Clean Invoice Financing is a type of short-term borrowing that provides immediate cash in exchange for unpaid invoices. It requires creditworthy customers who consistently pay on time and their creditworthiness plays a crucial role in the underwriting process, making it easier to qualify for invoice financing compared to other business loan options.

Clean Invoice Financing is a popular financial solution for businesses seeking immediate cash flow by leveraging their unpaid invoices. With this form of short-term borrowing, businesses can receive funds quickly from lenders in exchange for their outstanding invoices. The qualification process relies heavily on the creditworthiness and payment history of the customers associated with these invoices.

Therefore, having reliable, creditworthy customers who consistently pay on time is essential for eligibility. Invoice financing offers businesses a convenient option to boost cash flow and meet financial obligations promptly. We will delve deeper into the concept of clean invoice financing, its benefits, potential risks, and provide examples to better understand this financial solution.

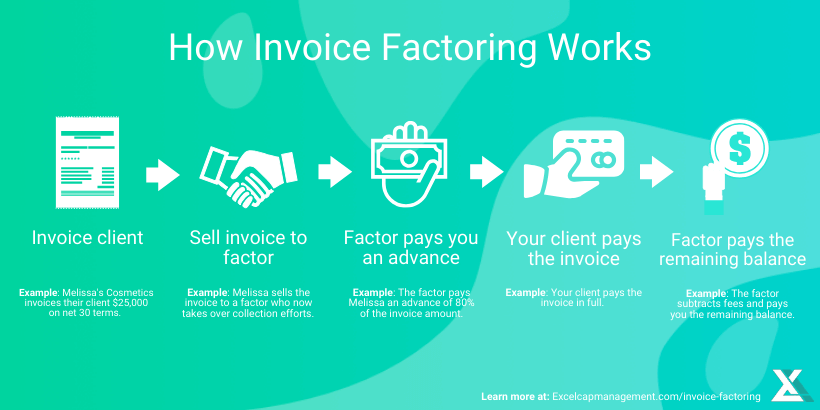

Credit: www.excelcapmanagement.com

What Is Clean Invoice Financing

Clean Invoice Financing is a type of financing that allows businesses to turn their unpaid invoices into immediate cash. It eliminates the need to wait for customers to pay, providing a quick and convenient solution for improving cash flow. This form of financing is particularly beneficial for businesses with creditworthy customers who have a history of paying on time.

Definition

Clean Invoice Financing is a type of invoice financing that provides businesses with immediate cash flow by converting their unpaid invoices into cash. It is a short-term borrowing solution where a lender advances funds to the business based on the value of their outstanding invoices. The lender takes on the responsibility of collecting the payments from the customers, allowing the business to focus on its operations and growth.

Benefits

Clean Invoice Financing offers several benefits to businesses in need of cash flow. Firstly, it provides immediate access to funds, allowing businesses to meet their financial obligations and invest in growth opportunities without waiting for customer payments. Additionally, it helps to improve cash flow management by bridging the gap between invoicing and payment collection. This can be especially beneficial for businesses with long payment cycles or seasonal fluctuations. Furthermore, Clean Invoice Financing eliminates the risk of non-payment, as the lender takes on the responsibility for collecting payments from customers. This reduces the financial burden and uncertainty for businesses.

Overall, Clean Invoice Financing is a valuable financing option for businesses looking to optimize their cash flow and unlock the value of their unpaid invoices. It provides a quick and hassle-free way to access funds, improve financial stability, and accelerate business growth.

How Does Clean Invoice Financing Work

Clean invoice financing is a convenient way for businesses to access immediate cash by converting unpaid invoices into funds. By partnering with reputable invoice finance companies, businesses can qualify based on the creditworthiness of their customers, making it an attractive option over traditional business loans.

Process

In clean invoice financing, the process is straightforward and efficient. Here’s how it typically works:

- You submit your unpaid invoices to the invoice financing company.

- The company verifies the invoices to ensure they meet the eligibility criteria.

- Once approved, the invoice financing company provides you with a percentage of the invoice amount, usually within 24 to 48 hours.

- Your customers make payment directly to the invoice financing company.

- After your customers pay, the invoice financing company deducts their fees and releases the remaining funds to you.

Requirements

To qualify for clean invoice financing, there are certain requirements you need to meet:

- You need to have creditworthy customers with a history of paying on time. This is important as the creditworthiness and reputation of your customers play a larger role in the underwriting process.

- Some invoice financing companies may require a minimum monthly invoice volume to ensure the process is financially viable for both parties.

- Additionally, you may need to provide financial statements and other documentation to demonstrate the stability and growth potential of your business.

Overall, clean invoice financing offers a fast and flexible way to access working capital by leveraging your unpaid invoices. It can help improve your cash flow, allowing you to focus on growing your business without the burden of waiting for customer payments. By meeting the requirements and understanding the process, you can make an informed decision on whether clean invoice financing is the right solution for your business.

Advantages Of Clean Invoice Financing

Invoice financing is a flexible and efficient way for businesses to improve their cash flow and access immediate funds. Clean invoice financing, in particular, offers several advantages that can benefit businesses of all sizes. Let’s explore some of the main advantages of clean invoice financing:

Improved Cash Flow

One of the key advantages of clean invoice financing is improved cash flow. Instead of waiting for customers to pay their invoices, businesses can receive the majority of their invoice amount upfront from the financing company. This immediate influx of cash allows businesses to cover daily expenses, invest in growth opportunities, and manage unforeseen financial challenges.

With improved cash flow, businesses can avoid the cash crunch that often accompanies delayed payments, ensuring that they have the necessary funds to keep operations running smoothly. This stability can lead to increased productivity, enhanced customer service, and overall business growth.

Flexible Financing Options

Clean invoice financing offers businesses greater flexibility when it comes to their financing options. Unlike traditional bank loans, clean invoice financing does not require collateral or long approval processes. Businesses can access funds based on their outstanding invoices, making it a viable option for small and medium-sized enterprises (SMEs) that may not have extensive assets to pledge as collateral.

This flexibility extends to how businesses choose to use the funds obtained through clean invoice financing. Whether it’s investing in new equipment, hiring additional staff, expanding marketing efforts, or managing cash flow gaps, businesses have the freedom to allocate the funds where they see fit. This adaptability allows businesses to make strategic decisions that align with their growth objectives and respond to evolving market demands.

Additionally, clean invoice financing allows businesses to maintain control over their customer relationships. Unlike traditional factoring, where the financing company takes over the invoice collection process, clean invoice financing keeps the relationship between the business and its customers intact. The financing company simply advances funds against the invoices, allowing businesses to continue nurturing their client base and preserving their reputation.

In conclusion, the advantages of clean invoice financing, including improved cash flow and flexible financing options, make it an attractive financial solution for businesses seeking to optimize their operations, seize growth opportunities, and maintain control over their customer relationships. By leveraging clean invoice financing, businesses can unlock the potential of their outstanding invoices and gain the financial stability needed to thrive.

Credit: www.banco.com.sg

Common Misconceptions About Clean Invoice Financing

When it comes to clean invoice financing, there are several misconceptions that can cloud one’s understanding of this valuable financial tool. In this section, we will debunk some common misconceptions surrounding clean invoice financing and shed light on the truths behind the risks and costs associated with this financing method.

Risk

One common misconception is that clean invoice financing poses significant risks to businesses. However, the risk associated with clean invoice financing is often lower compared to traditional loan options. Since this financing is secured by the invoices themselves, businesses don’t have to worry about providing collateral or personal guarantees, reducing the overall risk exposure.

Cost

Another misconception relates to the cost of clean invoice financing. Contrary to popular belief, the costs associated with this financing method can be quite reasonable. While there are fees involved, the ability to access immediate working capital and improve cash flow can offset these costs, making it a financially viable option for businesses.

Examples Of Clean Invoice Financing

Clean invoice financing is a flexible funding solution for businesses that need immediate cash flow. It allows businesses to borrow money against their outstanding invoices, providing a quick and efficient way to access working capital. Below are some specific examples of clean invoice financing in various sectors and for small businesses.

Service Industries

The service industries, such as cleaning services, are prime candidates for clean invoice financing. These businesses often face delayed payments from clients, which can disrupt their cash flow. With clean invoice financing, cleaning service companies can unlock the value of their unpaid invoices and use the funds to grow their business, cover operational expenses, and take on new projects.

Small Businesses

Small businesses across different sectors can benefit from clean invoice financing. Whether it’s a boutique retail store, a technology startup, or a consulting firm, small businesses often encounter the challenge of waiting for invoice payments. Clean invoice financing provides them with the necessary funds to support their growth, manage cash flow, and seize new opportunities without having to rely on traditional bank loans.

Credit: kodytechnolab.com

Frequently Asked Questions For Clean Invoice Financing

How Do You Qualify For Invoice Financing?

To qualify for invoice financing, you need creditworthy customers who consistently pay on time. The creditworthiness and reputation of your customers play a significant role in the underwriting process, making it easier to qualify for invoice financing compared to other business loan options.

What Is The Average Cost Of Invoice Financing?

The average cost of invoice financing varies depending on factors such as the lender, the size of the invoice, and the creditworthiness of the customer. Generally, fees range from 1-5% of the invoice amount per month. It’s important to compare different lenders to find the best rates for your business.

Is Invoice Financing Risky?

Yes, invoice financing can be risky due to potential non-payment from customers. It’s crucial to assess the creditworthiness of your clients before opting for this funding method. Proper evaluation and management of risks can help mitigate potential financial challenges.

What Is An Example Of Invoice Financing?

Invoice financing is when a business uses its unpaid invoices to secure a loan from a lender.

Conclusion

When it comes to invoice financing, having creditworthy customers who pay on time is key. The creditworthiness and reputation of your customers play a crucial role in the underwriting process, making it easier to qualify for invoice financing compared to other business loan options.

By turning your unpaid invoices into immediate cash, you can free up the trapped cash and improve your cash flow. Invoice financing is a cost-effective and efficient solution for businesses looking to maintain a steady cash flow and grow their operations.