An Invoice Factoring Agreement Template is a pre-built template that allows companies and factors to enter into an agreement where the factor purchases the accounts receivable from the company and collects payment from customers. This template helps define financial obligations and rights between parties involved in the invoice factoring process.

It is essential for companies seeking factoring services to have a clear and concise agreement in place to ensure smooth transactions and payments. By using this template, businesses can streamline their invoice factoring process and protect their interests.

Credit: www.pinterest.com

Introduction To Invoice Factoring Agreement Templates

When it comes to managing your business’s cash flow, invoice factoring can be a valuable tool. And one way to streamline this process is by using invoice factoring agreement templates. These templates provide a standardized framework for creating agreements between your company and the factoring company, ensuring clarity, consistency, and legal compliance. Understanding the basics of invoice factoring is essential before diving into the benefits of using these templates.

What Is Invoice Factoring?

Invoice factoring, also known as accounts receivable factoring, is a financing solution that allows businesses to convert their outstanding invoices into immediate cash. In this arrangement, businesses sell their accounts receivable to a factoring company at a discounted price. The factoring company then takes over the responsibility of collecting payments from the customers mentioned in the invoices.

Benefits Of Using Invoice Factoring Agreement Templates

Invoice factoring agreement templates offer several benefits to businesses:

- Consistency: By using standardized templates, you can ensure consistency in your agreements across different clients and transactions.

- Time-saving: With pre-built templates, you can avoid the time-consuming task of creating agreements from scratch, allowing you to focus on more important aspects of your business.

- Legal compliance: Invoice factoring agreement templates are designed to adhere to legal requirements, protecting your company’s interests and ensuring a smooth agreement process.

- Clarity: These templates provide a clear structure for outlining the terms and conditions of the agreement, reducing the chances of misunderstandings or disputes.

- Cost-effectiveness: Using templates can save you money by eliminating the need to hire a professional to draft custom agreements.

By leveraging the benefits of these templates, you can streamline your invoice factoring process and create a more efficient and effective cash flow management system for your business.

Important Elements Of An Invoice Factoring Agreement Template

An Invoice Factoring Agreement Template outlines the essential elements for a successful invoice factoring arrangement. It includes important terms and conditions related to the purchase of accounts receivable, payment terms, and fee structures, ensuring a clear understanding between the parties involved.

With this template, businesses can streamline their invoice factoring process and maintain a healthy cash flow.

Accounts Receivable

An invoice factoring agreement template typically includes sections dedicated to accounts receivable. This is where businesses detail the outstanding invoices they wish to factor. It is essential to clearly state the amount owed by each customer and provide supporting documentation. By organizing this information in an agreement, both the factor and the business can ensure a smooth and efficient process.

Terms And Conditions

The terms and conditions section of an invoice factoring agreement template outlines the rights, responsibilities, and obligations of both parties involved. It covers important aspects such as the length of the agreement, termination clauses, and any additional fees or charges. This section ensures that both the factor and the business are on the same page regarding the terms of the arrangement.

Payment Terms

The payment terms section specifies how the factor will remit the funds to the business. It includes details on whether the factor will make a lump-sum payment upfront or if they will make multiple payments over time. The payment terms can also cover factors such as discounts for early payment or penalties for late payments. By clearly defining payment terms in the agreement template, both parties can avoid any confusion or disputes.

Recourse And Non-recourse Factoring

In an invoice factoring agreement template, businesses have the option to choose between recourse and non-recourse factoring. Recourse factoring places the responsibility for any unpaid invoices back on the business if the customer fails to pay. On the other hand, non-recourse factoring protects the business from any losses if the customer defaults on payment. This section of the agreement clarifies which type of factoring arrangement the business and the factor have agreed upon.

Confidentiality

Another crucial element of an invoice factoring agreement template is confidentiality. This section ensures that both parties understand the importance of keeping sensitive business and financial information confidential. It may include clauses preventing the factor from disclosing the factoring relationship to the customer, competitors, or other third parties. By including confidentiality provisions, businesses can have peace of mind knowing their information is protected.

How To Set Up Invoice Factoring

To set up invoice factoring, first provide goods or services to your customers and invoice them. Then, sell the raised invoices to a factoring company, who will collect payment directly from your customers. This agreement allows you to receive immediate cash flow for your business.

Step 1: Provide Goods Or Services

Setting up invoice factoring begins with providing goods or services to your customers in the usual manner. Whether you sell products or offer services, it’s important to ensure that you have a clear understanding with your customers about the terms and conditions of the transaction.

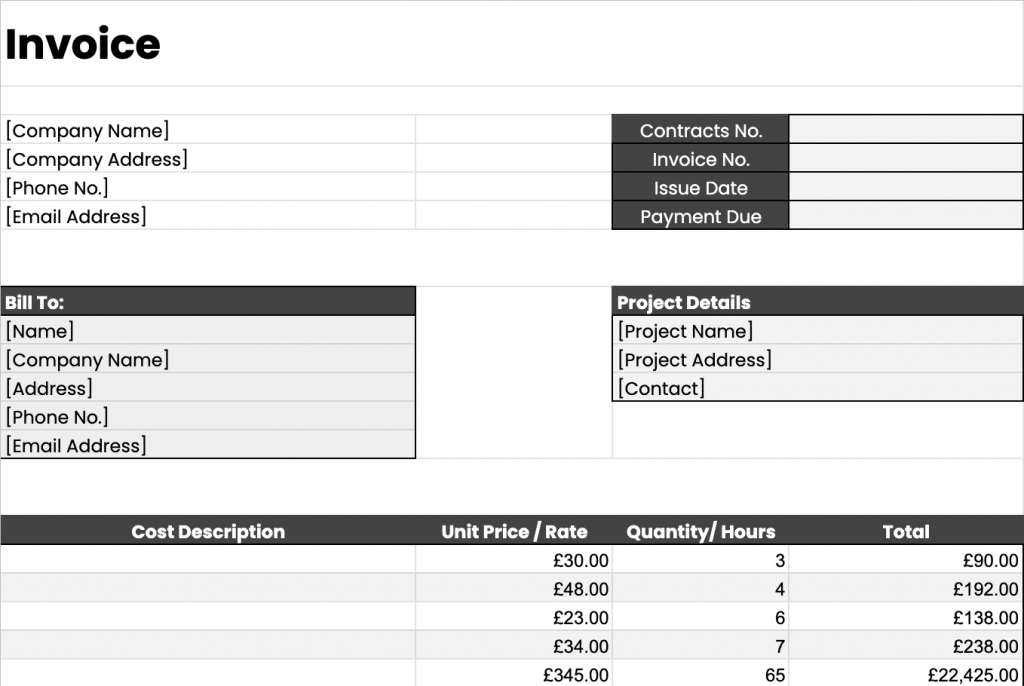

Step 2: Create And Send Invoices

Once you have provided goods or services to your customers, the next step is to create and send invoices to them. A well-designed invoice includes all the relevant information about the transaction, such as the customer’s name, the amount due, and the due date. Make sure to create professional-looking invoices that are easy for your customers to understand.

Step 3: Sell Invoices To A Factoring Company

After creating and sending invoices, you can now proceed to sell them to a factoring company. This step involves entering into a factoring agreement with the company, where they will purchase your invoices at a discounted rate. Selling your invoices to a factoring company allows you to receive immediate payment for your outstanding invoices, improving your cash flow.

Step 4: Direct Payment From Customers To Factoring Company

Once the factoring company has purchased your invoices, your customers will be directed to make payments directly to the factoring company. This arrangement ensures that the factoring company receives the full payment for the invoices they have purchased. It also means that you are relieved of the responsibility of collecting payments from your customers, allowing you to focus on your business operations.

Credit: archdesk.com

Sample Factoring Agreement: What To Include

A sample factoring agreement is crucial in outlining the terms, rights, and obligations between the parties involved in the invoice factoring process. It serves as a legally binding document that provides clarity and sets expectations for both the business and the factoring company. Knowing what to include in a factoring agreement is essential for ensuring a smooth and transparent transaction. Let’s delve into the key components to be included in a sample factoring agreement:

Clearinghouse Agreement

The clearinghouse agreement outlines the terms and conditions related to the transfer of receivables from the business to the factoring company. It should clearly define the process of submitting invoices, the timeline for approval, and any associated fees or charges. Additionally, it should specify the responsibilities of both parties in the event of disputes or discrepancies.

Financial Obligations And Rights

This section is crucial in delineating the financial obligations and rights of both the business and the factoring company. It should encompass details such as the factoring fee structure, advance rates, reserve requirements, and any recourse or non-recourse provisions. Moreover, it should outline the rights of the factoring company in the collection of receivables and the settlement of accounts.

Eligible Receivables

The agreement should clearly define the types of receivables that are eligible for factoring. This could include criteria related to the age of the invoices, the creditworthiness of the debtors, and any exceptions or exclusions. Providing a detailed description of eligible receivables helps in avoiding misunderstandings and ensures a smooth processing of invoices.

Drawbacks And Considerations Of Invoice Factoring

While invoice factoring can provide numerous benefits to businesses, it’s essential to consider the potential drawbacks and implications associated with this financing solution. Understanding the drawbacks and considerations of invoice factoring is crucial for businesses to make informed decisions regarding their financing strategies.

Additional Costs And Fees

One of the primary drawbacks of invoice factoring is the associated costs and fees. Factoring companies typically charge a discount fee or factor rate for advancing funds against the receivables. Additionally, there may be additional fees for credit checks, processing, and account maintenance. These costs can significantly impact the overall financial position of the business, and it’s important to carefully evaluate the total cost of factoring before entering into an agreement.

Loss Of Control

When a business engages in invoice factoring, it essentially relinquishes control of its accounts receivable to the factoring company. This loss of control can impact the autonomy of the business in managing its customer relationships and collection processes. It’s vital for businesses to assess the implications of surrendering control over their receivables and consider how it aligns with their long-term business objectives.

Impact On Customer Relationships

Invoice factoring can potentially affect the relationships with customers, as they may directly interact with the factoring company regarding payments. This shift in the payment collection process may impact the customer experience and the overall business-customer relationship. Businesses should carefully consider how invoice factoring may influence their customer relationships and implement appropriate measures to mitigate any negative impact.

Credit Approval And Risk

Entering into an invoice factoring agreement involves a certain level of credit approval and risk assessment by the factoring company. Businesses with less favorable credit profiles may face challenges in securing favorable factoring terms or may be subject to higher discount rates. It’s essential for businesses to evaluate their creditworthiness and the potential implications on their cash flow and financial stability when considering invoice factoring as a financing option.

Credit: juro.com

Frequently Asked Questions For Invoice Factoring Agreement Template

What Documentation Do I Need For Factoring?

To apply for factoring, you will need the following documentation: – Invoices of goods or services provided to customers – Proof of credit approval from the factoring company – Purchase orders or contracts related to the invoices – Bank statements showing your company’s financial stability – Any additional documents required by the factoring company.

What Is An Example Of Invoice Factoring?

Invoice factoring is when a company sells its unpaid invoices to a factoring company. The factoring company collects the payment directly from the customer, and the company receives immediate cash flow.

How Do I Set Up An Invoice Factoring?

To set up invoice factoring, provide goods or services, then invoice customers. Sell the invoices to a factoring company, and customers pay the company directly.

What Is A Factoring Agreement?

An agreement where a company sells accounts receivable to a factor, who collects and pays for them.

Conclusion

He invoice factoring process is an efficient solution for businesses seeking improved cash flow management. By understanding the importance of having a well-drafted invoice factoring agreement template, you can protect your financial interests and maintain successful business relationships. With clear terms and conditions, this agreement provides a solid foundation for smooth transactions between you, your customers, and the factoring company.

By implementing this template, you can confidently navigate the invoice factoring process and ensure a seamless flow of funds into your business. Take advantage of this valuable tool to enhance your financial stability and propel your business to new heights.