Invoice factoring is the process of selling your invoices to a financing partner (factor) in exchange for cash. This provides businesses with immediate access to funds tied up in unpaid invoices, improving cash flow and liquidity.

Invoice factoring is a financial solution businesses can utilize to improve their cash flow. It involves selling invoices to a financing partner, known as a factor, in exchange for immediate cash. This allows businesses to access funds that would otherwise be tied up in unpaid invoices, providing them with the necessary liquidity to meet their financial obligations and continue operating smoothly.

We will explore the meaning of invoice factoring in Malayalam and how it works, enabling businesses to make informed decisions about their financial strategies.

:max_bytes(150000):strip_icc()/final_externaldebt_definition_recirc_1028-blue-73de7e1315864fbaa53ce328dce1f881.jpg)

Credit: www.investopedia.com

What Is Invoice Factoring?

What is Invoice Factoring?

Invoice factoring is a financing solution that allows businesses to convert their unpaid invoices into immediate cash. It involves selling these invoices to a third-party company called a factor in exchange for a percentage of their total value.

Definition Of Invoice Factoring

Invoice factoring, also known as accounts receivable factoring or invoice financing, is a process whereby businesses sell their unpaid invoices to a third-party company, called a factor, for immediate cash. In return, the factor assumes the responsibility of collecting payments from the customers of the business.

How Does Invoice Factoring Work?

The process of invoice factoring involves the following steps:

- The business provides the factor with a batch of unpaid invoices

- The factor evaluates the creditworthiness of the business’s customers

- The factor advances a percentage of the total invoice value, typically around 80-90%

- The factor takes over the responsibility of collecting payments from the customers

- Once the customers pay their invoices, the remaining percentage (minus the factor’s fees) is released to the business

Invoice factoring provides businesses with a quick and reliable way to improve their cash flow by obtaining immediate funds from their outstanding invoices. It eliminates the need to wait for customers to pay their invoices and allows businesses to cover expenses, invest in growth, and meet their financial obligations.

Furthermore, invoice factoring offers several advantages over traditional bank financing. It does not require collateral or a long approval process, making it accessible to businesses with limited credit history or poor credit scores. It is also a flexible financing solution that grows with the business, as the available funding increases in line with the volume of invoices.

Advantages Of Invoice Factoring

Invoice factoring is a financing solution that provides numerous benefits to businesses. By selling their outstanding invoices to a factor, businesses can quickly access funds and improve their cash flow. Additionally, invoice factoring allows businesses to outsource credit control, reducing administrative burdens. Let’s explore the advantages of invoice factoring in more detail:

Improved Cash Flow

Invoice factoring greatly improves cash flow for businesses. Instead of waiting for customers to pay their invoices, businesses can sell these invoices to a factor and receive cash upfront. This provides businesses with the much-needed liquidity to meet their financial obligations, such as paying suppliers and employees. Improved cash flow also allows companies to invest in growth opportunities and expand their operations.

Quick Access To Funds

One of the significant advantages of invoice factoring is the quick access to funds. Traditional financing methods, like bank loans, often involve lengthy approval processes. In contrast, invoice factoring provides businesses with immediate cash. Once the factor approves the invoices, funds are typically made available within 24 to 48 hours. This swift access to funds allows businesses to address urgent financial needs, seize opportunities, and maintain their operations smoothly.

Outsourced Credit Control

Invoice factoring also offers the advantage of outsourced credit control. Managing credit control, chasing payments, and handling collections can be time-consuming and require specialized expertise. By partnering with a factor, businesses can shift this responsibility to the factor. The factor becomes responsible for collecting payments from customers, allowing businesses to focus on their core operations. Outsourcing credit control ensures efficient and professional management of receivables, reducing the risk of late or non-payment.

Overall, invoice factoring provides businesses with improved cash flow, quick access to funds, and outsourced credit control. These advantages make invoice factoring an attractive financing option for businesses looking to optimize their financial operations and maintain a healthy cash flow.+

Choosing The Right Factoring Company

When it comes to invoice factoring, choosing the right factoring company is crucial for the success of your business. A factoring company acts as a financing partner, purchasing your invoices in exchange for cash. But with so many options available, how do you ensure you choose the right one? Here are some key factors to consider:

Researching Options

Before making any decision, spend time researching and exploring different factoring companies. Look for companies that specialize in your specific industry or niche, as they will have a better understanding of your business’s needs and challenges. Consider factors such as their experience, reputation, and track record.

Comparing Fees And Terms

When selecting a factoring company, it’s essential to compare the fees and terms they offer. Look for transparent pricing structures that clearly outline the discount rates, advance rates, and any additional fees involved. Ensure that the factoring terms align with your business’s cash flow needs and growth plans.

Checking Reputation And Reviews

Checking the reputation and reviews of the factoring company is crucial to ensure you are partnering with a reliable and trustworthy organization. Look for testimonials from other business owners who have worked with the factoring company. Consider their overall customer satisfaction, promptness in payment, and support in managing collections.

By following these guidelines, you can make an informed decision and choose the right factoring company that meets your specific business needs. Remember, a good factoring company will not only provide you with immediate cash flow but also act as a strategic partner in your business’s growth and success.

Factoring Vs. Other Types Of Financing

Invoice factoring, or ഇൻവോയിസ് ഫാക്ടറിംഗ്, is a common financial solution used by businesses to optimize their cash flow. It is a process where a company sells its outstanding invoices to a third party, known as a factor, for immediate cash. While this method is commonly employed, it’s necessary to understand how factoring compares to other financing options. Let’s take a closer look at the key differences and benefits of factoring, as well as its comparison with bank loans and invoice financing.

Differences And Benefits Of Factoring

Factoring differs from conventional bank loans or invoice financing in several ways. Unlike bank loans, factoring doesn’t require a company to take on additional debt. This makes factoring an attractive option for businesses with limited credit or those aiming to maintain a healthy debt-to-equity ratio. Furthermore, factoring allows companies to quickly access cash by selling their invoices, enabling them to address immediate financial needs without having to wait for customers to fulfill payment terms.

Comparison With Bank Loans

Bank loans, unlike factoring, involve borrowing money from a financial institution and agreeing to repay the principal amount plus interest over a defined period. Traditional loans may entail a lengthy approval process and stringent credit requirements. On the other hand, factoring provides immediate funds, often without strict credit qualifications, making it a faster and more flexible financing option for businesses looking to enhance their cash flow.

Comparison With Invoice Financing

Invoice financing, also known as accounts receivable financing, allows businesses to obtain a cash advance based on their outstanding invoices. While similar in concept to factoring, there are distinctions between the two options. With factoring, the factor assumes responsibility for managing the sales ledger and collecting payments from customers, providing relief from administrative tasks. Conversely, in invoice financing, the business retains control over invoice collection and management. This key difference impacts the level of involvement required from the company, influencing the decision between the two financing approaches.

Understanding Invoice Factoring In Malayalam

Invoice factoring എന്നത് വാർത്തയുടെ അർത്ഥം മലയാളത്തിൽ അറിയാൻ ഇൻവോയിസ് ഫാക്ടറിംഗ് മലയാളത്തിൽ പഠിക്കാൻ കഴിയും. ഇൻവോയിസ് ഫാക്ടറിംഗ് ഒരു നിക്ഷേപ വാർത്തകനോ “ഫാക്ടർ” എന്നാണ് അറിയിക്കുന്നത്, അവയുടെ നഗദനയ്ക്ക് മറികടക്കാൻ വാർത്തകരുടെ ഇൻവോയിസുകൾ വാർധിക്കാൻ സ്വപ്രയത്നിക്കുന്നു.

Meaning Of Factoring In Malayalam

Invoice factoring, കാച്ചിട ഫാക്ടറിംഗ്, വസ്തുപ്രവർത്തനം ബിസിനസിൽ ഒന്നടങ്കം കൈവശവുന്ന പ്രാധികാരം ആയി പരിഗണിക്കുന്ന ഒരു വിതരണയിലേക്ക് പുറപ്പെടുന്ന പരമ്പരാഗത ധനലാഭമാണ്.

Importance And Application In Business

ഇൻവോയ്സ് ഫാക്ടറിംഗ്, ബിസിനസിലെ പരിധികൾ നേരിടാത്തതിനും ധനപ്രവാഹം നിർവരണം ചെയ്യുന്നതിനും കൂടെ ധനപ്രവഹനവും സുഖനിധിയാണ്.

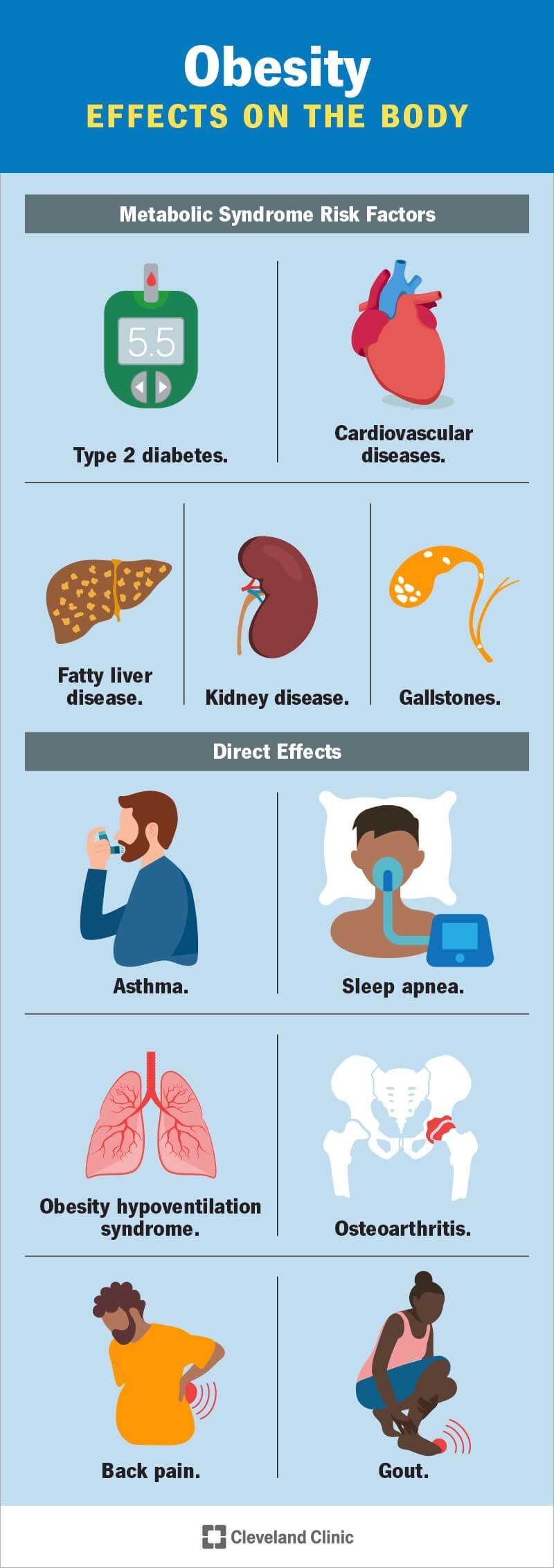

Credit: my.clevelandclinic.org

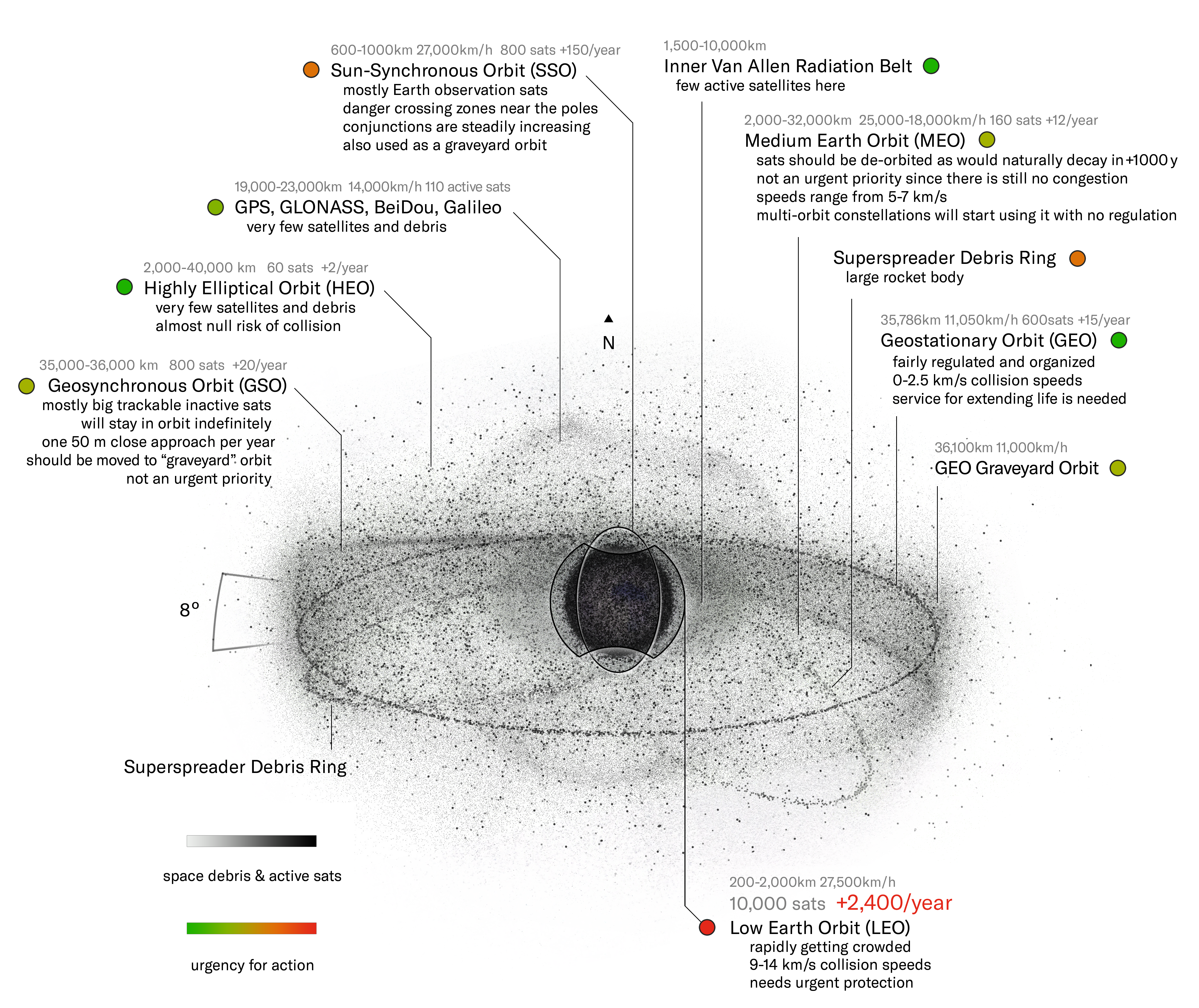

Credit: en.wikipedia.org

Frequently Asked Questions On Invoice Factoring Meaning In Malayalam

What Is The Meaning Of Invoice Factoring In Malayalam?

Invoice factoring in Malayalam is known as “അനുജ്ഞാപത്രം കൊടുപ്പു അർദ്ധം. ” It is a financial practice where a business sells its accounts receivable to a third party to meet short-term liquidity.

How Does Invoice Factoring Work For Businesses?

Invoice factoring involves selling unpaid invoices to a third-party company to improve cash flow. This helps businesses fund operations and growth without waiting for customers to pay their invoices.

What Are The Benefits Of Invoice Factoring For Companies?

Invoice factoring provides immediate access to working capital, improves cash flow, eliminates the waiting period for invoice payments, and allows businesses to focus on core operations without worrying about cash flow.

Is Invoice Factoring The Same As Invoice Financing?

While both involve using invoices to secure funding, invoice factoring and invoice financing differ in the way payments are collected. Invoice factoring involves selling invoices to a third party, while invoice financing uses them as collateral for a loan.

Conclusion

To summarize, invoice factoring in Malayalam refers to the practice of selling unpaid invoices to a financing partner, known as a “factor,” in exchange for immediate cash. This allows businesses to improve their cash flow and meet short-term liquidity needs.

By understanding the concept and advantages of invoice factoring, companies can make informed decisions to optimize their financial positions. If you’re looking for a way to enhance your cash flow and manage your invoices effectively, invoice factoring can provide a practical solution.