invoices and providing immediate cash for your business needs.

Conclusion

Factoring companies provide immediate cash, helping to fix cash flow issues and provide resources to pay expenses and take on new clients. With numerous factoring companies to choose from, it’s essential to find the best one for your needs. Some top options include AltLINE, FundThrough, RTS Financial, eCapital, TCI Business Capital, and Riviera Finance.

Each company offers different benefits and specializes in various industries, such as large invoice factoring, software integration, in-person factoring, and trucking businesses. Carefully consider your specific requirements and choose the best factoring company to support the financial needs of your business.